Community-as-a-Service

The next logical step in the nascent PvP world of Crypto

Good to see you all again & Thank you for reading! You can reach me personally on Twitter and reach out to the P1 crew over at contact@pageone.gg

Logically speaking, the way protocols/services are going to expand is going to be via tools that are specifically made to appease the community. Hereby, I am going to be introducing you to the concept of “Community-as-a-service” (CaaS)

To build upon this relatively new concept, we are going to be using a couple of different examples to illustrate what we mean:

League of Legends (LoL) has Mobalytics, there are countless “Aim Trainers” for First Person Shooter (FPS) games and of course, there is the absolutely beloved modding community for most modern games

In DeFi, Convex was created as a service built on top of Curve.fi

In NFTs, Delegate.cash is gaining ground as a way to service NFT holders through increased security and alternative income/yield.

Even notion has a metric shit tonne of people selling templates/courses for it

If you search online for the term “Community as a service” (CaaS) right now, you won’t see a clear definition for the term but after scrolling through enough articles the core concept of the term boils down to this:

“Community-as-a-service is where the access to a particular group of people is valuable enough that it can be considered a marketable product.”

If we go back to consider this definition and compare it with the examples listed above, the concept should start to click more:

Mobalytics is a tool for LoL players that are serious about improving their rank

Aim trainers are aimed at FPS players that want to get better at aiming

Mods are for people that love the base game and want to expand their experiences inside of it

Notion templates are for people that want to organise a certain aspect of their life in a digital manner

Best in Class

In this manner, Convex is a bit different out of all of these other listed items. Not just because it’s a crypto dApp or its place in the realm of DeFI, but rather because the Convex team didn’t compete with Curve when they built Convex despite this being the norm in crypto. They accepted that Curve was the absolute best product in their class and the users of Curve were where the value was to be addressed.

If you can appease the community of a product with a solution, it's a potentially viable business; the market is already validated. In terms of what Convex is to Curve (in very general terms and among other things), Convex acts as a liquid wrapper to Curve.

This kind of modular building is why a lot of people refer to DeFi as “Money Legos” and where Yield Farming strategies originate from. Using multiple different protocols in a particular order to maximise returns on deposited capital. This is one of the strategies that Yearn.Finance uses for $USDT deposits.

However, we’re getting a little bit ahead of ourselves. Taking a step back, to find a team that is building complimentary products like Convex is to Curve isn’t the norm, but rather the exception. In an industry where we are still having gargantuan raises for the “Next L-69” because it improves dink doinks per second or the next big OptionDerivativeSyntheticHumanSacrificeStaking trading platform being launched for the umpteenth time with its own token because “Trust me bro, we’re different”, the space is naturally in PvP mode. PvP is natural due to current market dynamics, the young nature of this space and of course provides some positive externalities. As the old economic saying goes, competition always benefits the consumer.

But here we are at a bit of an impasse. While you could argue that the DeFi space has some sort of logical methodology behind why platform A is different than Platform B, tribal association via bag-holding aside, through mechanisms like variable fee structure, tokenomics, innovative logic solvers etc. we are beginning to see which protocols have actually started to solidify themselves as the core protocols that people use (from bull to bear). The world of crypto quite literally is the wild west because while DeFi is still a relatively new industry, CaaS is newer still.

New Sector Valuation

When all we have to go by is the roadmap that hasn’t been delivered on and the art style/theming of projects is the biggest differentiator between projects, how do you empirically determine which project has longevity and/or the best chance of success? This article won’t answer that because simply put, no one really has an answer to this or ever can; only time and the execution of the team will tell.

Hell, most ‘investors’ don't really have an answer to this with DeFi protocols even with empirical stats to compare and contrast. Should a person conduct a poll on Twitter about which chain has the greatest chance of success between Arbitrum, Optimism, Aptos or Polygon, there isn’t a static model with clear parameters that provides everyone the same conclusion. For example, some would value TXs per second & scalability over current active wallets. It’s almost impossible to predict who is going to be the dominant player in the long term but, just as unsurprisingly, the dominant player usually emerges after standing the test of time.

Absolute Market Dominance

The logical progression in this space as it matures is going to a move from the current PvP copy pasta protocol environment to a more cooperative nature (as we see with Convex and Curve). While competition between certain products within a niche will always exist, there are going to be clear winners and the next wave of successful products/services will end up building in a complimentary manner. We can see this in the case of Liquid Staking.

As you can see, Lido has clear market dominance out of all the listed protocols. So much so that even if Frax was to 10x its TVL, it would still be less than 20% of the TVL that Lido has. If we look at other protocols that accept Lido Staked ETH (stETH) over the other variants, Lido has the most support. We even recently had the launch of Cat-in-a-box, which will only support stETH and aim to bring even more yield to this asset.

Assuming you’re an investor, if you were going to be speculating on a particular niche to gain momentum before a particular narrative catches on, would you rather place your bets on the best product/service in the niche or something that is clearly not the market leader? If you’ve just found out about liquid staking and are unsure of what is the best service, are you more likely to pick a product that has a higher TVL/presence or the product that doesn’t even dent the dominance of the best product?

This isn’t to say that protocols like Rocketpool, Coinbase’s staked ETH wrapper or even Stakewise are bad protocols to use as they all have their own pros and cons. From a pure numbers standpoint, however, Lido very much dominates the liquid staking market. It’s the product leader and because of that, the community of Lido users are a valuable and marketable group.

CaaS in Crypto

Curve, Lido and DeFi aside, what does cooperation in crypto look like? What happens when you have a team that isn’t trying to build a community of their own, but rather looking to serve the community of an established project? This is where the team behind Tribally comes in.

If you’ve been in or around crypto for even a small amount of time, you’ve likely heard of Axie Infinity. We’ve covered Axie a few times and during the height of the P2E narrative, they were far and away leader in that category. Axie was also how YGG became the defacto leaders in the P2E space as they were (and still are) the biggest P2E guild and scholarship providers. If you haven't looked into Axie Infinity for a while, they recently announced their brand new website which was built by Tribally.

Prior to them rebuilding the Axie website, they built Axie.tech which acts essentially as a hub for all facets of Axie Infinity: from everything esports to even breeding calculators. They then proceeded to become the official tooling partner for Axie Infinity in 2022 and are now directly working with the dev team over at Sky Mavis on building the community infrastructure for Axie.

Tribally is at the start of a long and detailed product roadmap which is being built to complement the base game. They aren’t involved with the base game, but rather they are involved in servicing the community of the game.

This is a key difference and this is going to be the norm as more native crypto communities spin up. You can read more about the case studies that Tribally has provided to us directly here.

We will likely see this phenomenon with games first in crypto as there are numerous games that are going to be launching soon with support from the likes of Ubisoft through TheWatch.com & Axie Infinity, Square Enix with Symbiogenesis and several others that aren’t revealed to the public yet.

The community that is being serviced doesn’t have to be limited to one IP/Brand either. We are also seeing tools such as Delegate.cash now being launched to better service NFT holders from a security angle while simultaneously providing them with alternative income/yield. The market for CasS is just as big (if not even bigger) than the communities they are serving.

As crypto matures, with new people joining the space through the next big thing or to be a part of the ever-growing niche communities as builders or participants, there is going to be increased value in catering to specific communities rather than constantly attempting to disrupt the status quo. This decision is for individual teams to decide which they would rather do, but our assumption is that the CaaS vertical continues to grow.

Just like there are “money legos” in DeFi, we need “community legos” in crypto for a deeper, more immersive experience which can be as boundless as the collective imagination.

Some of you may be wondering why CC0 wasn’t mentioned at all in this piece because, by all the definitions, it belongs in this category but we’ll address that in another separate piece because the dynamics powering CC0 are completely different. For now, however, this post has ideally given you some new ways to think about building for and valuing communities that exist in the space and make you think more about CaaS.

If you’ve made it this far, thank you for reading and I hope this has been a useful read. You can follow me on Twitter to let me know what you thought about this article, and don’t forget to subscribe to Page One for your essential crypto readings.

Special thanks to Tervo, Tolks and NoSleepJon for help with editing the article

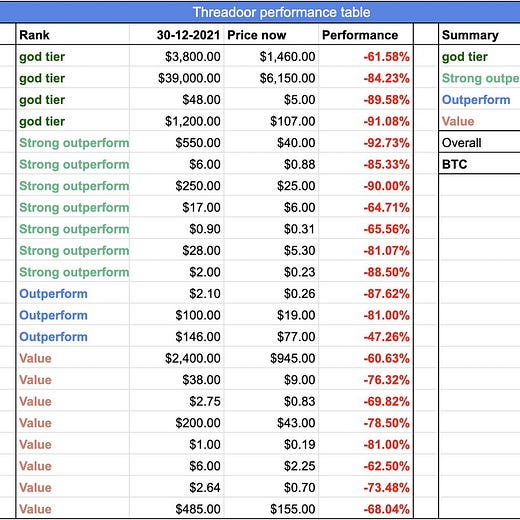

great article! although, sadly, we're not seeing more of CaaS in crypto. PvP intensified since you wrote this newsletter.