crypto recap 2/13 - 2/18

news, notes, charts, tweets, and funding to recap the week in the crypto ecosystem

thanks for reading and you can follow me here

tl;dr: macro uncertainty (inflation, everything Canada, Russia/Ukraine, legacy sell-off) has yet to impact the crypto funding and NFT sector. inevitably this will change, but the current decoupling in crypto is only seen between NFT volume/prices and funding when compared to BTC, ETH, and the broader crypto market to legacy correlation

news & funding:

Andrew Yang launches Lobby3 DAO to support and advocate for web3 policies in Washington, D.C.

Sequoia Capital to raise $500-$600M for new crypto fund

Castle Island Ventures raises $250M to invest further into financial services and web3

Ceramic Network, decentralized network for composable data, raises $30M series A to continue building open APIs, decentralized data infrastructure, and community-created marketplace for reusable data models

Safe Foundation raising $100M through token sale to spin off Gnosis Safe, valuation of SAFE tokens would be ~$1.25B

Alien Crypto Punk 5822 sells for 8,000 ETH ($23.7M)

RabbitHole raises $18M to continue building on-chain credentialing through partnerships with various chains and protocols

Universal Music Group working with Curio to launch NFT projects and develop NFT fan collection

Axelar Network, interoperability focus, raises $35M @ $1B valuation

Rainbow wallet raises $18M from Alexis Ohanian’s Seven Seven Six

Woodstock, blockchain venture firm, raises $100M for its latest fund

Twitter adds Ethereum wallet to its tipping feature

NYSE applies for NFT trademark applications, moves a step closer to facilitating NFT trading

J.P. Morgan opens Onyx Lounge inside Decentraland, publishes paper on metaverse opportunities

Oil giant ConocoPhillips announces they’re routing excess natural gas to BTC mining operation in North Dakota

YouTube hiring a web3 director to explore partnerships, open standards, and interoperability in web3

Snoop Dogg to launch Tha Doggies NFT collection for The Sandbox

Disney hires Mike White to lead metaverse efforts connecting the company’s “physical and digital worlds”

Florida home’s property rights officially auctioned as NFT, selling for $653,163 of ETH, signifying on-chain ownership

Animoca Brands buys mobile game maker Grease Monkey Games to further integrate tokens, play-to-earn capabilities, blockchain gaming integration

thoughts & notes:

NFT adoption, investment, and real world experimentation increase

NFTs continue to be the main entry point for legacy companies and are one of the only assets on Earth that (currently) seem to be agnostic to the macro narratives.

NYSE applying for a trademark to support NFT trading as companies continue to realize the volume and onboarding to the masses growth that they currently represent

Real world applications are slowly expanding, highlighted by the Alfa Romero SUV integrating verifiable ownership/maintenance history last week and Universal Music Group’s exploration of NFTs along with the NFT representing a home’s property rights this week

Blockchain infrastructure and crypto tooling stays hot

One of the clear investment focuses of the past few months has been the infrastructure needed to scale the ecosystem to hundreds of millions of users across various chains. We’ve seen anything relating to blockchain data, scalability, and interoperability raising funds and gaining market sentiment/momentum; a trend that will continue.

Rainbow Wallet, Ceramic Network, and RabbitHole are the examples this week as the base layer and UX/UI of the crypto ecosystem continues to develop

An under the radar story this week was oil giant ConocoPhillips announcing that they’re rerouting excess natural gas to a third party BTC miner

Undoubtedly, if you’re in crypto you’re aware of the narrative surrounding BTC (and ETH for now) mining but this highlights the ability oil companies have to decrease waste and increase profits through BTC mining operations. Expect this to be the first of a long string of similar announcements in the coming months.

BTC may be boring to some, but the king still controls the volume and direction the market is headed

on-going/shifting meta (s/o Cobie):

not much has changed in the meta interruption from last week, so going to repost from last week what I still think is the ongoing meta with the caveat that most meta and rotations bleed when macro, BTC, and ETH are this uncertain

Cosmos ($ATOM) ecosystem still, launch of Evmos (EVM of Cosmos) soon

driving the meta: IBC composability and the security and trust assumptions user sacrifice when using cross chain bridges, recently highlighted by the Wormhole hack

$OSMO/$JUNO and the launch of Evmos with Cosmos routinely airdropping new protocol tokens to holders drives incentives

GameFi 2.0

driving the meta: $AVAX subnets launching and the price appreciation of $DCAU/$JEWEL/$CRA launching there, GameStop’s recent partnership and fund with $IMX, Solana ecosystem games $AURY and Portals feeding anticipation of gamefi finding a bottom

NFT weekly highlights (s/o @terv0 for the research):

Wassies by Wassies (formerly loomlocknft)

founded by everyone’s favorite blueberry, the project announced a rebranding that will shift the focus of royalties to a new grants pool to fund new projects

9.5k supply, 0.93ETH current floor, Metadrop mint

A Merit Circle project consisting of four tribes that revealed this morning. The project features artwork from Andy Ristaino, formerly of Adventure Time, and is building a story in incremented chapters that features artifacts and creatures along with potential land and environments to explore for holders.

8.8k supply, 1.35ETH current floor, 0.145 mint price

Building on the project’s success and momentum of the past few months is an announcement of a partnership between WoW and Reese Witherspoon’s Hello Sunshine. The partnership will see feature films, TV series, and events focused on WoW NFTs and other women lead projects

10k supply, 10.34ETH current floor, 0.07ETH mint price

A massive multiplayer NFT ecosystem that takes inspiration from Minecraft, NFT Worlds are customizable and have seen other projects beginning to explore their design space and developer APIs. The project has seemingly had an 1 ETH floor price increase everyday this week.

10k supply, 13.6ETH current floor, 0.16ETH mint price

OpenSea and competition (x2y2, LooksRare)

LooksRare tried first, with x2y2 being the latest with an attempt to sap users and volume through vampire airdropping their token to previous OpenSea users.

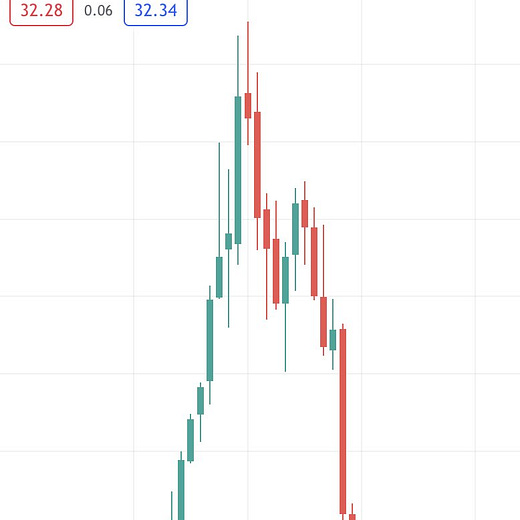

LooksRare’s token price and users (outside of wash trading) have been in a free fall lately with the price declining 50% this week

x2y2 botched their launch and froze airdrop claiming (along with selling pressure) for ~48 hours while they worked through technical difficulties. After promptly relaunching and pausing again overnight, the token fell from ~$4.50 to ~$1.50

For all its shortcomings, OpenSea is dominate for a reason. Building and scaling an ecosystem that can handle current/future NFT trading volume is extremely difficult, but expect this trend of competition to continue

around the ecosystem:

Locke Protocol to launch “soon” to improve protocol-facilitated token distribution through streaming auctions

gem.xyz continues to innovate NFT purchasing options through gas optimized contracts and multi purchase options

Packy McCormick with a great compilation of tokenomics resources

Alex Van de Sande with a good breakdown of the smart contract complexity that goes into protocol development (ENS highlighted here)

Everything you would ever want to know regarding stablecoin farming

Prateek with everything you would want to know about L2 StarkWare

tweets of the week: