crypto recap 2/7 - 2/11

news, notes, charts, tweets and funding to recap the week in the crypto ecosystem

tl;dr: markets have bounced nicely, currently inversely correlated to NFT floor prices and liquidity which have been methodically declining this week. most everything was overshadowed by the can’t-make-up couple that was found to be in possession of $3.6 billion of stolen $BTC from Bitfinex in 2016 (~$76M @ the time).

news & funding:

Polygon ($MATIC) raises $450M to expand ETH scaling solution operations

Qredo Network ($QRDO, cross-chain crypto infrastructure) raises $80M from 10T Holdings, Terra, Avalanche, Coinbase, others. valuation @ $460M

KPMG (one of the Big Four accounting organizations globally) adds ETH & BTC positions to its corporate treasury

Salesforce to provide cloud infrastructure for NFT creation and distribution

AssangeDAO raises ~$54M in ETH to buy NFT supporting Julian Assange’s defense fund and awareness campaigns

Compute North, crypto mining infrastructure company, raises $385M

Alfa Romeo to debut Tonale SUV that comes with verifiable service and ownership history through the use of NFTs

Canadian crypto exchange Newton Crypto raises $20M @ $200M valuation

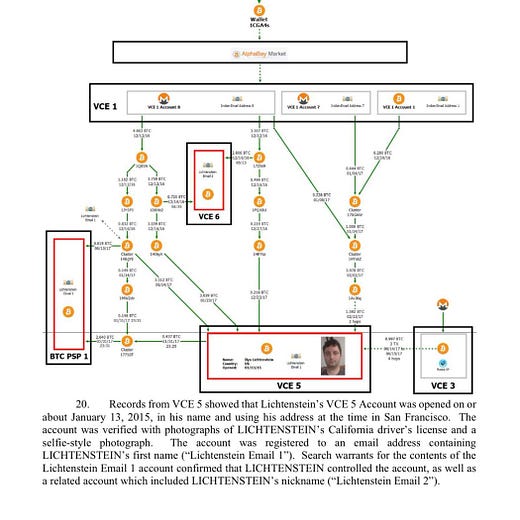

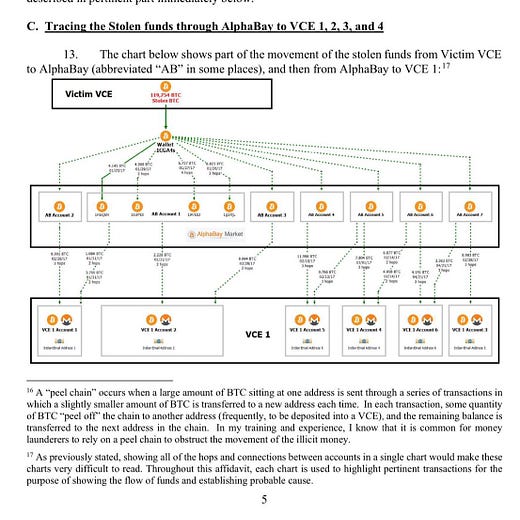

U.S. government seizes $3.6B of BTC moved from the 2016 hack of Bitfinex, chaos regarding the identities of the couple in possession ensues

No idea what to link here as crypto twitter was in absolute peak form when the news broke and you should read every possible thing about it

The Sandbox partners with Ubisoft to bring Rabbids to the Metaverse

Alchemy (crypto infrastructure) raises $200M, increasing valuation to $10.2B

Aleo (zk base layer, modular blockchain) raises $200M @ $1.45B valuation, to launch mainnet later this year

Washington Nationals (MLB team) partner with Terra ($LUNA), to accept $UST stablecoin in stadium as soon as next season

Gala Games ($GALA, blockchain gaming studio) confirms plans to allocate $5B by EOY to gaming, music, movie, theme park NFT operations

Zynga (gaming giant) plans to increase blockchain staff from 15 to 70 by EOY, launch NFT based games, and increase M&A within the gamefi ecosystem

Polkadot parachain Astar Network launches $100M funding/incentive program

Binance makes $200M strategic investment in Forbes

OnlyFans to support ETH NFTs as verifiable profile pictures

Microsoft hiring for a Director of crypto business development, to lay foundation and support their Web3 strategy

Russia pivots, to pass legislation that recognizes crypto as form of currency

BlackRock, the world’s largest asset manager, to offer crypto trading services

Sotheby’s to auction group of 104 CryptoPunks on February 23rd, expected sale price between $20M-$30M

Valkyrie’s BTC miners ETF approved for trading by Nasdaq

thoughts & notes:

ZK tech/rollups continue quiet expansion and development

Aleo funding round continues to highlight the excitement/future of zkTech on the crypto industry

Polygon raise and previous investment/acquisition of ZK scaling companies/protocols also signifies the increased focus as investors were willing to deploy $450 to Polygon’s long term ambitions

NFTs rule everything around me

even as every possible NFT metric has declined this week, NFTs are still the easiest on boarding application to “normies” and the first crypto native application legacy companies choose to engage with as evidenced weekly (this week by Ubisoft, OnlyFans, Zynga, Alfa Romeo).

also continues to be the case evidenced by every possible company & investor looking for exposure to the underlying infrastructure that supports NFT creation, lending, borrowing, liquidity, etc. highlighted by Salesforce announcement this week of ambitions to build NFT Cloud

Protocol funding rounds are drastically shifting to previous tech VCs

impossible to turn down funding from established, prominent VCs and was always going to eventually be the case but highlighted this week

Polygon raised $450 million through a token sale and the link to their announcement mentions established VC giants Sequoia, SoftBank, Tiger Global, Alan Howard and Kevin O’Leary before mentioning the crypto native participants in the next paragraph that were also involved

Aleo’s raise of $200M was again primarily funded by SoftBank, Samsung, Tiger Global, and the omnipresent a16z

face value positives are that it increases the validity and velocity of investment into the space and branches the legitimacy of the crypto to every VC and fund on the planet

AssangeDAO, echoing ConstitutionDAO, show new capital raise paradigm

for as controversial as ConstitutionDAO was, there was an equal amount of articles/thoughts highlighting the ability of crypto rails to form new global, permissionless funding vehicles used for anything

AssangeDAO reiterates this ethos. the use of capital within the DAO, results, and actual impact made are somewhat irrelevant imo as the core concept of permissionless capital aggregation in a time sensitive, coordinated manner should be the focus

we’ll continue to see experimentation with these forms of capital formation whether it’s to form a collection to deploy money and buy rare NFTs, pay for legal fees, acquire other companies, start a global, decentralized investment firm, etc. etc.

interpretation of weekly meta narrative forming (s/o Cobie):

Cosmos ($ATOM) ecosystem still, launch of Evmos (EVM of Cosmos) soon

driving the meta: IBC composability and the security and trust assumptions user sacrifice when using cross chain bridges, recently highlighted by the Wormhole hack

$OSMO/$JUNO and the launch of Evmos with Cosmos routinely airdropping new protocol tokens to holders drives incentives

GameFi 2.0

driving the meta: $AVAX subnets launching and the price appreciation of $DCAU/$JEWEL/$CRA launching there, GameStop’s recent partnership and fund with $IMX, Solana ecosystem games $AURY and Portals feeding anticipation of gamefi finding a boost

we also see Ubisoft and Zynga games announce a combination of funding and blockchain game development this week, as it’s only a matter of time until the NFT backlash subsides and every major game publisher eventually enters the space

NFT weekly highlights (s/o @terv0 for the research):

the next phase after the wildly successful Cool Pets launch finally launched after multiple DNS and bot attack issues throughout the week. spoiler: bots were still able to attack the public sale, but holders are looking forward to the Pokemon style game launch and $MILK token

20K supply, 0.5ETH mint, current floor: ~2.3ETH

the much anticipated reveal occurred on Monday to holders disappointment as the floor price dropped ~90% from ~3.5ETH at their high point pre reveal. customizable attributes and tailored music are on their way for current holders as they recover from the precipitous drop

10K supply, 0.08ETH mint, current floor: 0.38ETH

a rare hyped project that lives up to the expectations. reveal for the Karafus occurred yesterday and was promptly followed by heavy volume, floor price increases, and ETH sales of 66 and 100 for legendary traits

5.5K supply, 0.2ETH mint, current floor ~5ETH

hyped as Pokemon/Minecraft combination, launched as DA (dutch auction) mint starting @ 3ETH, sold out instantly raising $70M, game launch slated for Q2 2023, buyers burned as hype went parabolic

10K supply, 3ETH mint, current floor: ~1ETH

around the ecosystem:

andrewhong with a great guide to web3 data & analytics

Rob Sarrow with extensive, chain agnostic DAO tooling availability

Jason Choi with an excellent first post to a new personal blog

Superfluid (I wrote about last summer here) to launch token streaming to NFTS

Burnt Finance (zero fee, decentralized NFT platform on Solana) launches

Mars Protocol (lending and borrowing protocol on $LUNA) to launch 2/21/22

Starkswap (AMM built on StarkNet ZK-rollup) to launch soon

FTX now supports withdraws and deposits to Arbitrum mainnet

tweets of the week:

Glug glug glug