crypto recap 3/28 - 4/2

news, notes, funding, charts, and tweets recapping the week in crypto

as always, thanks for reading and follow me here

tl;dr: the coins are good, bridge wars are here, move to earn, direct NFT investments accelerate, Ronin suffers $625M hack, and Azuki is a blue chip.

news & funding:

LayerZero Labs, STG creators, raise $135M @ $1B valuation

Wormhole Bridge attempting to raise $187.5M @ $2.5B valuation through private token sale of 750M HOLE tokens @ $0.25 per token

Helium Inc. raises $200M @ $1.2B valuation, rebrands to Nevo Labs while the token and blockchain remain under the Helium name

Blockchain.com raises series D funding, now valued @ $14B+

gCC, crypto VC fund, raises $110M early stage fund for tokens/equity

Cross River Bank raises $620M @ $3B+ valuation to place crypto investments and business relations “front and center”

Fractal, marketplace for gaming NFTs based on Solana, raises $35M seed

Greenidge Generation Holdings, New York based crypto mining company, secures $100M in funding to triple its capacity this year

Citi Bank’s Metaverse and Money speculates a future “device-agnostic” metaverse could have an addressable market between “$8-13 trillion” with users approaching 5 billion by 2030

Composable Finance raises $32M series A

CowSwap developer, CoW protocol, raises $23M via token round and spins out of Gnosis DAO

Visa launches program to help creators monetize through NFTs

Google-backed Glance acquires gaming platform Gambit in NFT push

Blur raises $11M seed round to build NFT marketplace for pro traders

Cross the Ages, NFT card game, raises $12M seed from Ubisoft and others

Polygon unveils zero-knowledge powered identification service

OpenSea confirms integration of Solana NFTs coming in April

Axie’s Ronin network suffers largest exploit in DeFi history losing 176,300 ETH and 25.5M USDC valued around ~$625M at the time of discovery

MacroStrategy, subsidiary of Saylor owned MicroStrategy, gets $205M collateral loan from Silvergate to purchase BTC

Crypto Raiders, NFT RPG game based on Polygon, raises $6M

Battlebound, p2e gaming startup, raises $4.8M from a16z led seed round

ZkLend, StarkNet enabled ZK-L2 money market protocol, raises $5M seed

Blockchain.com completes deal for Altonomy’s crypto OTC trading for $250M

Dank bank raises $4.2069M to acquire & fractionalize “legendary memes”

Binance partners with the Grammy’s

OpenSea rolls out direct credit card payments for NFTs through MoonPay

Hedera announces $155M HBAR fund for DeFi incentives/initiatives

thoughts & notes:

Bridging Wars

On the heels of Axie’s Ronin losing ~$625M this week, Poly Network losing $600M in August of ‘21 and Wormhole losing $325M in February (which was backstopped by Jump), the conversation around security and viability of bridges takes center stage. Throw in recent cross chain developments covered previously by $RUNE, the Cosmos IBC communication layer, and the launch of $STG which claims to solve the “Bridging Trilemma“ and we have a lot to sort through moving forward.

While the bridge wars sort themselves out, what is clear is that users want cross chain applications and interoperability. While many claimed the demise of bridges this week, Synapse ($SYN, bridging protocol) highlighted exactly why that is not the case displayed in the demand/use of their bridging services as DFK transitioned to an AVAX subnet and users bridged ~$500M over night.

D2NCI

Direct to NFT Creator(s) Investing (working title). Yuga’s recent funding will exacerbate the trend but Parallel and Pixel Vault were some of the first to take direct invest to build out their NFT ecosystems a trend we’ll see accelerate.

The combination of an ever-increasing number of funds to deploy capital, the onboarding and pace at which NFTs are accelerating, and recent slowdown/dilution of new ERC-20 token protocols will continue to increase the number of direct NFT investments. Crypto Raiders, Battlebound, Cross the Ages and Crypto Unicorns are some of the examples we’ve seen in recent weeks.

Azuki & the 20E floor

Azuki is the talk of CT, and rightfully so. During their event at NFT LA, Azuki prompted holders to check their wallets where they found two airdropped NFT crates titled Something Official that have since transformed to piles of dirt, TBD on what they develop into. Building off of that momentum, and what is clearly an incredibly talented and innovative team, Azuki broke the vaunted 20e floor Thursday night and has continued to rally.

Several notable projects (Clone X, Doodles, Cool Cats, Clone X, NFT Worlds) have approached the 20e floor but quickly rejected it while Azuki used 20e as escape velocity. Azuki launched on January 12th @ a 1e mint price with a current floor of ~28e (99k) and is a reminder of the demand for quality NFT projects, displaying the rapid pace they can appreciate at.

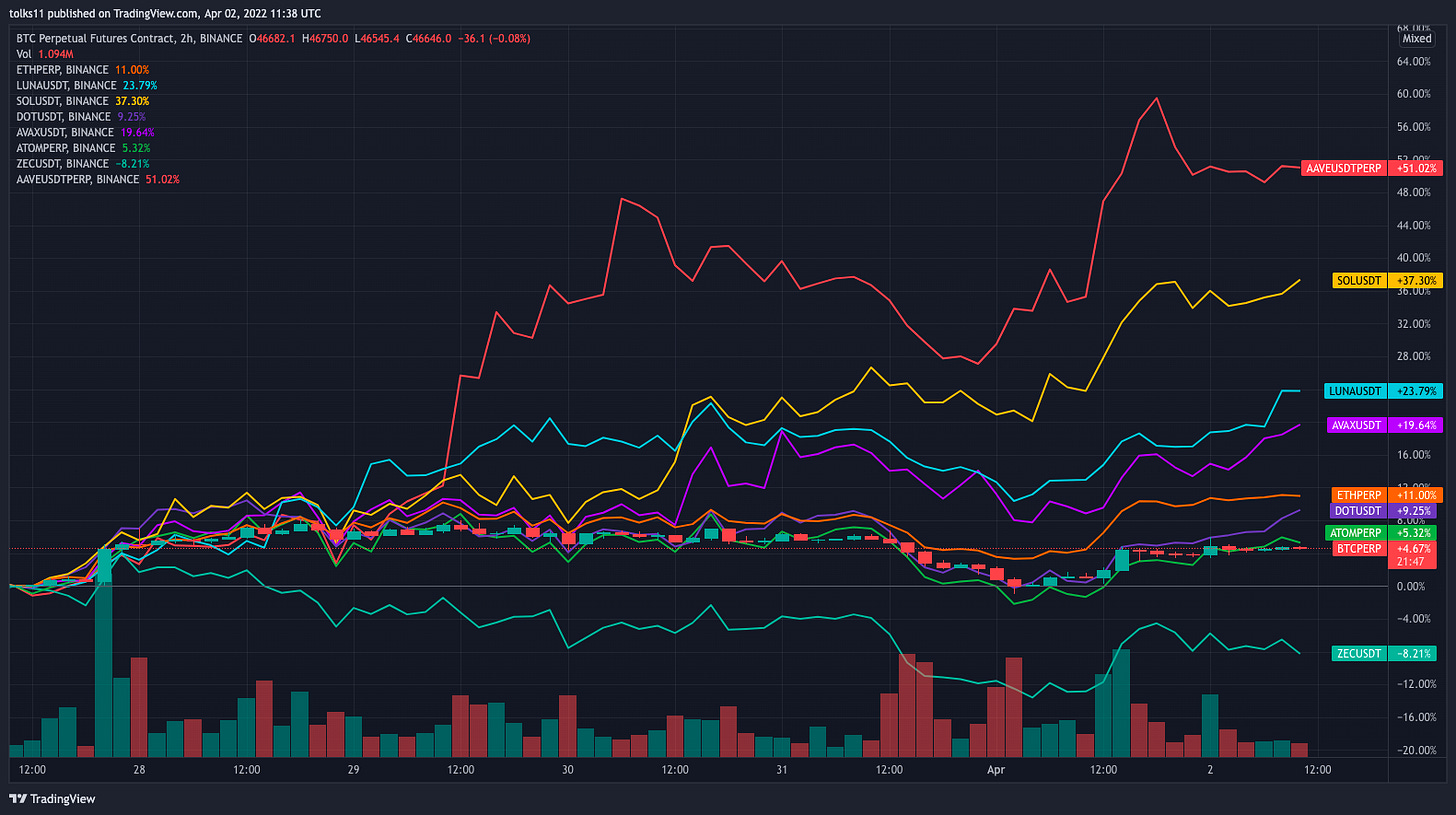

token recap (7d returns):

many of the tokens covered in the previous two weekly recaps continue to outperform, so for more information on what is potentially driving their prices you can find it in those posts as to not be repetitive.

LOOKS + 56% , AAVE + 51%, STG + 59%, JEWEL + 60%, RUNE +25%

WAVES + 70%, for an interesting thread and breakdown of WAVES tokenomics after it’s insane 200%+ monthly returns check here

GMT — + 239%

move to earn is here and the market believes it’s currently worth $1.6B with a $16B FDV. Step’n was one of the best performing assets across the crypto ecosystem this week as they continue to onboard more users. A “web3 lifestyle app” that allows users to buy sneakers in their app and then reward them in the native $GMT token corresponding to the amount of steps they’ve taken with upgrades and “re-charging” of shoes available within the app.

TBD on how the early subsidizing of growth through the native token and high initial entry cost (~$1k) plays out, but for now the token and users are accelerating at a rapid pace. For more information you can visit their site.

POKT — + 30%

$POKT is a decentralized RPC provider and has seen accelerated usage through the deployment of the $JEWEL subnet on $AVAX. Infrastructure investments, decentralized and centralized, has been a recurring theme throughout these weekly recaps (and Ansem’s quarterly reports s/o) as crypto adoption increases so does the underlying infrastructure usage.

As covered in the weekly recap last week, JEWEL announced partnerships with Synapse, POKT, and AVAX previously.

AXIE ECO — AXS -1.3%, RON -17%, SLP +3%

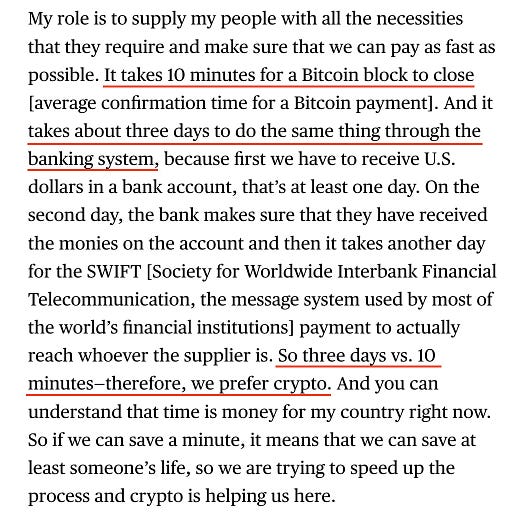

Axie and Ronin, as expected, were some of the poorest performing tokens this week on the heels of the $625M hack. A combination of social engineering and horrible security led someone to compromise 5 of 9 Ronin validators allowing someone to withdraw 173,600 ETH and 25M USDC. Details are sparse as to how exactly the hack and social engineering occurred, along with unanswered questions as to why the network wasn’t automatically checking and validating assets controlled. The hack occurred 6 days before the team was made aware by a user unable to withdraw 5k ETH.

Ronin has since replaced the compromised validator nodes and Axie has delayed the launch of its anticipated “Origin” upgrade to April 7th. For the latest updates you can check the Axie account here and the Ronin Network account here

around the ecosystem:

Altcoin Pyscho enlightens us on “the illusion of alpha”

Zaheer breaks down CLOB v AMM and the future of on-chain trading

Element Finance launches Element DAO

P with one of the best deep dives into the current $UST, $BTC, $LUNA dynamic

Jack with a good thread on innovative projects and founders

Li Jin drops the transition to web3 guide at guidetoweb3.xyz

tweets of the week: