this is a broad recap of February in the crypto ecosystem done by me and terv0_. you can find linked sources to projects, news, funding etc. in previous posts, enjoy!

tl;dr: another insane month where we witnessed: the insane 2016 Bitfinex hack couple, OpenSea phishing exploit that was initially thought to be a free-for-all hack, Coinbase Pro trading bug that *could’ve* allowed massive BTC selling, Pixelmon released the worst NFTs imaginable creating an unlikely crypto meme hero Kevin, the infamous 2016 DAO hack causing the ETH fork creating ETC perpetrator is *allegedly named, and to top it all off Russia invaded Ukraine. Yet still our coins (mostly) are up from where they stood last month, (good) NFTs are still minting, and secondary NFT volume is remains healthy. crypto is fucking beautiful.

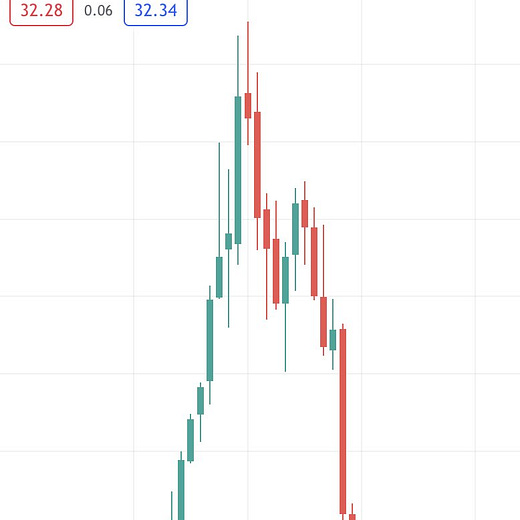

token roundup (monthly +/-):

BTC +~12.5%, ETH + ~8%, stablecoin supply hits 180B

30d gainer highlights

ANC +177%, JUNO +186%, OSMO + 50%, LUNA 81%,

Anchor and Luna saw dramatic price increases this week on the back of the Terra ecosystem announcing $1B in BTC backing for $UST along with Anchor’s recently released tokenomics revamp

I feel like a broken record on the Cosmos ecosystem, but OSMO/JUNO have proven the point. You can see the entire crypto twitter zeitgeist slowly embracing Cosmos and IBC in real-time while the anticipation of the Evmos drop reaches a tipping point.

30d declines

LOOKS -63.9%, IMX -44.36%, ATLAS -39%, RBN -39%

Looks Rare, Immutable X, and Ribbon were all the talk of crypto twitter for brief (or long in LOOKS case) periods throughout February and yet still become some of February’s biggest losers. LOOKS attempted a vampire attack on OpenSea users to no avail (so far), IMX announced a partnership and fund with GameStop (who proceeded to dump the tokens) and RBN has been long admired and anticipated by DeFi aficionados who are unaware of @DegenSpartan’s DeFi monthly bear market progression tracker (17 more to go!).

news & funding sector highlights:

Infrastructure & Interoperability

Dune Analytics raises $69.420M to continue improving crypto data accessibility

QredoNetwork ($QRDO, cross-chain crypto infrastructure) raises $80M, valuation @ $460M

Salesforce to build/provide NFT cloud infrastructure for NFT creation & distribution

ComputeNorth, crypto mining infrastructure company, raises $385M

Alchemy (crypto infrastructure) raises $200M, increasing valuation to $10.2B

Ceramic Network, decentralized composable data, raises $30M series A

Axelar Network, interoperability layering, raises $35M @ $1B valuation

Blockchain infrastructure (cloud services, staking solutions) startup Aligned raises $34M

InfStones, blockchain infrastructure provider, raises $33M to scale operations

Helium ($HNT) raises $200M @ $1.2B valuation to continue building decentralized wireless

Axelar Network, interoperability layering, raises $35M @ $1B valuation

Skale, ETH native multi-chain network, announces $100M ecosystem fund

Funding & Raises

Castle Island Ventures raises $250M to invest into crypto services & web3

Sequoia Capital to raise $500-$600M for new crypto fund

Alexis Ohanian raises $500M for two new funds, primarily investing in crypto startups

FTX raises $400M, valuation currently @ $32B – Arca launches $50M NFT fund

Woodstock, blockchain venture fund, raises $100M for its latest fund

Pixel Vault raises $100M to continue Punks Comic & superhero/NFT expansion

Trust Machines raises $150M to build out the Bitcoin application ecosystem

Yuga Labs (startup behind BAYC) looking to raise @ $5B valuation from a16z

Phantom raises $109M, launches mobile wallet for iOS

Canadian crypto exchange Newton Crypto raises $20M @ $200M valuation

Developer community behind Kucoin Exchange announces $50M accelerator program to grow network

Zero Knowledge Applications Accelerate

Polygon ($MATIC) raises $450M to expand ETH scaling solutions and ZK tech

Aleo (ZK tech blockchain) raises $200M @ $1.45B valuation, to launch mainnet later this year

ZK ETH scaling solution StarkNet completes launch, token in “second half of the year”

Opera Android browser integrates StarkWare allowing users to transact directly with ETH L2

NFTs Continue Adoption

Zynga (gaming giant) plans to increase blockchain & NFT game development by EOY

NYSE applies for NFT trademark applications, moves step closer to facilitating NFT trades

Universal Music Group to launch NFT fan collections and develop web3 projects

Warner Music Group developing ability for artists to use tokens and NFTs

Japanese e-commerce giant Rakuten to launch NFT marketplace

Gala Games confirms plans to allocate $5B by EOY to gaming, music, & NFT operations

Alfa Romeo to debut Tonale SUV with service/ownership history through NFTs

The Sandbox ($SAND) partners Ubisoft to bring Rabbids to the Metaverse

Highest NFT sales

General Notes

U.S. government seizes $3.6B of BTC from 2016 Bitfinex hack

Andrew Yang launches Lobby3 DAO to advocate for web3 policies in D.C.

ConocoPhillips (oil giant) announces they’re routing excess natural gas to BTC mining

$LUNA foundation raises $1B to put into BTC for reserve backing of stablecoin $UST

Laura Shin releases Cryptopians book & allegedly identifies infamous ETH DAO hacker

Washington Nationals partner with Terra ($LUNA), to accept $UST in stadium soon

KPMG (global accounting firm) adds BTC and ETH to corporate treasury, buys WoW NFT

Bulgarian Stock Exchange enables crypto trading on its platform

Coinbase reports ~$2.4B in 2021 Q4 revenue, CashApp generates ~$2B of BTC revenue in Q4 2021, CoinShares reports highest quarterly earnings

Binance makes a $200M strategic investment in Forbes

Valkyrie’s BTC miners ETF approved for trading by Nasdaq

Page One / NFT Recap:

Despite volatility and geopolitical mayhem, February was a pretty good month for NFTs. Sometimes it didn’t feel like it, but the volume says otherwise - February ‘21 OpenSea volume clocked in around $3.5B, making it the second-highest volume month to date. Some highlights below.

News and Notes:

Azuki settled in after a record-setting first few weeks. The collection sits at #8 on OpenSea’s all-time volume rankings with 123,000e traded.

CryptoPunk 5822 was sold for 8,000e, nearly double the previous all-time high.

V1 CryptoPunks were rediscovered and quickly sued.

Kaiju Kingz expanded their universe with Failed Experiments and Mutants.

Mfers went ballistic. The floor rose nearly as quickly as the number of derivatives. CC0 FTW.

NFT Worlds have proven you need nothing more than Minecraft to make the Metaverse.

RTKFT continues to spoil their holders, delivering a MNLTH and a Space Pod to all Clones.

Wassies for Wassies, the collection formerly known as Loomlock, debuted their long-awaited roadmap which is heavily focused on the community.

New Mints:

Cool Pets struggled to get their mint off the ground, but got it done. The Cool Cat universe is ready to expand.

Edenhorde, a story-centric collection supported by Merit Circle, wants holders to play a pivotal role in the development of their universe.

Invisible Friends minted after months of hype-building. The highly-anticipated collection debuted upwards of 12e before settling down after reveal.

Karafuru picked up the torch that Phanta Bear dropped and created some hype for Asian NFTs.

Pixelmon turned into the biggest fiasco of the month, nuking from its 3e sale price and giving birth to Kevin, the world’s finest meme.

RaidParty minted at the beginning of the month and have been working to push out their game. Holders wait.

Tubby Cats premiered and got spammed all over CryptoTwitter (and will be for the rest of eternity).

For deeper analysis on these projects (and a ton more) reference previous Page One articles

tweets of the month:

as always, thanks for reading! comments, feedback, and suggestions for improvement are always welcomed. until next time frens.