as always, thanks for reading and follow me here

tl;dr: ETH’s deflationary week & reflexivity, L2 momentum, prices down but devs up, RBN, FXS, CANTO, & XMON gud, regulatory szn upon us, & bottom signals increasing

BTC dominance 38% | ETH dominance 16% | DeFi TVL $54B |

Total Crypto Market Cap $974B | Stablecoin Supply $147B |

Market Overview

As we continue to chop around inside the same never-ending range with macro conditions remaining undoubtedly in control, one signal is beginning to provide hope as the evidence mounts: crypto bottom indicators. Of course, these indicators are purely subjective measures of broad sentiment, but they are typically useful at the extremes. Just as top indicators reach exuberance a la Katy Perry posting her crypto nails to Instagram or Meta and Pepsi tweeting “wagmi” at each other, true bottom indicators provide some insight. In recent weeks, we’ve seen:

volatilty/liquidity reach depressed levels on par with past bear markets

engagement outside of specific, topical events on crypto twitter bleed out

hacks and exploits explode, some teams & protocols from last cycle abandoning

crypto traders pivoting to FX markets & macro podcasts

increased concerns around the viability of BTC mining due to decreased prices

mainstream media increasingly publishing articles on the demise of crypto

PvP rotation games between the hundred of us left leading to stalled narratives

excitement for new developments nonexistent (CANTO & berachain the outliers)

Whether these indicators mark a relative bottom or not is TBD, but they clearly signal behavioral change that often aligns with capitulation and market reversals. Sentiment aside, BTC and ETH continued another week rangebound while pockets of fundamental and narrative price appreciation were highlighted by SUSHI, RBN, FXS, MKR, ENS, XMON, AR, and Huboi’s exchange token (HT). ETH’s price once again remained stagnant WoW, but its weekly issuance was notable as it became deflationary for the first time post merge.

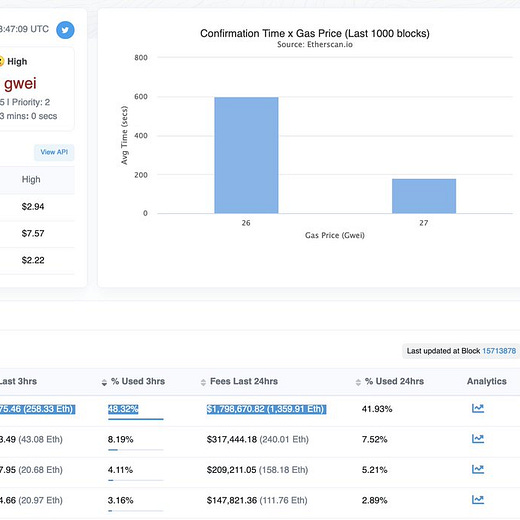

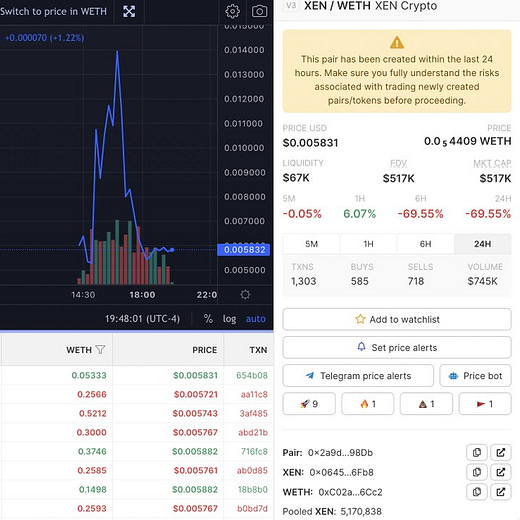

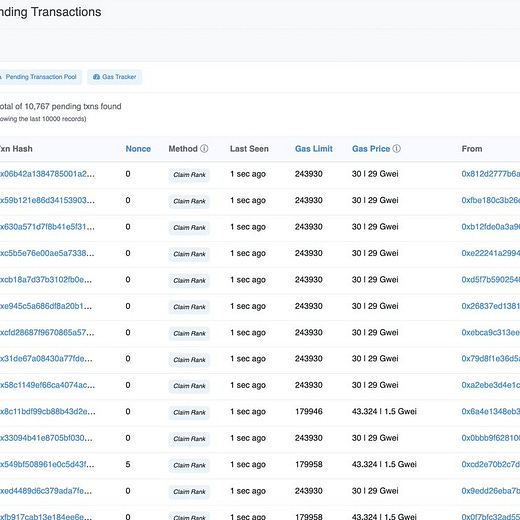

Catalysts maintaining momentum and returns are difficult to come by in today’s macro controlled market, but XEN displayed sustained on-chain demand for the first time in what seems like an eternity. XEN can be considered an afterthought with the focus being on how on-chain activity affects ETH’s supply and the catalyst it creates.

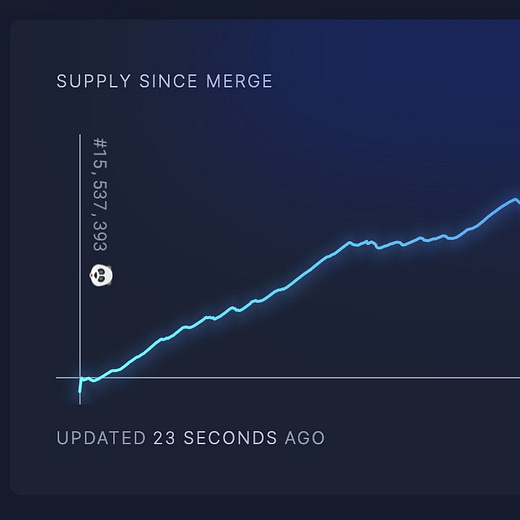

As of Monday morning, according to ultrasound.money, ETH’s supply change since the merge has been increased by ~7.5k ETH ($9.7M). Toggling the display to simulate if ETH was still PoW, we can see that the supply increase would be ~390k ETH ($507M). A massive difference. Demand for ETH and net crypto inflows may remain suppressed for longer, but it’s easy to envision ETH’s coming reflexive appreciation as the narrative of supply reduction becomes self-fulfilling.

Scaling Soon

As a result of ETH issuance being deflationary the past week, complaints regarding gas fees returned to the timeline and chats for the first time in months. On-chain activity has been largely non-existent in recent months, but XEN was a good reminder of ETH’s need for scaling solution adoption as deflationary issuance is a double-edged sword that requires increased transaction costs.

Fortunately, scaling solutions’ moment is coming soon with another week of progress across the L2 and sidechain stack behind us that included:

Polygon releasing their zkEVM product to public testnet with ETA being Q1

Matter Labs, zkSync L2 creators, to launch Pathfinder L3 testnet in Q1 2023, along with initial zkSync 2.0 protocol launch on mainnet October 28th

Offchain Labs, L2 Arbitrum developer, acquired Prysmatic Labs

Ribbon Finance (RBN) launched Aevo, their options exchange built on EVM rollup

SUSHI launched stable swaps & pools on MATIC, KAVA, & Optimism

Uniswap’s v3 of the protocol will be live on zkSync after it’s October 28th launch

While the usage of L2s and ETH scaling solutions has been largely an overhyped meme over the past year plus, we’re finally approaching and seeing some adoption. The eventual winners of scaling blockchains is increasingly murky as appchains revive themselves, L2s and L3s are slowly taking shape, and modular chains along with purpose built execution and data availability rollups are being developed. This week, Page One will be releasing an updated overview of the L2 and zero-knowledge scaling solutions ahead of zkSync’s mainnet launch. In the meantime, you can read what I previously outlined in the “Zero-Knowledge Landscape”.

funding:

Copper, London-based crypto custody company, raises $196M series C

Uniswap Labs, creators of UNI DEX, raise $165M series B, valuation @ $1.66B

BlockTower’s new $150M venture fund emerges from stealth

Tatum, blockchain developer platform, raises $41.5M

Nxyz, blockchain indexer, raises $40M series A & emerges from stealth

Pillow, consumer focused DeFi yield generating app, raises $18M

SettleMint, low-code blockchain tooling platform, raises $15.5M series A

Eclipse, SOL-based cross-chain modular rollup, raises $15M

Rye, token enabled web3 commerce platform, raises $14M

Fabric Systems, developing liquid cooling ASIC BTC miner, raises $13M seed

Zerion, wallet & asset management platform, raises $12.3M for wallet disruption

MetaStreet, NFT debt, financing, & liquidity platform, raises $10M

Pine Street Labs, wallet infrastructure company, raises $6M

Gomu, NFT infrastructure company, raises $5M seed

Magic Square, crypto app store, raises $4m from token rounds with plans to raises another $4.4M @ $120M valuation

news:

Coin Center initiates lawsuit against Treasury Department over Tornado Cash sanctions; salute to the tireless work Coin Center consistently does

Google — integrates Etherscan data enabling ETH address balances to be displayed when searched; Google partners with Coinbase to offer crypto payments for its cloud services and crypto devs can now use Google’s BigQuery crypto public datasets

OpenSea launches support for Avalanche (AVAX) NFTs

SEC — rejects WisdomTree’s latest spot BTC ETF proposal; probing Yuga Labs (BAYC creators) over, “whether certain [Yuga] NFTs..are more akin to stocks”, as well as the distribution of ApeCoin violated federal laws; Grayscale contends SEC harmed investors for rejecting GBTC’s conversion to ETF

Betterment, robo-advisor investment platform, partners with Gemini to launch crypto investment services

Tether (USDT) has eliminated commercial paper from its reserves & says increased direct exposure to U.S. Treasuries by more than $10B

BNY Mellon receives approval to custody customer deposits of BTC & ETH on the same platform as traditional investments

tokens & protocols:

UNI — v3 of the protocol will be live on zkSync after it’s October 28th launch

MATIC — Polygon releases their zkEVM product to public testnet

BNB — executes hard fork as a result of $100M exploit that occurred

RBN — launches Aevo, their options exchange built on EVM rollup, live on mainnet

SUSHI — launches stable swaps & pools on MATIC, KAVA, & Optimism

GRT — The graph outlines 2023 roadmap including move of protocol to Arbitrum

Timeless Finance launches Bunni, protocol for composable UNI v3 liquidity

Beamer — bridge protocol for ERC20 assets between L2s is live on mainnet

LayerZero confirms integration support for Aptos when the L1 launches

Matter Labs, zkSync L2 creators, to launch Pathfinder L3 testnet in Q1

Hyperlane — Interchain, sovereign consensus protocol explained by NoSleepJon

Offchain Labs, Arbitrum developer, acquires Prysmatic Labs

Silent Protocol introduced, zkSNARK-based for private EVM contract interactions

Collection.xyz — liquidity incentive protocol for NFT AMMs like sudoswap

SFTX announces their upcoming alpha mainnet trading competition, live Monday

Flashbots announces & outlines their next generation, “SUAVE”

reading:

“Web3 Development Report, Q3 2022: Ethereum Ecosystem and Beyond“ — Alchemy

As we’re all aware, crypto, and progress in general, is pushed forward by developers. Devs creating, improving, and iterating upon smart contracts is a more valuable metric than any current price of assets throughout the space. Crypto advances through cycles where the infrastructure and developer improvements are often ignored as their peak corresponds to declining prices, but eventually leads to the next cycle. “The Apps=>Infrastructure Cycle” and “The Crypto Price-Innovation Cycle” are required reading on this topic.

As such, Alchemy’s Web3 Developer Report released this week provides valuable insights to the future of the crypto ecosystem not visible in the current horrid charts. Below are some key data points from their research that can be summarized succinctly by the second slide that states, “The Big Picture: Prices down, devs up”.

despite Ethereum decreasing 70% in price, developer activity rose by over 40%

1.5M ETH SDK installs per week, +178% YoY

36% of all smart contracts ever deployed & verified have been in 2022

while NFT volume is down, there’s been a 10x increase in NFT API requests YTD

Solana’s active developer teams have grown >1000% YoY

Optimism (+1000%), Arbitrum (+516%), & MATIC (+335%) all showing increased active developers

around the ecosystem:

Luca @ Dirt Roads talks infrastructure in “Liquity + a Glimpse of (My) Future”

Amanda Young — “Unpacking Web3 Social”

Drew threads his learnings after exploring all things “Web3 Identity”

tweets: