as always, thanks for reading and follow me here

tl;dr: we’re so back as liquidations fuel rally, LSDs recent run, SOL’s recovery, RWAs are here, L2s growth, market digesting bad news, AVAX x AWS, & ETH’s reflexivity

BTC dominance 41% | ETH dominance 18.5% | DeFi TVL $47B |

Total Crypto Market Cap $1.1T| Stablecoin Supply $137B

gm, gm and welcome to another edition of Round Tripping. Apologies for the recent biweekly posts, and their extended length as a result, but rest assured we’ll be back to the usual weekend posts every week moving forward. We’re grateful for everyone’s support in dunking on the bozo who stole terv’s work along with pushing us past a giant milestone of 10k subscribers! Onwards and upwards for the people we go.

Two weeks ago, I wrote, “there’s nothing new to say about a market where the majors continue bleeding volatility and liquidity” which, thankfully, partially contributed to the explosive move upward we saw last Friday night. When markets lack their usual vol and liquidity, conditions are ripe for powerful moves particularly when they’re fueled by heavy liquidations.

As you can see below, the move last Friday, which saw BTC and ETH break above 21k and 1.55k respectively, was aided by a combination of crypto being idiosyncratically forced/oversold due to FTX’s collapse, the first monthly decline in CPI since May 2020, and around five hundred million worth of short liquidations.

Since last weekend’s rally, the market remained relatively flat until another Friday push upwards that saw another ~$335M worth of short liquidations. After oscillating around a total market cap of one trillion, the recent weekend rallies have, for now, definitively pushed the total market cap above that level as BTC is up ~50% since the FTX induced lows.

Since those lows, ETH is also up 50%+ while countless alts are up 100%+ on the back of strength from the majors. Many are proclaiming this rally a classic bull trap, but the market’s reaction to recent news indicates continued strength. Wednesday morning, the DOJ announced an eerie press conference regarding “cryptocurrency action” that ended up being memed across CT as the “big announcement” was enforcement against and the closing of the barely used Russian crypto exchange Bitzlato.

As the week progressed, the drips of information regarding the fate of DCG’s Genesis Global deteriorated which eventually culminated Friday morning as the largest crypto lender filed for Chapter 11 bankruptcy protection. According to the filing, Genesis owes its top fifty creditors more than $3.6B including a $766M claim to Gemini.

The fate of Genesis and DCG was once a significant market overhang, but the market digested both of these major events seamlessly as their impact was minimal and quickly erased. The swift processing of potentially negative news and small rallies in spite of bad news signals broad market strength as we’ve entered the bad news doesn’t affect markets stage of the ongoing rally. Since the start of the year, this reaction has become clear and contributed to the next leg of the continued rally. Thankfully, the days of a random headline being maybe, possibly, potentially interpreted as negative which plummets token prices are currently over.

As we exit the clusterfuck of fraud that was 2022, the environment necessary for the often sited “echo bubble” is rapidly improving. Sure, maybe it’s a meme but it’s actually worth thinking through who is left to be the marginal seller? Essentially every large player from last cycle has been liquidated and forced to sell, some BTC miners capitulated while others sold everything they mined, and the fraudulent clown SBF was secretly stealing everyone’s BTC/ETH and leverage selling it.

Of course, this doesn’t mean were destine for ATHs in 2023 as rallies this vertical need healthy corrections and the macro outlook along with legacy markets will continue to steer crypto short term. In that regard, Sunday morning brought news of the FED whisperer saying that Fed officials are, “preparing to slow interest-rate increases for the second straight meeting…before (potentially) pausing rate rises this spring.” Regardless of macro conditions and the recent rally, it’s clear that the FTX induced lows reached oversold levels that were prime for an explosive rally.

With the markets green across the board, new narratives and developments are taking shape with the main ones I’ll be following including:

Market’s reaction to news — as I covered more in depth above, I’ll be monitoring the bad news continuing to be minimally, if at all, impactful while the good news, such as AVAX’s partnership with AWS, resulting in strong rallies

Liquid Staking Derivatives (LSDs) — LSDs have been one of the most popular narratives and trending sectors in recent weeks as LDO, FXS, RPL, SWISE, & SD continue to be some of the best performing tokens. Aiding their recent run, ETH developers have committed to the Shanghai upgrade (allowing staked ETH from the beacon chain to likely exit to LSDs) sometime in March and Metamask announced the beta integration of in-app ETH staking where users can natively connect to Rocket Pool or Lido and receive liquid staked ETH.

As competition within the LSD sector grows, I’ll be monitoring changes in each protocol’s market share of staked ETH (as deep liquidity necessary for efficient swaps has historically triumphed greater yields leading to winner take most), the percent of ETH staked after Shanghai enables withdrawals, staked ETH yield rehypothecated throughout DeFi, and the growing excitement for repurposing and restaking staked ETH (and other assets/L1s) to secure and validate other protocols, middleware, and appchains through protocols like Eigenlayer

SOL’s recovery — I’ve previously expressed confidence in SOL’s ability to recover several times which is off to a good start as the NFT ecosystem continues to flourish and SOL has gained ~200% since the lows around $8 — Page One collectively remains optimistic on SOL’s outlook with the simplest thesis distilling down to: it’s currently one of two chains/tokens that is consistently used to transact for things, specifically NFTs, or perform actions. Outside of the NFT ecosystem, the chain continues to improve uptime, reliability, and consistent TPS above 2.5k, has xNFTs building an innovative OS, priority fees are working as intended, Jump’s firedancer independent validator client scaling throughput, Jito Labs tackling MEV and routing it to jitoSOL stakers, committed devs & a diehard community.

NFT strength & associated ERC-20 tokens — Speaking of NFTs, they’ve been incredibly fun and profitable over the past several weeks — read terv’s latest Page One for in-depth NFT coverage, it’s great per usual — Yuga had their sewer pass monkey butthole mint thing this week which was available for purchase in APE along with the game creating some minor sinks for the token as well. This is notable because next cycle, whenever that is, I’m expecting the number of ERC-20 tokens released by NFT collections to drastically expand.

In the past, with APE & DUST (DeGods/y00ts token), market participants have done a poor job pricing in the buy pressure/timing of NFT ecosystems releasing something for purchase only through their associated ERC-20 token. While most will be vaporware, NFTs that release ERC-20s have every incentive to provide utility and value to their token and I’m anticipating NFT ERC-20 tokens to become new versions of previous cycle memecoins with the added benefit of unit bias where the token is orders of magnitude cheaper than the NFT. Finally, NFTs, including their derivatives, ERC-20 tokens, and speculation, were, and will continue to be, the best way to onboard new users to crypto rails.

Real World Assets (RWAs) — more of a mid to long term trend forming compared to the others but many are expecting RWAs to play a significant role in crypto in 2023 and beyond. Ondo Finance made the first significant step in this direction last week announcing that the protocol is tokenizing US Treasuries and institutional bonds allowing global stablecoin holders access to risk-free rates on-chain (although restrictive to KYC compliance & qualified purchasers). TBD on the regulatory compliance and whitelisting necessary to rehypothecate these yields through other DeFi protocols, but the design space and adoption of RWAs on-chain will be something to monitor moving forward. As I wrote two weeks ago, RWAs and increased legacy adoption will only complicate the fissure between pure DeFi and a fully regulatory compliant parallel DeFi.

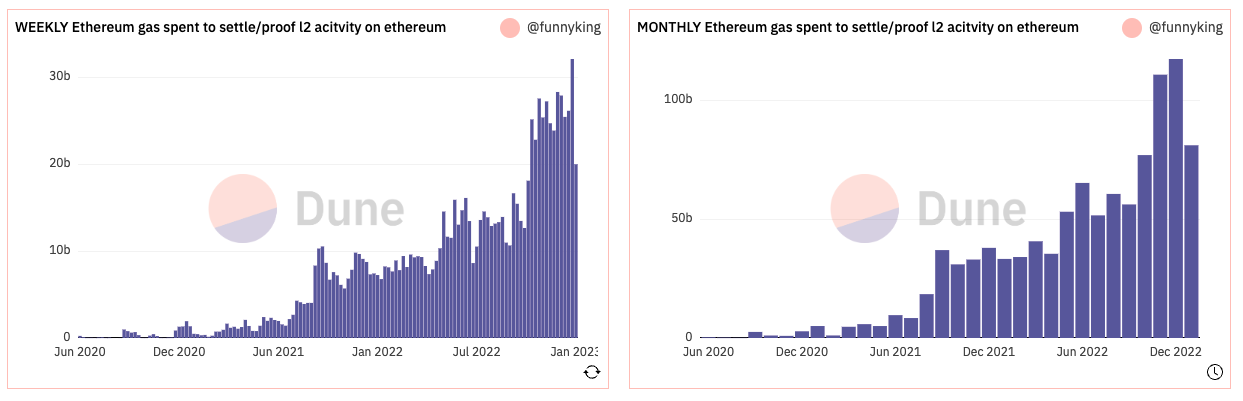

L2s Growth — some noise was made throughout last week as Optimism flipped Arbitrum in transactions, but those heightened transactions have since rolled back over after OP’s quests (incentivizing txs to farm the token airdrop) have ended — while the oscillation between which L2 has more adoption and use has remained incentive driven, the overall trend of L2 usage and ETH gas consumption continues up and to the right. Arbitrum has GMX and a burgeoning gaming ecosystem through MAGIC, but the true adoption of L2s for non-incentive driven use with simplistic UI/UX has yet to be seen. L2s/appchains, and their growing gas consumption, will be worth monitoring throughout 2023 as we see the competition between ORUs and ZKRs takeoff coupled with modular scaling solutions from the launches of zkSync, Celestia, StarkWare’s token, Polygon’s zkEVM, Fuel Labs, Cosmos appchains, Eclipse, AVAX subnets, & more.

ETH deflation — as everyone is aware, one of the most talked about/fun sites to monitor is ultrasound.money where you can track the real-time fluctuations and sometimes deflation of ETH’s supply. With the recent rally increasing on-chain activity, again largely through NFTs, ETH’s supply has once again become deflationary since the merge enabled PoS consensus. I’ve previously talked about ETH’s coming reflexivity when sustained activity returns and it’s now more clear than ever this will be the case due to its past fundamental upgrades (PoS, burn).

The combination of several (NFTs growth, L2 gas consumption, RWAs expanding) of the above trends growing all slowly chip away at ETH’s supply and create the deflationary narrative. Specifically, imo, NFTs are going to drastically increase use of the chain (creating deflationary ETH) over the coming months/years and are my bet for the most profitable sector throughout the echo bubble and beyond. This is in part because of their relative market cap compared to tokens, their ability to onboard users highlighted above, and their expanding design space.

The flywheel of on-chain activity and NFT growth leading to ETH deflationary talk/memes combined with staking yields and staked ETH securing additional economic value makes ETH and higher beta assets extremely attractive in 2023 and beyond. In addition to that, the narrative that forms around a potentially deflationary asset producing yield has only just begun as it’s incredibly easy to envision the non-crypto native demand created from traditional asset managers, Wall Street, interviews and TV segments eventually discussing ETH’s deflationary fundamentals which pushes the already accelerating flywheel into overdrive.

We’ve partnered with Parsec to provide P1 and our readers with top notch data and analytics. We’ve been using Parsec for months and are happy to support their team of chads - use code PAGE1 for 20% off Parsec’s NFT membership.

funding:

Venom Ventures Fund, UAE based, raises $1B for “chain-agnostic” crypto venture

HashKey Capital closes third fund raising $500M for crypto investments

Flashbots, ETH MEV infra company, raising $50M @ $1B valuation

Escape Velocity raises $25M fund focused on decentralizing bandwidth/compute

Nil Foundation, ZK-tech & infra developer, raises $22M @ $220M valuation

Ulvetanna, ZK-tech hardware provider, raises $15M seed

CyberX, crypto market maker, raises $15M series A

Parfin, crypto solutions for Latin American financial institutions, raises $15M seed

Obol Labs, distributed validator tech for PoS chains, raises $12.5M series A

Intella X, Matic backed/based gaming platform, raises $12M ahead of Q1 launch

Createra, UCG metaverse engine with crypto components, raises $10M series A

Syky, digital fashion brand embracing NFTs, raises $9.5M series A

Alkimiya, decentralized capital markets for blockspace provider, raises $7.2M

Quasar, ATOM-based decentralized asset manager, raises $5.4M @ $70M val

Architect, Brett Harrison’s new DeFi software venture for institutions, raises $5M

Msafe, Aptos-based multisig wallet, raises $5M seed

DWF Labs invests $5M strategic round in MASK through token purchase

Cypher, multichain crypto wallet provider, raises $4.3M seed

Gateway, credential protocol for professional identities, raises $4.2M seed

Diva, new liquid staking protocol with no min ETH requirement, raises $3.5M seed

Sleepagotchi, gamification & NFT reward app for better sleep, raises $3.5M seed

Hyper Oracle, ZK middleware developer, raises $3M pre-seed

Elixir, DeFi market making protocol, raises $2.1M seed

news:

National Australia Bank creates ETH-based AUDN stablecoin that allows business customers to settle transactions in Australian dollars; backed 1-to-1 with bank fiat

ETH’s Shanghai update enabling withdraws of staked ETH to take place in March

Visa partners with Alchemy Pay to boost NFT checkout service

LongHashX, startup-accelerator, creates soulbound tokens to reward contributors

Mastercard partners with MATIC to launch crypto-focused art incubator

Justin Sun considering up to $1B purchase of DCG assets because of course he is

3AC founders trying to raise $25M for claims crypto exchange because of course

C3 Protocol, a self-custodial exchange, announced & outlined

Fanatics sells majority stake of NFT platform Candy Digital to Galaxy & Consensys

Nexo, unsurprisingly, sees massive withdraws after police raid of its offices

Indonesia plans to launch a national crypto exchange

CoinStats outlines their impressive year of growth & features added

DefiLlama launches DEX aggregator of aggregators for best price swaps

OpenSea adds support for Arbitrum Nova

Goldman Sachs launches private tokenization platform GS DAP

Judge rules that assets in Celsius’ yield-bearing accounts belong to Celsius and not individual users — highlights the need for self-custody

MicroStrategy sells 13.5% stake to Group One

Congo National Park benefits from hydro-powered BTC mining facility

BNY Mellon sees crypto/digital assets as its “longest-term play”

MetaMask announces beta of support for Lido (LDO) & Rocket Pool (RPL) native ETH liquid staking directly inside wallet

DCG facing US investigations into conglomerate’s potential internal transfers

FTX — SBF’s $450M of Robinhood shares seized, Alameda liquidators liquidated on AAVE trying to consolidate funds, FTX debtors identify $5.5B in liquid assets, FTT rallies 30% new FTX CEO John Ray saying exchange could restart

tokens & protocols:

MATIC — PoS network hard fork upgrade completed — reduces the impact of transaction fee spikes, chain reorgs, and security, MATIC also live on Rarible

AVAX — partners with AWS to scale blockchain solutions & increase adoption

BIT — launches testnet for Mantle L2 network while 2 million per day token buybacks continue until the end of February

LDO/RPL — MetMask adds support for native liquid staking solutions

BLUR — delays token but confirms February 14th launch

SUSHI — Head Chef outlines SUSHI’s 2023 roadmap & goals with core focus on improving the DEX, a DEX aggregation router, and UX/UI improvements

AAVE — updates v3 release along with eligible initial assets supported

YFI — launches ability for users to create yield vaults in ongoing v3 rollout

Collection — NFT protocol launches DEX for instant NFT trading

EVMOS — adds auto-conversion for token swaps between ETH & ATOM tokens

JOE — expanding DEX & NFT marketplace support to BNB chain; JOE also outlines their ongoing tokenomics revamp and multi-chain use-case

BNB — 22nd quarterly burn worth ~$600M completed

SD — liquid staking protocol, releases ETHx LSD litepaper

SHIB/BONE — Shib developers announce/introduce Shiba Inu’s L2

XMON/SUDO — reference “ahead of the lockdrop” in tweet, SUDO token soon

DPX — launches stETH SSOV vaults in partnership with LDO

ATOM — progressing toward another vote & hopeful launch of Interchain Security

1INCH — DEX aggregator announces development of hardware wallet

XNFT — wallet/app interface protocol on SOL debuts wallet to wallet messaging

AMKT — token for diversification to “alongside crypto market index” introduced

FTM — Andre continues shilling, outlines “Why build on Fantom?”

Masa — soulbound identity & credit protocol launches on mainnet

UXP — fully collateralized, decentralized stablecoin expanding to ETH & L2s

ConsenSys zkEVM — launches private testnet for upcoming zkEVM L2

Eclipse — announces proof-of-concept for first SOL VM Zero-Knowledge Rollup

StarkWare — debuts Papyrus, another full node client for StarkNet

zkSync/Espresso — zkSync integrating Espresso’s CAPE privacy tech

Unstoppable Domains/Ready Player Me — partner to allow users to connect digital avatars to their crypto domain name identity

Lens — AAVE’s decentralized social protocol launches “token-gated publications”

around the ecosystem:

Ryan Watkins reflecting on the last year plus in “Meditations on Mayhem”

Electric Capital releases their 4th annual Crypto Developer Report

Ria of Castle Island Ventures on ‘Reviving Trust in Crypto”

Andrew Kang lays out his Echo Bubble thesis

tweets: