as always, thanks for reading and follow me here

tl;dr: the merge vs. macro, recent & ongoing rotations, the narrative to leverage liquidation flywheel, and protocol updates/developments galore

BTC dominance 38% | ETH dominance 18.4% | DeFi TVL $61.5B |

Total Crypto Market Cap $1.06T | Stablecoin Supply $153B |

Market Overview

As the week progressed, market’s began to roll over leading to selloffs across the industry resulting in the total crypto market cap falling from $1.22T (at the time of last week’s publishing) to $1.06T today. There were a confluence of factors impacting the move including gross economic data from Europe, a lack of broad liquidity, exhaustion and profit taking in the sharp rally over the past month and half, and the legacy market selling off Friday that was exacerbated in crypto by a Friday night liquidation party that saw BTC fall from just below $23k to briefly (for now) sub $21k.

The merge confirmation combined with improving CPI numbers and the FED’s response fueled the recent rally as the general lack of liquidity creates volatility in both directions. Crypto’s ability to create and fuel flywheels of short term bullish narratives that result in leveraged buying which eventually lead to liquidation cascades was on display perfectly over the past few days. There’s been an increasing amount of everyone’s long ETH hopium and narrative around the vast exposure and positioning for the merge which was countered by an excellent data driven thread from Zaheer last week.

ETH’s merge is one of the biggest events to happen in the history of crypto, but the hypothetical underlying bid is not yet present. There are obvious tail risks to the outcome of the merge which could sideline participants until successfully completed. The projected impact on the change of annual issuance, yield generation, and the structural change of inflows and outflows as a result of ETH’s transition to PoS are unequivocally bullish, but being caught offsides by macro factors and crypto’s ability to extend downward momentum through leverage is a tough place to be.

Movements in the market leading up to the merge, tentatively scheduled for September 15th, will continue to be volatile in both directions as large market participants game theorize and employ strategies to maximize profit before and after the merge while the macro backdrop remains poor. The merge and bid for ETH will have a difficult competition with macro uncertainty that should gain some clarity next week as Powell speaks at Jackson Hole on August 26th. In hindsight of this week, what wasn’t uncertain was the confluence of apocalyptic local top signals including the cursed Cosmos ecosystem showing relative strength, heightened flippening discussion, and the liquidity draining dog token rallies of DOGE & SHIB.

Rotation Games

While there’s been a steady decline of liquidity over the recent months, the remaining capital has been rotating in what was formerly known as a hot ball of money. Those days are clearly gone for now, but there’s still been ample opportunities to profit from the best casino ever made. As I wrote in last week’s edition, there’s severe downside to being late to these rotations as evidenced by the L2 token ecosystem fueled by Optimism and Arbitrum. At least Arbitrum’s rotation will occur again as they distribute their token sometime in the coming months but timing that is critically important.

Profits are hard to come by under current market conditions, but there’s been a steady drumbeat of opportunities that have presented themselves in the recent weeks including the aforementioned L2s, Canto, the “real-yield” narrative tokens, XMON and sudoswap NFTs, ETC, Dogechain, and liquid staking protocol tokens. These rotations are currently short lived so securing profits is paramount while we wait for easy season to return.

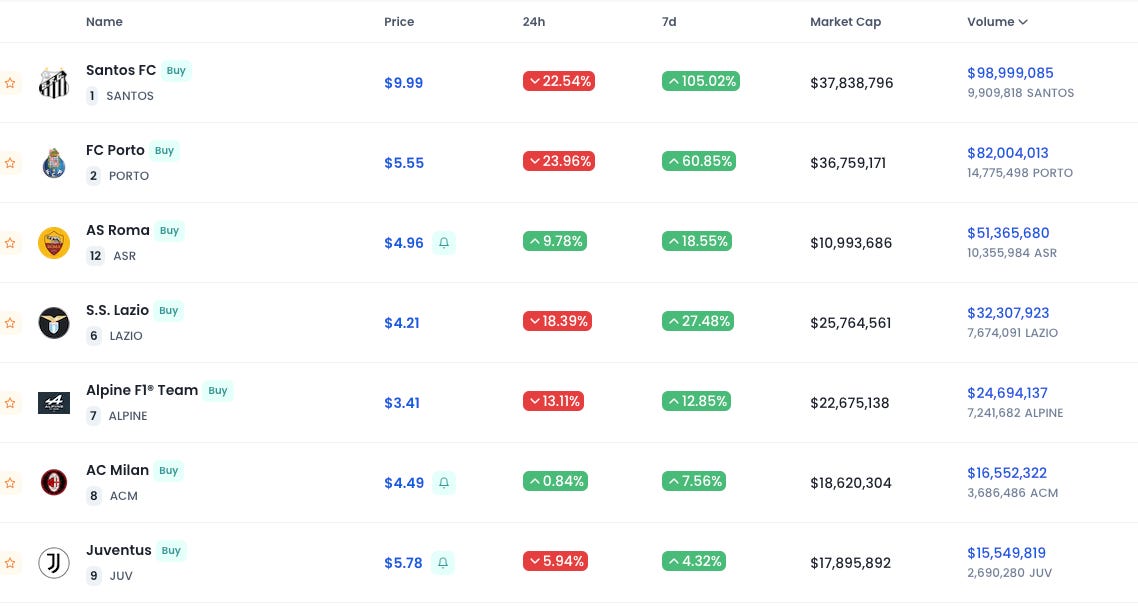

The most recent example of this is the European soccer fan club token ecosystem. Socios.com, a major issuer of the tokens, was granted regulatory approval in Italy on the 18th and the total market cap of tokens ballooned to just shy of $400M as a result. As you can see from the screenshot of FanMarketCap below, the volume for individual tokens is impressive with current 24 hour volume coming in above $350M.

Many of the tokens are currently down from their recent highs, but remain up multiples over recent weeks. It goes without saying that none of these tokens, or the previously mentioned tokens, are recommended buys but it provides further evidence that what remains of the hot ball of money is still moving. Securing profits from rallies across tokens and NFTs should be paramount until there’s broad market confirmation of sustainable rallies, but the above few paragraphs highlight that there are opportunities, ecosystems to explore, and reasons to continue learning and engaging.

funding:

CoinFund announces launch of new $300M crypto fund

Shima Capital raises $200M for first crypto fund from Bill Ackman, Dragonfly, Animoca, Andrew Yang, and others to invest in early stage crypto

Dragonfly Capital rebrands to Dragonfly, acquires crypto fund Metastable Capital ($400M+ AUM) founded in 2014

Snackclub, DAO centered around blockchain gaming, raising @ $100M valuation through private token sale

Polygon leads $25M investment in web3 venture studio SuperLayer’s new fund

Fractional, NFT infrastructure & collective ownership platform, raises $20M; rebrands to Tessera

.bit, cross-chain decentralized identity protocol, raises $13M series A

Primitive, DeFi infrastructure product developer focused on AMMs, raises $9M

MatchboxDAO, StarkNet based on-chain game developer, raises $7.5M seed

Safeheron, multi-auth self-custody wallet solution for businesses, raises $7M

news:

Tether (USDT) announces accounting firm BDO will now handle reserve attestations and will transition to releasing monthly reserve updates — BDO also completed and published Tether’s latest quarterly report

Steve Cohen launches crypto focused fund “On-Chain Investments” and hires reformed hacker Acidphreak to lead development

Gemini announces staking solutions allowing users to stake MATIC with support for ETH, SOL, DOT, and AUDIO coming soon

Mercado Libre, Latin American e-commerce giant, to launch an ERC-20 token rewarding members of it’s loyalty program with the ability to exchange the token for products or exchange it for Brazillian reais

Galaxy Digital terminates $1.25B acquisition of BitGo

CoinGecko launches tokenomics tab including token allocations, supply schedules, vesting, and mechanics

DefiLlama launches DeFi Liquidation Levels dashboard

tokens & protocols:

CANTO is live — new Cosmos L1 chain with an EVM execution layer and liquidity mining program launching soon; breakdown here

SOL — Jump Crypto building new validator client for Solana to improve scalability and reliability; thread on best protocols SOL summer hackathon here

Compound (COMP) announces Comet upgrade enabling COMP to become a multi-chain protocol is ready for launch, governance to vote soon

Frax Finance (FXS) — flurry of updates and products in development including frxETH a liquid ETH staking derivative, Frax Rollup, Fraxlend, and Fraxswap

Berachain — “DeFi focused EVM compatible L1 built on Cosmos SDK, powered by Proof of Liquidity Consensus” that has been in development, launching early next here — highly recommend this interview with founders for good alpha

BTRFLY launches Hidden Hand bribing on Optimism

Ethereum Name Service (ENS) crosses 2 million ENS names created

Flashbots open sources the Flashbots Relay MEV-Boost stating “multiple relays at the merge—rather than a single default—is key to Ethereum’s health”

Gnosis Safe confirms airdrop of SAFE tokens to early users so check eligibility

Nexus Mutual (NXM) to deposit $29M of ETH in Maple Finance (MPL) for yield

Monero (XMR) protocol upgrade completes slew of new enhancements

Rarible (RARI) publishes NFT marketplace proposal for APE DAO joining Magic Eden and Snag Solution in lobbying for Yuga Labs NFT asset marketplace

Solend (SLND), lending & borrowing protocol, launches permissionless pools

around the ecosystem:

Arthur continues his ETH bullishness & merge thesis with “ETH-flexive”

Ansem’s “A Soft-ish Landing” on where we are what to expect moving forward

@aradtski with “Crypto Gaming: A Most Practical Thesis”

On Data Availability Sampling for scaling blockchains & Celestia’s approach

Lido provides perspective and information around The Merge, LDO, and stETH

tweets: