as always, thanks for reading and follow me here

tl;dr: DeFi’s strong resurgence, token standard ERC-4079 improving NFTs, heavy funding week, ETH merge looking at September, & the usual token/protocol updates

BTC dominance 41% | ETH dominance 15% | DeFi TVL $77.5B |

Total Crypto Market Cap $981B | Stablecoin Supply $153B |

funding:

Multicoin Capital announces third fund with $430M to deploy

Lightspeed raises $7B+ for four new funds & unveils new crypto native team

Mysten Labs, builders of new L1 Sui, look to raise $200M @ $2B valuation

SOL based NFT platform Magic Eden launches venture arm for web3 gaming

Animoca Brands, gaming & venture company, raises $75M @ $5.9B valuation

Saber Labs founders launch crypto fund Protagonist with $100M to invest

Gnosis Safe raises $100M in token sale and rebrands to Safe leaving Gnosis

Farcaster, decentralized social network protocol, raises $30M

UnCaged Studios, web3 gaming company building on SOL, raises $24M

Morpho, DeFi lending protocol, raises $18M through native token sale

Inflection Points, crypto recruitment firm, raises $12.6M; buys Proof of Talent

Hang, NFT powered loyalty and rewards platform, raises $16M

Quadrata Network, web3 passport/identity builders, raises $7.5M seed

Hologram, virtual avatar firm, raises $6.5M seed

LI.FI, infra protocol aggregating bridges & DEXs cross chain, raises $5.5M

news:

Circle publishes first of ongoing USDC monthly reserve asset breakdowns

Celsius officially files for Chapter 11 bankruptcy as they have $1.8B asset hole

Snapchat testing the display of NFTs as AR filters

GameStop launches public beta of NFT marketplace

Brazilian mobile app PicPay (30M active users) to support crypto payments, launch a crypto exchange in app, & create stablecoin pegged to Brazilian real

Plaid, tech platform enabling bank connections, extending crypto integrations and functionality through partnerships with Binance, Kraken, Gemini

Brave browser officially launches native SOL support inside it’s wallet

thoughts & notes:

DeFi’s Revival

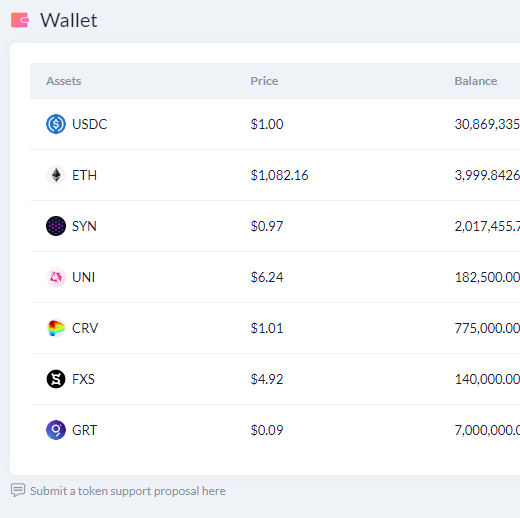

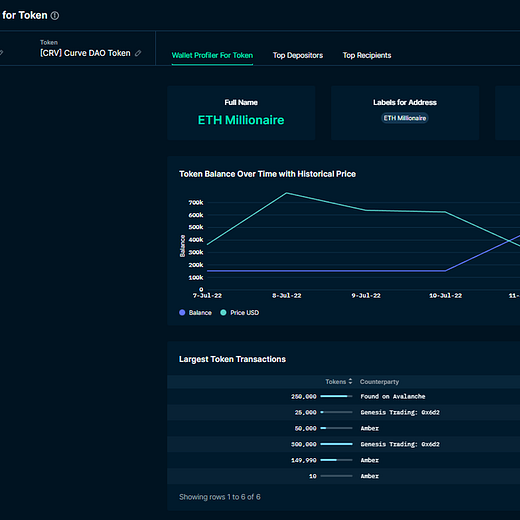

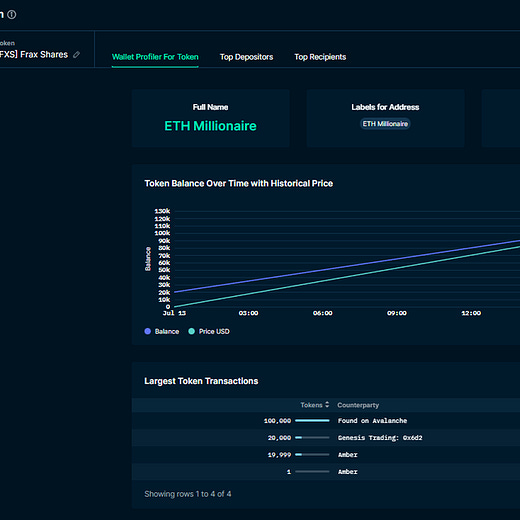

Who, what, and why is bidding the DeFi tokens? This question has percolated across Crypto Twitter this week as the DeFi sector, mainly AAVE, CRV, UNI, LDO, and COMP, have continuously out performed the broad market which we can see in DexGuru’s token terminal shown below.

While it remains unclear if there is a specific fund or entity accumulating tokens representing these productive protocols, there’s been a confluence of other factors that could be enabling the consistent bid.

First, there’s the continued functioning and robust protocol design that enables DeFi protocols to operate efficiently as numerous CeFi companies became insolvent through opaque, and likely criminal, lending practices. Secondly, numerous fundamental and narrative catalysts have emerged such as UNI’s listing on Robinhood, AAVE’s proposal of over-collateralized stablecoin GHO, COMP’s code release of their upcoming multi-chain protocol, and MKR’s approved proposals to integrate RWA’s (real world assets) and diversify their holdings into treasuries and IG corporate bonds.

Finally, as we’re all aware, DeFi by every relative price measure has been consistently obliterated to new lows over the past ~year and a half. How much worse could it get? Whether there’s a new fund accumulating DeFi tokens or not, the strength of the sector in response to both fundamental and narrative catalysts is a welcoming site. MATIC for instance is up ~17% this week, see the DexGuru linked chart above, on the back of acceptance in to a Disney accelerator program that wouldn’t benefit them in anyway? The market entertaining and continually bidding tokens on both fundamental (DeFi, SYN) and narrative driven indicators (MATIC, UNI) is a good sign for its overall willingness to take risk as the same catalysts a few weeks ago would’ve likely resulted in short-term wicks and non-sustained rallies.

Token Standard ERC-4079

As regular readers know, and beating a dead horse by now, Page One is extremely excited and monitoring the intersection and application of increased financialization, utility, and liquidity for NFTs. Last week saw the approval of a new token standard, ERC-4907, that will increasingly enable new NFT use cases. The token standard allows efficient NFT renting by introducing an automated “expires” function returning the NFT to the owner after a predetermined time and fee are met.

The above linked thread, along with this one, outline several use cases and practical implications the new token standard can achieve through increased financialization and utility. Automated in-game NFT rentals, temporary membership and usage of token gated clubs, experiences, and software, NFTs as collateral, NFTs representing real world rentable assets, NFTs as interest rate swaps, structured products, and debt financing an asset are the main potential use cases outlined in the linked threads. The rollout, protocols, and use cases enabled by ERC-4079 will be something to monitor as NFTs continue expanding their reach and capabilities.

ETH Merge Update

As the below tweet outlines, we’re inching closer to the implementation of ETH’s transition to PoS through the merge. The critical date to bookmark is the final testnet merge of Goerli on August 11th. All indications are that with a successful Goerli testnet merge taking place, the merge will likely occur in mid-to-late September with September 19th being the tentative target date. These dates are obviously fluid and subject to change, but having a hypothetical date ~2 months from today is an exciting potential catalyst for ETH and crypto at large.

tokens & protocols:

Canto & $NOTE — L1 deploying core DeFi as Free Public Infrastructure (FPI) is announced with details outlining their launch sequence here

StarkWare confirms StarkNet token that will eventually be used for transaction fees on the ZKR but airdrops not until next year, and abysmal tokenomics

LOOKS investor unlock occurs detailed here, token +12% this week in response

Stepn announces earnings of $122M in Q2, with 5% buying and burning GMT

SOL NFTs are now live on Rarible (RARI)

Arbitrum Nova chain built on AnyTrust Technology is open on mainnet for devs and new Arbitrum Rollup Nitro Gorli testnet is live

Binance burns $405M of BNB, part of efforts to reduce supply to 100M tokens; BNB chain launches dapp aggregator hub DappBay with anti-scam alerts

ZRX introduces Slippage Protection enabling MEV-aware smart order routing

BTRFLY’s Q2 updates on treasury, hidden hand, v2, and more

SFTX, DeFi and social platform for short-term asset management, announced

Lenstube, web3 video sharing platform built on Lens Protocol, is live on mainnet

around the ecosystem:

Vitalik on Network States

Arthur’s back — in-depth analysis on YCC, QE/QT, and fate of dollar/EUR/YEN

article outlining the 16 teams/protocols graduating AllianceDAO’s latest cohort

Nat Eliason with “Understanding and Profiting from Crypto Hype Cycles”

tweets:

Defy! 🤙🏽🤙🏽🤙🏽