as always, thanks for reading and follow me here

tl;dr: everyone’s hearing things, zk scaling continues advancing, UNI introduces UR for token & NFT combined swaps, ATOM 2.0 vetoed, flight to GMX, & ETH reflexivity

BTC dominance 37% | ETH dominance 16% | DeFi TVL $42B |

Total Crypto Market Cap $835B | Stablecoin Supply $145B |

musings:

Once again we find ourselves deep underwater in the rumor ocean, with speculation about the future of Digital Currency Group (DCG) and its subsidiaries Genesis and the GrayScale GBTC/ETHE trusts leading the way.

DCG and Genesis have survived numerous cycles and previous market calamities including their losses of $1B+ due to bad debt from loans to the now bankrupt 3AC. FTX’s sudden collapse resulted in another substantial Genesis loss as their derivatives trading arm said it $175M locked on the disgraced exchange. As a result of FTX and the broader market sell-off, Genesis, which is the largest prime broker in crypto, has since temporarily suspended withdrawals and new loans.

Before officially suspending redemptions, Genesis was seeking an emergency loan of $1B which further ignited the rumor mill around the solvency and future of both Genesis and Grayscale. As mentioned, Grayscale is the issuer of the GBTC and ETHE trusts which hold ~633k BTC and ~3M ETH. Obviously, FUD began to ensue as market participants speculated that DCG will begin to liquidate and/or restructure its assets, including the massive GBTC/ETHE trusts, to pay its debt.

DCG threw gasoline on the FUD fire as they decided against providing proof of reserves for their assets backing GBTC and ETHE. Fortunately, Coinbase, custodian of Grayscale’s assets, has since publicly affirmed that their assets are secure. Despite that reassurance, the future of Grayscale and DGC remains uncertain which led to GBTC and ETHE discounts once again making new all-time lows.

The future of Grayscale, DCG, and Genesis has provided a cloud over the market throughout the weekend that led to broader market declines as BTC and ETH approach 16k and 1.1k. While the uncertainty remains cloaking the market, extremely connected market participants including Chris Burniske, Split Capital, Ryan Selkis and others have alluded to their expectation of news, good or bad, providing clarity sometime this week. Cheers to hoping for the most positive outcome.

Despite the FTX fraud-induced uncertain contagion continuing to trickle out, there have been notable developments across the ecosystem that include:

ETH’s structural changes (supply reduction and EIP-1559 burn) continue to result in its deflationary supply since the merge as it positions itself for extreme reflexivity when broad risk-on returns to crypto markets

ATOM’s long awaited Cosmos Hub 2.0 upgrade was surprisingly vetoed, community plans to initiate votes on individual proposals rather than the broad changes ATOM 2.0 would’ve initiated

SOL — ecosystem recovery efforts continue as DeFi TVL bleeds ~60% to under $300M; SOL ecosystem participants remain present though, exemplified by SOL NFT collections (y00ts, LILY & t00bs) leading volume across all chains Sunday

CHZ, WCI, and any World Cup trades appear to be over as GCR wins again

GMX, decentralized perp exchange on Arbitrum, remained strong in growth & price appreciation (~+10%) this week as users flock to DeFi after FTX’s collapse

Zero-Knowledge scaling solutions continue advancement as Scroll announces their pre-alpha testnet, StrakNet deploys STRK token to mainnet, zkSync raises $200M, and MATIC’s zkEVM reaches 10k proofs generated on testnet

funding:

Matter labs, developer of zkSync ETH zk-scaling solution, raises $200M series C

OKX exchange plans $100M market recovery fund to help “high-quality projects”

Applied Digital, BTC hosting provider, secures $15M loan for Texas expansion

Virtualness, crypto content creator monetization platform, raises $8M seed

Heroic Story, crypto gaming and entertainment studio, raises $6M seed

Revv, DeFi marketplace infrastructure, raises $5.5M seed

Joepegs, AVAX-based NFT marketplace, raises $5M seed

Zulu, Colombia-based crypto wallet app, raises $5M seed

Yakoa, NFT fraud detection platform, raises $4.8M

Anode Labs, token incentivized energy network, raises $4.2M seed

PlayEmber, crypto gaming monetization platform, raises $2.3M pre-seed

news:

Apple Pay adds USDC support for merchants who accept crypto as payment

Nike readies to launch .Swoosh, a digital collectible marketplace for “Web3 wearables” that fans can collect and co-create

Man Group, largest publicly traded hedge fund, preparing to launch their crypto hedge fund strategies despite the collapse of FTX and centralized companies

TrueLayer, UK fintech unicorn, partners with Coinbase to enable users to deposit via their mobile banking app; TrueLayer also exploring adding a GBP-backed stablecoin to its crypto-focused offering

Binance US to relaunch bid for bankrupt lender Voyager while CZ says Binance is launching an “industry recovery fund” for projects facing liquidity problems

Genesis Trading temporarily suspends redemptions for its lending business

BlockFi continues withdrawals pause, potentially filing for Chapter 11 bankruptcy

Coinbase’s thoughts on “transparency, risk management & consumer protection”

BitMEX publishes proof of reserves & liabilities, to be updated twice per week

Luna Foundation Guard releases audit saying it spent $2.8B defending UST’s peg

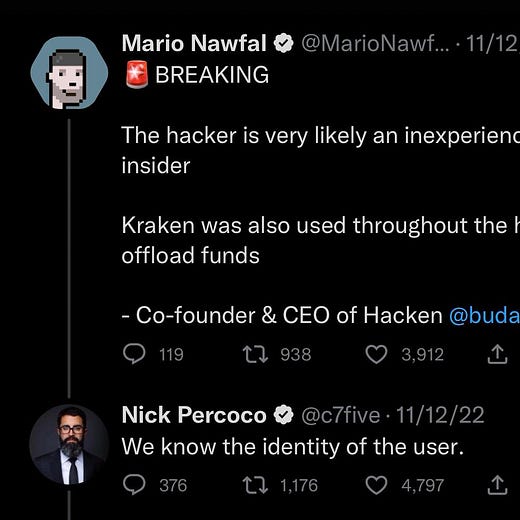

FTX updates — Vox article full of Sam DMs showcasing his insanity, Bahamas SEC says it transferred FTX assets to a wallet it controls, bankruptcy fillings posted & full of tidbits that are too insane for parody, House Financial Services Committee to hold a hearing on FTX in December, SBF cashed out $300M of $420M October 2021 fundraise

tokens & protocols:

UNI — announces Permit2 & Universal Router (UR) that can aggregate ERC20s & NFT swaps into one transaction along with much more; UNI also details unitrade, “pro trading DEX for Uniswap with a CEX experience”

ATOM — surprisingly, the long awaited 2.0 proposal to establish the future of the Cosmos Hub voted no; ATOM participants will propose individual upgrades now

CVX/CRV — Convex is now live on ETH L2 Arbitrum

SYN & CANTO — Synapse bridge support for Canto now displayed on SYN dapp

SOL — Solana Compass’ dashboard on unlocks, circulating supply, & tokenomics

STRK — StarkWare launches native token, but distribution & tradability not live yet

ACX — Across bridging protocol token will launch on the 28th

partyDAO — open protocol for on-chain group coordination, released & outlined

Lifinity — delta neutral market maker on SOL releases first v2 pool on Jupiter

Flashbots — open sources their leading MEV block builder

Scroll — zkEVM L2 rollup in development launches their per-alpha testnet

reading:

“What’s Next For Crypto“ — Faizan Khan

Faizan of Visary Capital delivers an amazing, must-read piece this week. The piece covers a wide-ranging number of topics including their current positioning, the fallout from FTX, broad market-psychology, cyclicality and the fractal market thesis, DeFi’s robust resiliency, crypto’s eventual return to being the fastest horse, the value of on-chain data and transparency during financial crises, and where/how the market can begin to heal its wounds.

“The same relative level of energy and emotion that occurs in bull markets, has to then be inversely mirrored in bear markets for finality to occur…perhaps crypto is slowly becoming contrarian again…there will be aftershocks in the market and likely some final contagion…crypto did not need a bailout here, bad actors failed and will be punished…we have no doubt a recomposition will occur and narratives will shift again in time…’this too shall pass’ “

around the ecosystem:

0xsmac with the usual “good stuff i read this week” list

Arthur’s thoughts on SBF and how he hoodwinked to the peak of the industry

Luca Prosperi’s writing “What I Talk About When I Talk About Credible Neutrality“

Nansen with the definitive on-chain analysis of FTX/Alameda’s collapse

tweets: