as always, thanks for reading and follow me here

tl;dr: SOL’s turbulent two weeks, account abstraction’s massive potential, crypto’s improving pipes leading to DeFi vs. KYC crypto, & covering the recent meta games

BTC dominance 38% | ETH dominance 17.5% | DeFi TVL $39B |

Total Crypto Market Cap $836B | Stablecoin Supply $138B |

Good evening everyone, Happy New Year, and welcome back to another edition of Round Tripping! This week’s post will cover the last ~two weeks as I’m mostly back from a hectic few weeks of navigating the holidays while simultaneously moving. I hope everyone was able to recharge throughout some holiday break & is back ready to move full steam ahead. Cheers to Page One’s future & a profitable year ahead. 🥂

Holistically, not much, if anything, has changed in crypto markets since my last post as there’s nothing new to say about a market where the majors continue bleeding volatility (as BTC’s volatility has reached a new all-time low) and liquidity. Everyday I wake up, check ETH price, price 1.2k.

Thankfully there’s been some volatility to capture within the ecosystem outside of the majors since I last wrote, led by Solana. SOL has been expectedly twapped to hell since FTX’s collapse, and the aggressive selling accelerated last week resulting in SOL reaching single digits, and a low of $8, for the first time since February 22nd, 2021.

The token looked to be on a straight line to Sam’s (RIP BOZO) infamous $3 dollar level due to a combination of FUD, year end redemption selling, a broad alt selloff, and Dust Labs announcing DeGods/y00ts would be bridging to ETH & MATIC in Q1. As fear compounded and SOL ticked downward, buyers along with Vitalik’s tweet stopped the bleeding by showing his support and hope for the SOL community.

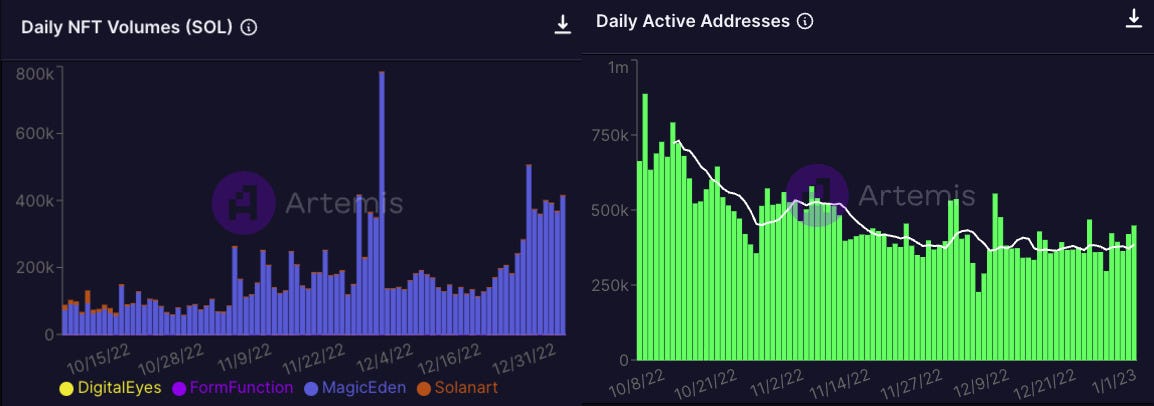

Despite the ongoing FUD and Dust Labs announcements, most of SOL’s underlying user metrics look stable, healthy, and are growing. SOL DeFi is undoubtedly still in shambles, but I would once again reiterate that the strength of SOL’s community, the number of DAA, and NFT ecosystem present ample time for the DeFi ecosystem to revive itself. Page One continues to remain optimistic on the future of SOL.

Increasing the Fluidity of Crypto Pipes

Visa proposing account abstraction for recurring auto payments built on an ETH L2 was not on my 2022 bingo card, yet here we are. Account Abstraction (AA) has endless potential use cases and Visa highlighted AA’s impact on one of the most common types of payments used in the real world today: recurring payments. As Catherine outlines in the thread below, one of the many breakthroughs AA enables would allow users to enable and set up recurring payments through a self-custodial wallet with only one initial signed transaction.

Visa describes the power of this in their accompanying paper saying, “this application could allow a user to setup a programmable payment instruction that can push funds automatically from one self-custodial wallet account to another at recurring intervals, without requiring the user’s active participation each time.”

As mentioned, recurring payments are only one of the endless number of UX improvements AA enables. Essentially, the idea of AA is to make self-custodial wallets on ETH function similar to smart contracts by allowing users to have programmable features embedded into their wallets.

AA has massive implications for crypto’s user friendliness (adoption) and security (seed phrase hell, multi-party security, social recovery) & AA’s potential represents step-function improvements to crypto’s future. Expect Account Abstraction to be one of the most talked about topics throughout crypto in 2023 and beyond.

Visa wasn’t the only organization improving crypto rails in recent weeks as UNI announced the ability to directly purchase crypto on the Uniswap Web App using a credit/debit card or bank transfer through a partnership with MoonPay. UNI, MoonPay, and Visa join Stripe, who this month announced a “customizable and embeddable fiat-to-crypto onramp” for dapps, in drastically improving the fiat to crypto pipes.

Importantly, all of Visa, Stripe, and MoonPay are registered money transmitters in the U.S. which requires them to adhere to KYC and AML regulations. While the ability for fiat to enter the crypto system is drastically improving, it’s important to note that it comes with the cost of privacy. Just as account abstraction is likely to be one of the most talked about topics of 2023, so too is the growing divide of regulated DeFi and the unregulated, pure crypto ecosystem.

Meta Games

Admittedly, being plugged in to the space on a day to day basis since FTX’s collapse has been challenging with opportunities few and far between. Still, there remains opportunities for those watching closely as evidenced by recent events including the ongoing cute NFT meta over the past few weeks, BIT’s public voting proposal to buyback $100M of its token where the token was able to be bought days before the actual vote passed resulting in ~40% gain, SOL’s airdropped BONK gaining many multiples, and Degen Spartan’s Lido tweet days before the momentum reached LDO pushing it ~25% higher.

Out of the above meta-games, LDO’s narrative and momentum is the most important/sustainable as the Shanghai staked unlocks quickly approach and staked ETH’s value is infinitely greater than the others, but BONK is the most interesting to me. The ability of BONK, a meme dog token airdropped to SOL ecosystem participants, to command attention and gain multiples provides positive foreshadows for the next eventual cycle as market participants continue to be willingly blinded by unit bias and memecoins (specifically dogs and cute animal NFTs).

We’ve partnered with Parsec to provide P1 and our readers with top notch data and analytics. We’ve been using Parsec for months and are happy to support their team of chads - use code PAGE1 for 20% off Parsec’s NFT membership.

funding:

BTC miner & public company Argo Blockchain (ARBK) avoids bankruptcy after selling Helios mining facility to Galaxy Digital for $65M & securing a $35M loan

Revel, NFT/”social collectibles” platform, raises $7.8M seed

Foundation, BTC tooling & wallet developer, raises $7M seed

Pods Finance, DeFi structured product protocol, raises $5.6M seed

Utorg raises $5M seed to build crypto wallet “super app”

Arrakis Finance, decentralized market making protocol, raises $4M seed

Pine protocol, permissionless NFT-backed loans & financing, raises $3M seed

Layer 2 Labs, BTC scaling developer, raises $3M seed

news:

CF Benchmark & CME Group launch reference rates & real-time indices for AAVE, SNX, & CRV; to be used for accurate pricing & developing structure products

Neobank Cogni releases in-app non-custodial (KYC) wallet allowing users to custody their crypto assets, will soon enable in-app crypto purchases

Core Scientific, publicly traded largest BTC miner by compute power, files for Chapter 11 bankruptcy protection

Binance joins exec committee of U.S. crypto lobby Chamber of Digital Commerce

Sandeep, MATIC co-founder, launches crypto startup accelerator Beacon

Binance completes acquisition of Indonesian exchange Tokocrypto

Fireblocks receives Cryptocurrency Certification Standard (CCSS) certification

Fidelity continues crypto push, files for trademarks around NFTs, virtual real estate investing, & crypto trading/metaverse investment services

China is launching a state backed NFT marketplace

Valkyrie Investments says it’s ready to “sponsor and manage” DCG’s Grayscale GBTC fund including redemptions at NAV via a Regulation M filing & reducing the fund fee from 200 basis points to 75

FTX — SBF pleads not guilty, DOJ investing the ~$400M hack of FTX, Bahamas Securities Commission holding $3.5B of FTX customer assets after they took custody of them following the hack, Alameda wallets shadily moving funds

Alameda gave $400M loan to Modulo Capital which was founded by three former Jane Street employees; Modulo operated out of same Bahamas condo as SBF

Avi Eisenberg arrested & charged with market manipulation for role in Mango Markets “highly profitable traded strategy” that netted him millions; notably, the DOJ calls Mango & CRV commodities (not securities!) in their report

tokens & protocols:

BIT — proposal passes enabling BitDAO to buyback $100M of its token starting January 1st, to occur through $2M of USDT purchases per day for 50 days

1INCH — completes “Fusion” upgrade enabling user protection against MEV front-running & allows custom swap orders placed without gas fees

JOE — most used AVAX DEX is now live on Arbitrum

SUSHI — new tokenomics proposal from “Head Chef” outlining four key changes, SUSHI will also deprecate Kashi lending service and MISO launchpad

MATIC — launches second testnet for zkEVM, y00ts bridging to Polygon Q1

AVAX — ‘Banff 5’ upgrade enables subnet interoperability of assets & data

REN — DAO passes proposal to mint 180M new REN tokens (~$10.8M) to fund the wrapped asset protocol’s Ren 2.0 development

BTRFLY — teases Dinero: overcollateralized stablecoin backed by staked ETH

XMON/OHM — sudoswap now allow accepts purchases in OHM

COIN — Coinbase stock reaches new low as the route in growth assets continues

UNI — partners with MoonPay to enable direct, in web-app crypto purchases

MAGIC — Arbitrum’s gaming ecosystem has displayed strength through

CVX/CRV — Convex Finance provides updates on staking dynamics for cvxCRV

Taiko — zkEVM in production launches its “Alpha-1 testnet”

around the ecosystem:

Ryan Selkis with his usual yearly crypto theses

Ace & Four Moons “2023 Blockchain Themes and Bold Predictions“

Brian Amrstrong’s recent piece on sensible crypto regulation & a new Howey test

tweets:

Lastly, thank you all for the continued support! We’re actively looking to expand our platform and relationships in the form of protocol partnerships, potential guest posts, sponsorships, branding, etc. so reach out to me or terv to discuss any ideas.