as always, thanks for reading and follow me here

tl;dr: crypto is contrarian again, CRV’s stablecoin, SOL’s NFT strength & path to recovery, APE & Yuga NFTs rally ahead of staking, & examining treasury management

BTC dominance 36% | ETH dominance 16.5% | DeFi TVL $41B |

Total Crypto Market Cap $854B | Stablecoin Supply $143B |

As you can see from the above ETH supply chart, on-chain activity has largely remained non-existent over the past couple of weeks. The market remains relatively paralyzed by a combination of the FTX hacker holding $215M in ETH, uncertainty around the future of DCG despite Barry’s optimistic message to shareholders, and the ongoing fallout from FTX’s collapse.

On the bright side of things, it feels like crypto is contrarian again. Once again, questioning the validity of crypto and proclaiming its demise is becoming the status quo. The problem with this is twofold with the first mistake being the declaration of crypto’s death despite it already dying 466 times. Secondly, common knowledge and conventional wisdom don’t provide any edge or the potential for drastic impact and returns.

Typically, when people proclaim that something is stupid, dead, or impossible while there’s still organic demand, it’s a good idea to sprint towards whatever said thing, examine why it’s occurring, and evaluate its potential. In such cases, the opportunity and risk/reward is often immense and crypto’s potential remains unparalleled.

Speaking of death proclamations and contrarianism, let’s talk about Solana as it continues to rebuild itself after the collapse of FTX. While the direct association of SOL to FTX is a disservice to the committed devs, ecosystem participants, and teams that continue to build on SOL, FTX’s role in the heights SOL reached is inexorable.

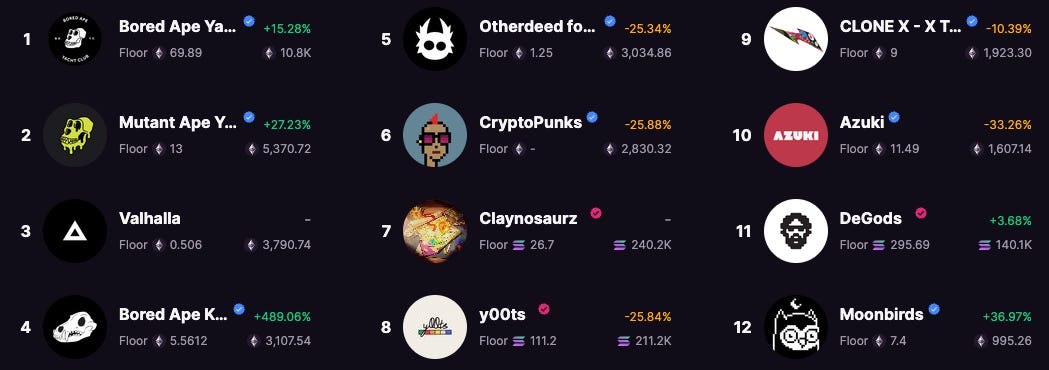

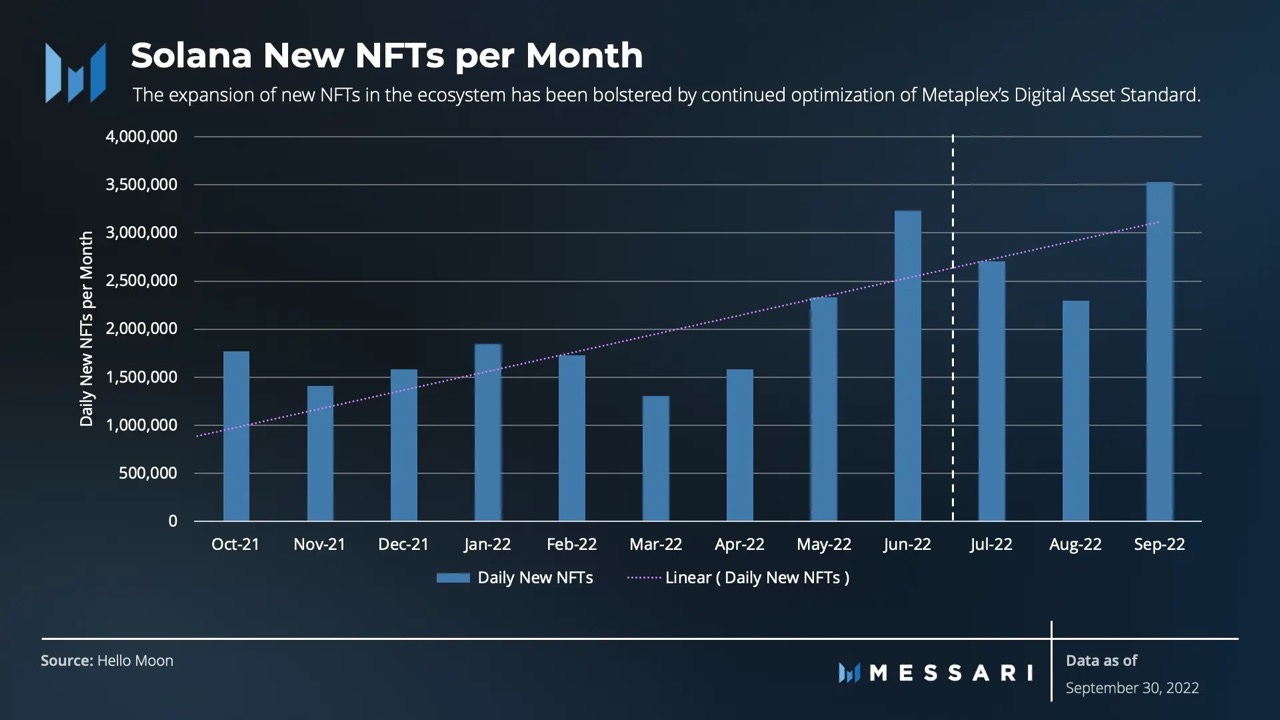

Despite the heightened negative sentiment, SOL ecosystem participants have shown life and a willingness to use the chain for NFTs. As the below picture shows, the demand for SOL-based NFTs is on par with, and sometimes exceeding, the largest and most established collections on ETH.

Page One remains incredibly bullish on the future of NFTs and believes that we’re still in the earliest stages of their future impact, collective market cap, and evolution as they are still mostly altcoins with pictures. One of the simplest heuristics for evaluating a token is whether demand for the token exists for users to transact it on-chain, which SOL continues to exhibit through its NFT ecosystem.

With that being said, legitimate questions surrounding the future of SOL’s DeFi ecosystem remain. TVL on SOL continues to evaporate, but efforts to rebuild DeFi, and the ecosystem at large, are underway led by OpenBook, a community driven fork of Serum.

NFTs alone can’t support SOL in the long run, but they, and the broader market selloff can provide time for SOL’s revival. In the meantime, TPS throughput is steadily increasing, Jito Labs recently released their novel MEV-boosted liquid staking token jitoSOL, xNFTS are still being developed, Phantom remains an incredible wallet, JIT fees have been implemented, Solana Pay is rolling out, the Saga phone is coming in Q1, and the community remains engaged, present, and motivated. These ongoing developments, along with the ones I’m surely missing, combined with the continued strength of the NFT ecosystem make me optimistic for SOL’s future recovery.

Lastly, the look ahead for this week is mostly macroeconomic indicator centric along with scheduled FTX hearings for the U.S. Senate Committee on Thursday and the European Parliament on Wednesday.

As for Page One, expect the November Recap and Page One #47 later this week along with upcoming posts that include: EigenLayer & The Liquid Staking Future, Picking Up The Pieces, and Designing Better Game Economies.

Lastly, thank you all for the continued support! We’re actively looking to expand our platform and relationships in the form of protocol partnerships, potential guest posts, sponsorships, branding, etc. so reach out to me or Terv if that sounds like you.

funding:

Binance commits $1 billion BUSD to its “industry recovery fund” with other contributions coming from large players including: Jump Crypto, Polygon Ventures, GSR, Aptos Labs, Animoca Brands, and Kronos

Matrixport, crypto financial services firm, raising $100M @ $1.5B valuation

Bybit exchange announces $100M fund for institutional client support

Thirdverse, crypto and VR gaming company, raises $15M

Across Protocol (ACX), L2 to L1 bridge, raises $10M @ $200M valuation

Proximity Labs announces $10M developer fund for NEAR based DEX tools

Onomy, Cosmos-based DeFi protocol, raises $10M in private token round

t3rn, DOT-based interoperability protocol, raises $6.5M in private token round

Tropee, NFT utility platform, raises $5.1M seed

Carv, crypto gaming identity solution, raises $4M @ $40M valuation

Nucleo, zk-enabled multi-sig for organizations startup, raises $4M seed

XDao, multichain DAO builder, raises $2.3M seed @ $50M valuation

news:

Hamilton Lane & Apollo Global Management partner with fintech company Figure to launch “blockchain investment vehicles” on Provenance

BTC miner Core Scientific posts $434M loss in Q3 and says there is “substantial doubt” it continues operations past November 2023

Justin Sun says Huobi & Poloniex exchanges could merge in the future

DefiLlama ships trending contracts dashboard & token distribution among DeFi protocol TVLs dashboard to see which protocols hold the most ETH, BTC, etc.

Brendan Blumer & Block.One buy large stake in crypto bank Silvergate Capital

tokens:

CRV — code & whitepaper for LLAMA stablecoin (lending-liquidating AMM)

SYN & CANTO — Synapse bridge support for CANTO officially live

MATIC — Magic Eden adds support for Polygon-based NFTs

APE — APE staking deposits are live on December 5th with reward accrual beginning December 12th along with standalone marketplace for Yuga NFTs is live where 50% of seller fee transaction going to the DAO

GNO, MKR, DAI — MakerDAO delegates pass initial vote to add GnosisDAO (GNO) as collateral to mint DAI

frxETH & FXS — number of ETH staked in FXS’s LSD reaches 17k ($20M TVL)

YFI — proposal to activate vote-escrowed (veYFI) begins

1INCH — announces RabbitHole for its aggregator to protect user transactions from MEV sandwich attacks

DYDX — dYdX’s account tweets “loading dYdX Chain…87% complete”

PENDLE — announces their V2 AMM & updates to DeFi yield markets

Yama Finance (YSS) — omnichain, decentralized stablecoin announced

Vertex — cross-margin spot, perps, & money markets protocol testnet live on Arbi

reading:

“Treasure, What’s Yo Pleasure“ — 0xsmac

0xsmac writes on all things treasury management, aligned incentives, the complications of native tokens, yield generation, and the prioritization of staying alive for new crypto protocols. He highlights the need for a treasury management protocol that automates and monitors treasury diversification strategies that include: selling the native token for BTC, ETH, or stables, acquiring tokens of strategically important adjacent projects, yield farming, and earning fee revenue denominated in other tokens which accrues directly to the treasury.

“One of the unique problems crypto projects face is that most fundraised in their native token. This introduces a very idiosyncratic risk and adds to the reflexivity of the ecosystem broadly…tokens are supposed to align incentives so treasuries default to holding their native token in size…long-term alignment means constructing a treasury that can withstand volatile, difficult times…there are a lot of inefficiencies that still exist and a lot of services yet to be built that…could lead to quicker compound gains for the space.“

around the ecosystem:

Vitalik’s thoughts on the ongoing debate around CEX proof-of-reserves

Sandra provides a glimpse into the current state of DeFi in Nansen charts

Jason Smith detailing his evolution of thoughts on SOL and its future

tweets:

Hi there, great read as always!! =)

I have something in my mind by the way, could you reach out to me? ^^