as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: majors continue chop, Visa deepens crypto experimentation, Apple’s growing warmth to crypto apps, BTC’s scaling phase, & DEXs increasing market share

BTC dominance 48% | ETH dominance 20% | DeFi TVL $47B |

Total Crypto Market Cap $1.16T | Stablecoin Supply $130B |

My apologies for the recent Page One hiatus as I’ve been out touching grass, traveling to Miami and my sister’s college graduation (s/o to her!!), and have spent far too much time watching the one minute chart on shitcoins, sorry memecoins, instead of writing. Anywho, we’re now officially back, locked in, and grinding harder than ever.

This week’s Round Tripping will cover the past ~10 days of the crypto ecosystem while a post I’ll release Thursday will detail the main trends, fundamental improvements, narratives, developments, and important data/flows that have occurred throughout the last ~month.

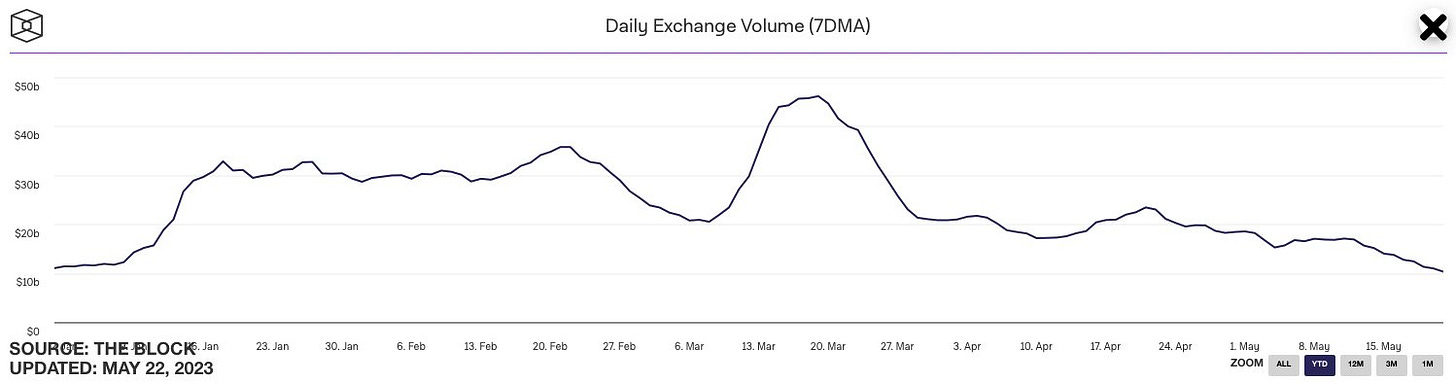

As for this past week, it was another stretch of muted volatility and price action, specifically for the majors. ETH and BTC continue to chop around 27k and 1.8k respectively with the past ~11 days enduring extremely muted volatility. As Frank highlights, daily crypto exchange volumes have hit their lowest level of the year after peaking at $46B on March 19th, they currently sit just above $10B at $10.42B.

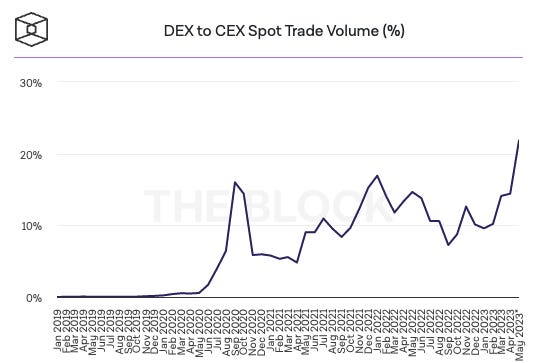

The beneficiaries of the suppressed CEX volumes have been DEXs throughout the crypto ecosystem as centralized crypto exchange volumes are at an all-time low for the year while the ratio of DEX volumes relative to CEXs is at an all-time high, clocking in at ~22% in May.

What we’re seeing develop over the past few months is a US regulatory environment that is bifurcating liquidity throughout the crypto ecosystem. On one end, volume is increasing at the most centralized levels as evidenced by the CME gaining volume from CEXs while the other end of the spectrum, decentralized exchanges, continue to increase their market share relative to their centralized exchange counterparts.

There’s several factors contributing to the above scenario with the most impactful including the continued US regulatory crackdown resulting in market makers such as Jane Street and Jump scaling back their operations, broadly lower liquidity and book depth as a result, capital shifting from the majors to play onchain in the ongoing memecoin frenzy, and key settlement infrastructure missing through fragmented banking rails after the closing of Signature and Silvergate.

How and when the US regulatory environment once again enables a thriving CEX ecosystem is anyone’s best guess, but in the mean time traders, volume, & volatility are pivoting to DEXs and onchain solutions. While the CEX and liquidity environment appears bleak, crypto is a global asset class and someone will always fill the void where money is to be made. In addition, stagnant price movement generally begets complacency and more stagnant price movement until volatility dampens to the point where it ends up exploding. While I’m expecting downward pressure to occur as a result of the consolidation we’ve seen, the eventual move is TBD while ciniz eloquently memed the current environment I’m referencing with the below image.

One of the biggest developments this week outside of DEXs continuing to gain market share came from Visa and their continued embrace of account abstraction and crypto at large. Visa continues to be at the forefront of the growing convergence between traditional payment rails and unique, new possibilities enabled by crypto rails which they first embraced in 2021 by using USDC to settle payments on ETH.

This week, Visa once again displayed their commitment to developing and contributing to crypto solutions by experimenting with the cutting edge tehcnology of account abstraction. In the words of Cuy Sheffield, the head of crypto at Visa, they’re, “excited to see Visa deploy our first paymaster smart contract on testnet as we continue to research and experiment with account abstraction and ERC-4337.”

As for exactly what Visa did, Catherine Gu, a developer of protocols, payments & infra at Visa, described it by saying, “we tested two core user operations: paying with ERC-20 tokens using ERC-4337 Paymaster; and sponsoring transaction fees for users (aka gasless txs) with ERC-4337 Paymaster.” While incredibly complex in nature, the simplest way to view account abstraction is developer magic that improves the UI, UX, programmability and security of operating throughout the Ethereum ecosystem by orders of magnitudes and expect account abstraction to continue being a major focus and catalyst for easily onboarding users moving forward.

Visa was not the only legacy giant to make waves in the crypto ecosystem this week as it appears that Apple is slowly warming to mobile crypto applications through recent developments surrounding their App Store. The Block reports, Apple’s crypto policy softens as Stepn offers in-app digital asset trading — “Stepn users will be able to buy, sell and trade the game’s NFT sneakers without having to leave the app”.

Stepn’s breakthrough follows Axie’s recent announcement that ‘Axie Infinity: Origins’ will be available on Apple’s App Store in a select number of countries throughout Latin America and SE Asia before an eventual global launch. While Axie’s gameplay is available for download, an in-app marketplace and NFT transactions are still unavailable as Sky Mavis co-founder Jeffrey Zirlin said, “we are hopeful around adding in-app purchases for NFTs and Apple allowing for the linking to third-party marketplaces.”

Historically, Apple has made it incredibly difficult for any semblance of crypto mobile adoption by forbidding the ability of companies to allow users to buy, sell, and trade NFTs. In the past, mobile iOS development was a non-starter for crypto applications trying to facilitate trade of digital assets as Apple would severely restrict how and where users could participate and/or demand a 30% cut of all in-app sales.

To date, crypto has been dominated by desktop usage with the mobile experience severely lacking despite the massive growth, specifically from emerging markets where crypto is currently most useful, that continues in mobile internet traffic. Apple slowly embracing the demand for crypto applications is a great sign for the growing wave/access of crypto mobile adoption, further evidenced recently by Solana’s Saga launch and Uniswap’s mobile wallet receiving approval from Apple last month.

While Stepn will initially launch complying with Apple’s egregious 30% tax, the ability of users to natively, in-app transact NFTs is a massive step in the right direction for the entire crypto space. Stepn also confirmed that Apple Pay will be directly available in their mobile application allowing users to purchase digital assets using traditional debit and credit cards. The ability of users to buy, sell, and trade NFTs through a functional, App Store available mobile application is a positive leap forward necessary for crypto mobile adoption to eventually take off.

Speaking of growing trends, MariaShen of Electric Capital highlights the shifting tide in BTC land as she says the most discussed topics at last week’s BTC Miami conference included:

It’s a brave new world for the future of BTC and its horizontally expanding ecosystem as evidenced by Bitcoin Frogs, an Inscription NFT collection on BTC, leading all NFT collections across all chains by volume traded on May 17th. As most everyone is aware by now, BRC-20s, Inscriptions and Ordinals are drastically changing the dynamics of BTC transaction fees, blockspace, future security and what’s possible on the bitcoin blockchain.

As with anything else that explodes to capture mindshare in crypto, Inscriptions and Ordinals volume/hype will fade in the short-term but the trend of their growing adoption and usability will only steadily increase over time. What’s necessary for that to occur, as with any blockchain, is improved tooling to manage, operate, and monitor the burgeoning space.

To that point, the focus on better tooling is dominating BTC mindshare and developer effort evidenced by discussions throughout the BTC community and BTC Lightning Network developer Lightning Labs announcing Taproot Assets v0.2 enabling an unlimited amount of assets to be minted and/or moved in a single onchain transaction. Monitoring the ongoing developments of tokens and scaling on BTC will be crucial in the coming months to years as the space continues to expand.

This edition of Round Tripping is sponsored by Kraken! Kraken — one of the most trusted names in crypto for over a decade — has built a new way to securely explore, collect, and trade NFTs across multiple blockchains.

With zero gas fees for all trades on their platform and built-in rarity rankings, Kraken lets you build your collection your way using cash or 200+ cryptocurrencies. See how Kraken is building a better trading experience at https://kraken.com/nft

funding:

Hong Kong-based Hashkey targeting a $100-$200M raise @ $1B valuation

Auradine, developers of zk tech for blockchains, AI & privacy, raises $81M series A

River, BTC tech & financial services company, raises $35M Series B

Cormint, BTC miner, raises $30M Series A to build Texas data center

Story Protocol, ‘developer of web3 narrative universes’, raises $29.3M seed

Red Beard Ventures raises $25M to invest in early-stage DeFi and crypto gaming

Airstack, AI-backed crypto developer platform, raises $7M pre-seed

Azteco, ‘easiest, fastest, & private way to buy BTC’, raises $6M seed

Jia, crypto-based small business lender in emerging markets, raises $4.3M seed

Hourglass, time-bound token infrastructure protocol, raises $4.2M seed

Pyor, crypto data analytics company, raises $4M seed

Lagrange Labs, zk-interoperability DeFi protocol, raises $4M pre-seed

Asymmetry, ‘ETF’ for liquid staking tokens, raises $3M

news:

Tether releases Q1 Assurance report detailing $1.5B of BTC holdings in its reserves; Tether announces plans to purchase BTC with up to 15% of its net realized operating profits

Visa deploys Paymaster smart contracts to ETH’s Goerli testnet for account abstraction testing

Ripple acquires crypto custodian Metaco for $250M; Ripple also announces proprietary CBDC platform for banks, governments, & large financial institutions to create their own digital currencies

Ledger shoots themselves in the foot

Voyager, failed crypto broker, cleared to start repaying customers’ frozen funds, expectation is ~36% return of customer funds which could go up based on FTX

SEC instructs Grayscale to remove its application for the Grayscale Filecoin Trust claiming the FIL qualifies as an unregistered security

Layer Zero partners with Immunefi to launch $15M bug bounty

BTC payments company Strike expands payment support to 65 countries while Tether announces that USDT will be integrated to Strike

anything on daily exchange volumes making a new low?

USDC issue Circle rebalances reserves, adds $8.7B in overnight repo agreements to protect against possible US default on treasury payments in the coming weeks

tokens & protocols:

STEPN — integrates Apple Pay and becomes first crypto gaming app to be fully available inside Apple’s app store

BIT — proposal to consolidate their token & eco around Mantle ETH L2 passes

NEAR — to integrate Wormhole support to enable cross-chain transfers to ETH

RBN/AEVO — launches perpetual futures markets along with Aevo OTC allowing users to trade altcoin options onchain

CRV — officially launches their native stablecoin crvUSD

OP — announces the long-awaited Bedrock upgrade will take place on June 6th

LDO — successfully completes v2 upgrade enabling withdrawals

Origin Protocol — launches OETH for simplified/yield boosted ETH staking

around the ecosystem:

DeFiance Capital’s Arthur breaking down “Liquid Venture Investing in Crypto”

Joel John’s “On-ramp Everybody” detailing the current fiat-to-crypto landscape

Visa’s “Rethink Digital Transactions with Account Abstraction”

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.