Round Tripping

a weekly recap of the crypto ecosystem featuring news, notes, tokens, charts & more

as always, thanks for reading and you can follow me here

tl;dr: macro in the drivers seat, chasing BAYC & gamefi returns, goblin town population growth, LOOKS & SYN keep shipping, HOP airdrop, & LIDO tops TVL.

funding & news:

Blockchain Coinvestors raises $200M fund for “mid-stage” investing

LFG buys $1.5B in BTC to continue backing UST, total BTC now worth $3.5B

Nym, privacy enabled blockchain startup, launches $300M ecosystem fund

Ryan Watkins & Daniel Cheung launch $85M digital asset fund Pangea

Zora, NFT tooling/infra/marketplace provider, raises $50M @ $600M valuation

Amberdata, crypto analytics for institutions, raises $30M series B

Bitcoin.com raises $33.6M in private token (VERSE) sale

Jane Street, global market maker, enters DeFi with $25M USDC loan

Binance is building a team to explore social media/crypto integrations and commits $500M to Elon Musk’s purchase of Twitter

Google Cloud is creating and enhancing developer support for web3

Billboard’s President stepping down to become new Doodles CEO

Decrypt, crypto news outlet, raises $10M @ $50M valuation

Block (formerly Square) reports $1.7B in BTC sales via Cash App

Bundlr raises $5.2M to help scale decentralized storage protocol Arweave (AR)

Starbucks to launch utility NFTs with “unique experiences and benefits” by EOY

Valkyrie Investments launches new AVAX trust

Kraken opens waitlist for NFT marketplace with built in analytics tooling

Under Armour and Steph Curry partner to launch NFTs

Tron’s (TRX) new algo-stablecoin USDD goes live with initial 30% APY

LootRush raises $12M to enhance user access/onboarding to blockchain games

Cometh, blockchain game on Polygon, raises $10M seed round

InfiniGods, blockchain gaming dev studio, raises $9M seed

Untamed Planet, gaming startup on SOL, raises $24M series A from Animoca

Dubai’s Virtual Asset Regulatory Authority (VARA) launches HQ inside Sandbox

thoughts & notes:

NFTs & GameFi

On the heels of BAYC’s one year anniversary, launch of APE coin, and disastrous land sale we see gamefi and legacy brand NFT integrations accelerating. The BAYC ecosystem created the best ROI (~5000x) the crypto industry has seen since BTC’s launch and ETH’s ICO. In addition, while the Axie ecosystem has crumbled in recent weeks, the explosive growth they endured in a few short months (also see GMT) is a reference point for investors to deploy capital chasing insane multiples.

The combination of broad market and L1 ecosystem fund trend exhaustion, paired with failed gamefi tokenomic learnings and NFT ecosystems expanding (BAYC, Azuki, Doodles, etc.) entices funds, individuals, and brands alike to shift their focus to gamefi and NFT investing. I previously alluded to this in a crypto recap at the end of March saying that D2NI (Direct to NFT Investing) would gain traction over the coming months. TBD on how the trend plays out, but the returns NFTs and NFT integrated gamefi examples of the past are fueling the current movement exemplified by several announcements linked above.

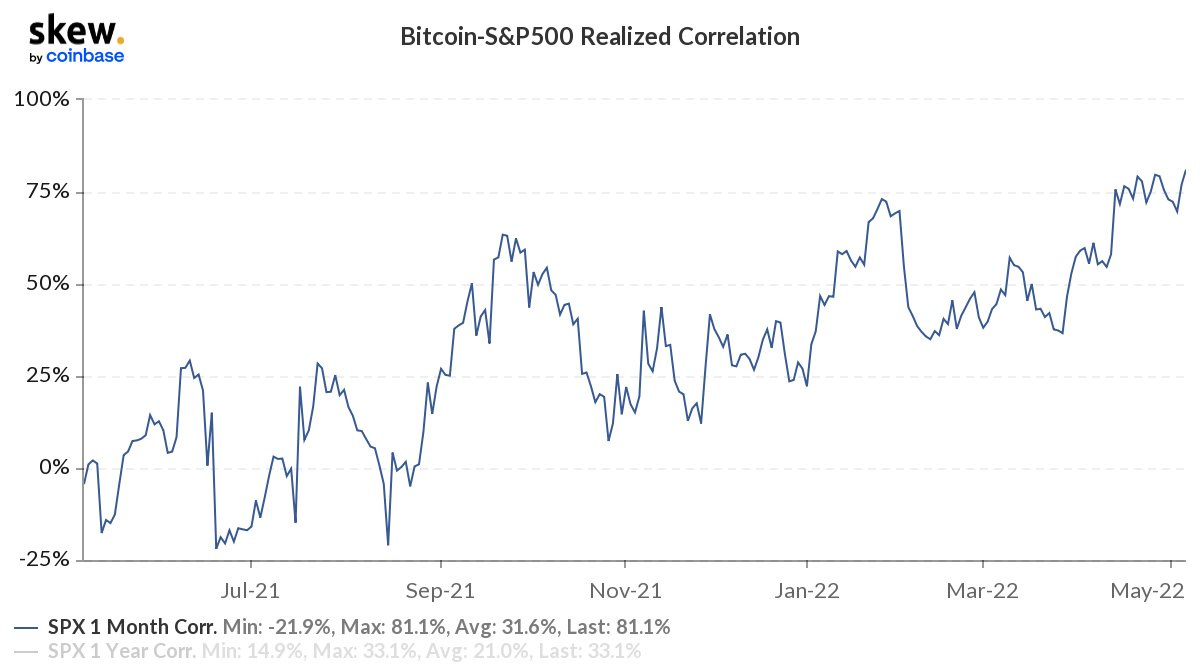

Correlation Determining Direction

While the correlation between legacy markets, specifically the S&P and Nasdaq, have become common knowledge it’s important to remember what you’re trading. Crypto will eventually decouple from the legacy intraday movements, but until that occurs and the market provides clear indication we’re all along for the unfortunate ride.

tokens:

LOOKS — 7d -9%

The LooksRare team keeps shipping as they announced a new development to their listing rewards this week. Users are now incentivized to list their NFTs closer to global floor prices with maximum rewards coming from listing within 1.1x of the collection floor. The upgrade should serve several benefits to the both the user and the protocol. Liquidity, inventory depth, rewards and users should all increase while the protocol earns additional revenue. Dingaling wrote a good thread on the new mechanics here and Dune dashboards suggest the reward system is working.

SYN — 7d +16%

I’ve previously touched Synapse, the bridging wars, and the multichain future ad nauseam in previous Round Tripping installments when they bridged ~$500M of assets during DFK’s transition to an AVAX subnet and when they launched xAssets a few weeks ago. SYN has been one of the strongest outperfomers this week on the back of their growing cult of meme heavy users/investors and product expansion which included the launch of their first NFT cross-chain integration this week. SYN and STG are the current leaders in building the multichain native asset future, a space that should be monitored by market participants.

Other Token News

FXS added as asset to AAVE V3 markets

Optimism outlines their plan for OP token adoption through Stimpack

Hop Protocol’s token airdrop and vision moving forward; tokenomics here

Polkadot releases parachain messaging for interoperability of assets

Retrograde Phase 1 launch on Terra is underway

LIDO, liquid ETH staking, tops Curve for #1 DeFi protocol by TVL

$36M worth of JUNO tokens mistakenly sent to burn address

Bastion proposal for UST integration into Aurora and NEAR ecosystem

Yearn announces and outlines v3 Vaults coming soon

ETH’s third mainnet merge test is successful

Alice Finance, releases UST point-of-sale system integration

AURY, blockchain game on SOL, beta gameplay launched

around the ecosystem:

gigabrain/whale GCR updates his LUNA short and bet

Charl3s with thoughts on scarcity of digital land

Ansem outlines his May Monthly Plan with charts and analysis

The goat zachxbt with an amazing, and ongoing, track of a recent hack

The Block’s L2 report released with a detailed thread on their analysis

always read mgnr threads and thoughts

Nansen data providing a view on the current state of market

Bixin Ventures with a deep dive on AVAX, subnets, and their future

tweets: