as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: BTC dominance breaks out, ETH as a growing safe haven asset, altcoins experience a deathly weekend, OP & MATIC’s recent updates & week size: big

BTC dominance 50% | ETH dominance 20% | DeFi TVL $43B |

Total Crypto Market Cap $1.1T | Stablecoin Supply $128B |

Apparently just shy of $300M worth of liquidations on the news of the SEC suing Binance wasn’t enough, with that total being quickly topped as ~$350M worth of long liquidations occurred Friday night. That $350M of liquidations is the new “high bar” since FTX’s collapse, and was largely the result of cascading altcoin prices.

In the usual crypto low liquidity weekend dumping fashion, most alts throughout the entire crypto ecosystem lost somewhere between 20-30%+ in the span of a brief ~15 minutes late Friday night. While we’ve never confirmed an exact answer as to what happened, the best guess is some combination of somewhat often scam weekend dump, someone severely hedging ahead of the massive week ahead, and a relatively sizable entity decided to cut *all* their altcoin positions that could have the slightest remote potential to be affected by US regulatory enforcement and liquidations exacerbated the move.

To further support that last point, BTC and ETH have remained unscathed throughout the SEC’s lengthy lawsuits and the two crypto majors only shed ~4% in the same 15 minute candles that saw essentially every other token retrace 20%+. What this signals to me is an unfortunate trend that may continue throughout at least the summer of 2023 where the market shakes off headlines potentially impacting BTC and ETH, instead passes fears down to continued selloffs and underperformance of any tokens that could remotely be considered a security.

As a result of the broad alt selloff Friday night, BTC dominance is approaching 50% after (for the time being) breaking through a 768 day range that began in May of 2021. In addition to BTC dominance’s strength, ETH’s dominance remains at a healthy level of ~20.5% while the total market of crypto excluding BTC and ETH took a beating last week, closing the week down ~15%.

The continued relative strength in the dominance of ETH and more specifically BTC further highlight the flight to safety that is ongoing as US-based and offshore entities alike sell altcoins to presumably avoid holding any tokens that could under potential regulatory scrutiny.

As for ETH, the ETH/BTC ratio has remained strong at ~0.07 in the face of the largest regulatory pressure the industry has seen. To me, if there was any doubt, this signals what most rational people have concluded since ETH’s transition to PoS: that it is now officially a crypto major and treated by a growing number of market participants as a safe haven asset, something that was previously only bestowed upon BTC.

Speaking of ETH, as I’ve written numerous times previously, it’s difficult to find a metric around total staked ETH that doesn’t point towards it being a premier asset for the next few decades of crypto. Well, Coinbase’s Wrapped Staked ETH, cbETH, is one of the lone indicators of the entire staked ETH ecosystem that isn’t displaying immense growth. In fact, cbETH’s growth has declined on both the 30d and 7d time frame which is largely a result of 24,750 cbETH redemptions on June 6th in response to the SEC’s suit against Coinbase.

Coinbase has continuously said they’ll operate “business as usual” but market participants are clearly displaying caution when it comes to Coinbase’s staked ETH product with alternative options abundant. On the bright side, most other metrics involving both Coinbase and Binance since the SEC filed suit last week remain relatively unchanged.

As I wrote last week, there have been some outflows from both exchanges, but Coinbase’s public quarterly financial reports and Binance’s publicly visible wallet holdings are reassuring to customers. Ironically, the public withdrawals Coinbase and Binance have endured would’ve almost certainly sent every US regional bank into FDIC receivership in a similar crisis-inducing fashion as to what happened with SVB.

Scaling Efforts Continue

While overall market sentiment remains at FTXish levels, protocols and teams throughout the ecosystem continue building towards a better, more scalable future. This week, Optimism and Polygon highlighted that fact as Optimism completed their long-awaited Bedrock upgrade and Polygon detailed their vision to build “the Value Layer of the Internet”.

Optimism’s completed Bedrock upgrade is the more near-term relevant accomplishment as it significantly reduces fees by upwards of ~47%, establishes the path for OP’s modular Superchain vision (which Coinbase’s Base and Worldcoin have committed to building on), drastically reduces deposit times, enabled multi-client systems, and opens the door for multi-proof systems on OP including ZK and hybrid proofs in addition to the optimistic native fraud proofs (h/t binji_x).

As mentioned, Optimism wasn’t the only ETH scaling protocol that announced fundamental changes this week as Polygon released their vision for the future of MATIC. Ryan Wyatt, president of Polygon Labs, stated that Polygon 2.0 aims to achieve, “unifying the protocols: seamless usage across zkEVM, PoS, & Supernets to feel like using a single chain, token evolution, & establish the long-term decentralized governance.”

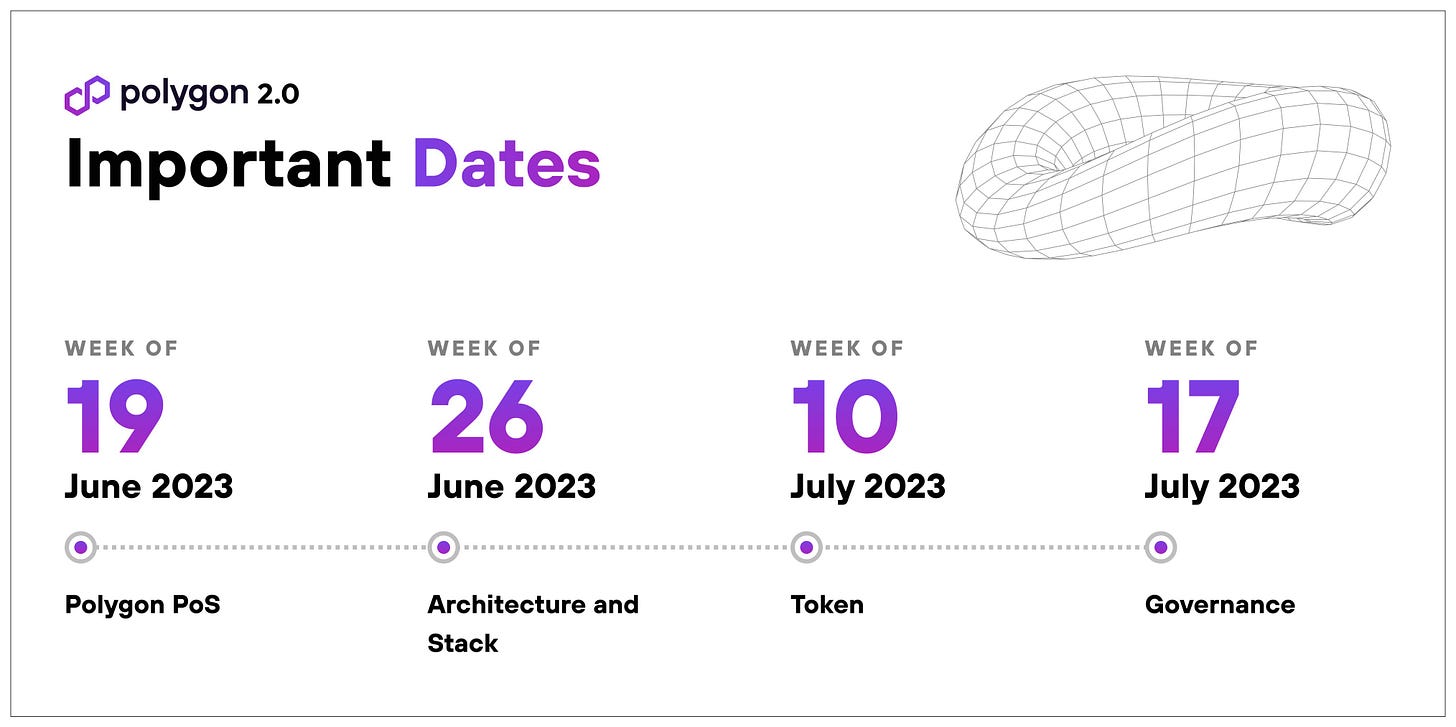

Most interesting to most of us crypto market participants, is the lack of plurality when referencing “token evolution”. As Polygon has slowly rolled out their zkEVM L2, the founder of Polygon, Sandeep, previously hinted at a possible additional token airdrop specifically for Polygon’s zkEVM. While nothing has been officially confirmed or denied, Polygon outlined their 2.0 roadmap with important dates that span the next month+. Personally, I’m much more excited about OP’s Bedrock upgrade as Polygon continues to face consistent chain reorgs (often ignored by the broad ETH community) and their zkEVM launch has come with plenty of hiccups and a TVL that has only managed to reach ~$23M.

A few other recent developments of note include:

AVAX DAAs — according to Artemis’ dashboard, daily active addresses on AVAX have climbed 162% over the past 3 months which is 2x more than the next leading blockchain (TRON) when you exclude addresses farming zkSync, Starknet & Base’s testnet. Interestingly, Artemis shows AVAX daily transactions as -41% over that same time period and it seems the attribution to their DAA growth belongs to the activity the DEX JOE is fostering & the adoption of the dapp Galxe.

Unlocks — BLUR will unlock 196M tokens on Tuesday, 6.5% of the total supply, which will increase the circulating supply by 40% from 509M to 715M. BIT unlocks 2% of the supply (Wed.), LOOKS unlocks 3.75% of the supply (Thur.), & APE unlocks 1.5% of supply (Friday).

Bottom Signals — Traders pivoting to legacy markets, increased questioning of crypto’s future, Cramer saying to sell crypto for treasuries, sentiment as low as it’s been since FTX’s collapse, mainstream media publications saying to quit crypto, etc. Of course, while the bottom signals are escalating a rapid pace, the question of who is stepping in to be the marginal buyer and liquidity addition to crypto markets is mostly unanswerable at the current juncture but regardless, the proclamation of crypto being dead has been a historically undefeated signal.

Looking ahead, we have a flurry of macro news and data to process this week starting with what will likely be an incredibly volatile day tomorrow. Tuesday alone brings us new US CPI data, the disclosure of the long anticipated Hinman documents from the SEC’s case against Ripple (expected to massively benefit Ripple), Binance US hearing on a motion to seize their assets, and the SEC’s required response to Coinbase’s petition for ruling originally filed weeks ago.

Following that, macro news becomes front and center as Wednesday brings us US PPI data and the FOMC rate hike decision with Thursday bringing ECB and BoJ monetary policy meetings. As Barry would say: gonna be a big week.

As a reminder, the P1 team consisting of myself, MoonOverlord, terv & boffin are always reachable at contact@pageone.gg. If you want to contact us in regards to sponsoring the newsletter, pitch a guest post, tell us about your protocol or to collaborate on anything in general, you can always reach us there or @PageOneGG.

funding:

Gensyn, blockchain-based marketplace for AI compute power, raises $43M

Meanwhile, BTC-denominated life insurance issuer, raises $19M @ $100M val

Taiko, EVM equivalent ZK rollup in production, raises $22M

Lens Protocol, decentralized social media platform, raises $15M

HyperPlay, “web3-native game store and launcher, raises $12M Series A

Argus, onchain game developer and publisher, raises $10M seed

Informal Systems, Cosmos-based developer team, raises $5.3M

Ironforge, serverless Solana development, raises $2.6M pre-seed

news:

Coinbase says they won’t delist assets or remove their ETH staking program, to continue “business as usual”

Robinhood announces plans to delist tokens named in SEC lawsuit, users who don’t sell or transfer those assets by June 27th will have them market sold with value credited to user accounts; Robinhood crypto trading volumes -43% in May

Kraken’s NFT marketplace exits beta, officially available to everyone

BitGo signs letter of intent to acquire Prime Trust; TrueUSD, issuer of TUSD stablecoin, has since paused minting of the stablecoin through Prime Trust

Binance US suspends USD deposits, says bank partners will pause dollar payments as soon as next week; SEC claims Binance and US affiliate redirected $12B+ of customer assets to entities controlled by CZ between 2019-2021

Investment bank BOCI issued $28M of tokenized structured notes on ETH, becomes first Chinese financial institution to issue tokenized security in HK

a16z announces opening of London office, PM plans to make UK “Web3 hub”

Circle hires former chairman of CFTC, Heath Tarbert, as its new chief legal officer; Circle obtains Major Payment Institution license in Singapore

Leaked documents show FTX 2.0 to formally market offshore exchange in Q3/Q4

Judge dismisses suit claiming DeFi protocol PoolTogether operated illegal lottery

Soros Fund Management CEO says crypto is here to stay, ripe for TradFi takeover

tokens & protocols:

OP — completes Bedrock upgrade, enables support for ZK proof systems

AAVE — governance proposal to officially launch native GHO stablecoin

UNI — updates Universal Router to improve NFT aggregator & gas prices; UNI introduces FLAIR, new metric to evaluate LP competitiveness in AMMs

SNX — launches spot market V3 Alpha release

AVAX — launches Arcad3 program to accelerate crypto gaming

LINK — partners with Swift to trial connecting private & permissionless chains

crvUSD — proposal to allow wstETH to mint crvUSD passes, borrowing rate 6%

USDT — mints 1 billion Tether on ETH to support fluidity of cross chain swaps

USDC — now natively available on Arbitrum

ENJ — officially launches Enjin Blockchain

Castle — wallet provider launches Safe Gasless Vault Creation for max security

EtherFi — LSD protocol announces/outlines the launch of ether.fan NFT collection that rewards users for staking their ETH

around the ecosystem:

Vitalik outlines three he wants to see ETH implement in “The Three Transitions”

Patrick Collins releases The Ultimate Learn Blockchain Development, Solidity, AI-Powered Smart Contract Course | Foundry Edition

redphonecrypto’s thread of thoughts on the SEC vs. Coinbase

tweets:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.

Great summary Tolks