as always, thanks for reading and follow me here

tl;dr: DOGE as Elon’s social token, BNB’s continued strength & semi TWTR derivative, FTX entering stablecoin wars, short liquidations, & the heavy ETH burn week ahead

BTC dominance 37% | ETH dominance 18% | DeFi TVL $55.6B |

Total Crypto Market Cap $1.07T | Stablecoin Supply $146B |

musings:

The story of the week tangentially-related-to-crypto-that-resulted-in-overtaking-crypto was Elon finalizing his purchase of Twitter. DOGE is essentially Elon’s social token, and gained an astonishing ~100% this week reaching highs of 0.14.

Over the past few months, DOGE was virtually a 0.06 stablecoin before beginning its appreciation Tuesday, which accelerated throughout the weekend, on rumors that Elon would be “Chief Twit” of Twitter on Friday. While Elon has remained relatively quiet on DOGE, the correlation between him and crypto’s 8th largest token remained on the speculative integration of DOGE into Twitter.

Of course, DOGE lead to a broad dogcoin rally that saw SHIB, BONE, DC, FLOKI, & ELON all gain 30%+ this week as the current memecoin meta continues. Memecoins aside, BNB has recovered well from its recent hack induced lows and provides semi-derivative exposure to the Elon social token meta as CZ invested $500M into Elon’s purchase of Twitter and Binance “to help Twitter with blockchain”. Macro wise, BNB/BTC continues reaching new ATHs further bolstering BNB’s strength.

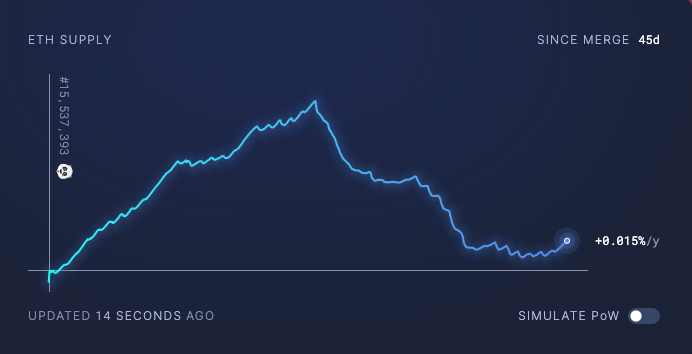

Speaking of strength, ETH gained ~20% this week on the back of large short liquidations that predominantly occurred on FTX. Additionally, ETH’s supply reduction narrative is increasingly referenced and should reach something of a local top this week as the upcoming Art Gobblers NFT mint and token mechanism fuels on-chain activity throughout the week.

Elsewhere across the market, returns were abundant as crypto, and legacy markets, shook of flash-crash reactions to earnings from META, AMZN, & AAPL. DeFi, metaverse tokens, alternative L1s, scaling tokens, and virtually every sector within the crypto ecosystem appreciated this week (/we_are_so_back).

Historically speaking, DOGE is a liquidity black hole that can signal both the beginning of sustained risk-on rallies while also potentially a sign of the cycle’s end. Here’s to hoping we’re blessed with the former of those outcomes.

The final notable event this week was SBF saying that FTX could launch its own stabelcoin in the “not-too distant future”. Everyone wants a stable coin yield from holding assets that back their stablecoin, and FTX is likely to join USDC, USDT, DAI & BUSD as one of the largest players.

AAVE & CRV should also be deploying their stablecoins in the near future as the benefits of issuing a stablecoin become increasingly clear. Large protocols and exchanges alike capture users and a stablecoin allows the entity to control on/off ramps within the DeFi ecosystem, helps contain liquidity within an ecosystem, and provides flexibility to incentivizing liquidity to various initiatives.

funding:

Zoop, digital collectibles platform, partners with Ready Player Me & raises $15M

DEC raises $9M with new idea (lol) to “decentralize ride sharing” on SOL

Oragami, DAO tooling startup, raises $6.2M

Thala Labs raises $6M seed for building DeFi applications on Aptos

Exclusible, luxury brand NFT incubating startup, raises $5M

Notebook Labs, privacy focused identity protocol, raises $3.3M seed

news:

Google Cloud launching blockchain node-hosting engine, starting with ETH

Premier League on verge of signing $35M/yr deal with SoRare for soccer NFTs

FTX exploring options around launching its own stablecoin

NFT marketplaces Magic Eden, Rarible, Dapper Labs, & Jump.trade join Twitter pilot to embed NFTs in tweets with direct links for purchases & sales

Twitter working on a “wallet prototype” that supports deposit & withdrawal

Crypto exchange BitOasis partners with Mastercard to offer crypto payment cards

Visa partners with Blockchain.com to launch debit card with 1% crypto cashback

Hong Kong to legalize retail investors crypto trading on licensed exchanges

Core Scientific, one of world’s largest BTC miners, halts debt financing repayments and warns of potential bankruptcy

Stone Ridge Holding Group, multi-billion dollar asset manager, launches accelerator for BTC’s Lightning Network scaling solution

Kollider raises $2.4M seed to continue building their BTC lightning network derivatives exchange & “lightning-native” financial products; Synota, BTC payments company, raises $3M seed

tokens & protocols:

Oasys — upcoming gaming blockchain with storied validators, debuts plan for rollout of mainnet and public token listing coming over the next ~month

SUSHI — Avi posts “brain dump” of GoldenTree’s ideas for Sushi

zkSync — launches Baby Alpha of their zkEVM scaling product on mainnet, announces development of L3 scaling chain called Opportunity

MC — Merit Circle DAO votes to burn 200M tokens (~$147M) to reduce supply of tokens dedicated to the community incentive wallet in fell swoop vs. years

GEAR — launches supply side of leveraged yield farming protocol

llamalend — DefiLlama team ships protocol for borrowing ETH against NFTs

HOP — Hop’s first liquidity mining program is now live

FIL — Filecoin launches Saturn, new data delivery network for dapps to use

USN/NEAR — USN algo-stable to be wound down after Near Foundation announces $40M grant to replenish depleted deficit in collateral reserves

BNB — Binance launches oracle product for real-world data DeFi integrations

LOOKS — switches exchange to option NFT royalties, to pay 0.5% of trading fees per transaction to creators in native token

AURY — highly anticipated game on SOL outlines in-game rewards & their efforts to create a sustainable “play & own loop reward”

Harpie — “first on-chain firewall” preventing malicious signed transactions is live

reading:

“Rethinking DeFi Tokenomics“ — Will Comyns

The core takeaway from previous cycle’s high remains that sustainability matters. TVL and liquidity are mercenary metrics that shift fluidly and lack loyalty. Sustainable token models that effectively accrue value to holders are necessary as the ecosystem internalizes learnings from the past failures of ve-tokenomics, (3,3), rebasing, burning, and staking.

To move past this, Will Comyns from Shima Capital, outlines the past cycle’s token model failures and presents his outline for a more sustainable ecosystem moving forward. The eventual ideal token model that Will settles on involves a holders entitlement to governance, a share of protocol revenue when staked, and, instead of lock-up periods, the institution of an unstaking “tax” that has the following mechanisms:

“The tax a user must pay to unlock is determined by taking a percentage of the number of tokens they have staked. One portion of the taxed tokens will be distributed pro rata to other stakers in the pool, and the other portion will be burned…whether implementing a flat or progressive tax, protocols should adopt this model of revenue sharing and taxation only after accruing substantial TVL…the most important aspect of this proposed token model is that it is sustainable.“

As a protocol grows in both usage & TVL, the prioritization from bootstrapping TVL to creating long term, sustainable token value accrual should become paramount. Will articulates this clearly and presents a compelling argument that revenue share is an eventual necessity or DeFi and crypto at large. There are obvious regulatory hurdles to overcome and gain clarity on, but the experimentation is necessary as the ecosystem increasingly focuses on sustainability.

around the ecosystem:

Matt Levine’s 40k word exploration & thoughts on crypto in “The Crypto Story”

Thread of threads on all potential airdrops & ecosystems to explore from Sandra

0xsmac with his usual great list of weekly reading content

Great debate (clip below) on crypto regulation between Erik Voorhees & SBF

tweets: