as always, thanks for reading and follow me here

tl;dr: LINK & ATOM tokenomic revamps, hopeful seller exhaustion, appchains & the uncertain future of scaling, volatility & liquidity nonexistent, & peak fundraising week

BTC dominance 38% | ETH dominance 16% | DeFi TVL $54.8B |

Total Crypto Market Cap $1964B | Stablecoin Supply $149B |

musings:

Market Overview

Although we’ve yet to reach the extremely low volatility and liquidity evaporation levels on par with previous cycle bear markets, the conditions continue deteriorating. Broadly speaking, tokens across various sectors have ranged within relatively tight, clear levels after forming bottoms in mid-June as a result of the 3AC/LUNA fallout. Many across the industry anticipated a stagnant summer/fall and in Cyclicality & What’s Next, published on May 27th, I concluded the article with,

“My current view is slow chop & pain until the sustained rally begins around the end of Q3/start of Q4 and accelerates through Q1. Many of the sectors developing I outlined receive catalysts starting in Q3 with the obvious caveat to a successful ETH merge.”

Monday begins Q4, and the amazingly successful merge is now behind us, so can we go up again? Valuations and prices across all assets have been destroyed for weeks on end, but a roulette table hitting red thirteen times in a row isn’t an indicator to shove everything on black. Macroeconomic and geopolitical factors will control crypto markets for the foreseeable future despite numerous crypto specific catalysts that have occurred recently or are upcoming.

Despite the negativity, I’m largely aligned with Ansem’s recent tweet and the thinking that *most* all crypto sellers are exhausted as ancillary crypto holdings were likely all sold when macro began puking and 3AC/LUNA collapsed. Still, weak liquidity and tight macro correlations can easily result in another leg(s) lower no matter how impactful crypto improvements (merge, tokenomics upgrades, scaling, etc.) are.

While liquidity and volatility aren’t present like in previous cycles, this year’s bear market has what other cycles didn’t; the aforementioned improvements. Regardless of prices and near-term impact, crypto teams continue iterating to ensure value accrual and find PmF. The week’s biggest news reinforced this as LINK and ATOM held conferences that resulted in announcements and roadmaps focused on upgrading their ecosystem’s. Round Tripping is slightly late this week due to travel, so I’ll assume readers have seen the numerous threads and articles detailing each token’s specific revamps, but will link ATOM’s proposal and LINK’s thread instead of waxing poetic about yesterday’s news.

Appchains, L2s & the Future of Scaling

While volatility and liquidity are hard to find, appchain, Cosmos, and ETH scaling takes are abundant across CT. Aided by the recent excitement around Cosmos updates, appchains are back en vogue again. “Wars”, various teams and ecosystems pushing/fighting for certain narratives and users, come and go throughout crypto cycles, and after battles over alt L1s, stablecoins, and bridges we’re presented with the appchain wars.

Polygon’s suite of products, Optimism, Arbitrum, Fuel VM, zkSync, Starkware, Cosmos appchains, AVAX subnets (to a much lesser extent), Celestia, and many other protocols/teams are readying their solution for the appchain war.

The core problems facing essentially all protocols/tokens throughout crypto can be simplified into a combination of three buckets that are: scaling (increasing transaction throughput wile lowering tx fees while maintaining composability), value accrual, and decentralized security guarantees. Round Tripping has previously covered and written about the appchain thesis, most notably when a mixture of the above problems initially reignited the appchain momentum after dYdX announced their departure from ETH’s L2 scaling ecosystem in favor for its own dYdX chain within Cosmos.

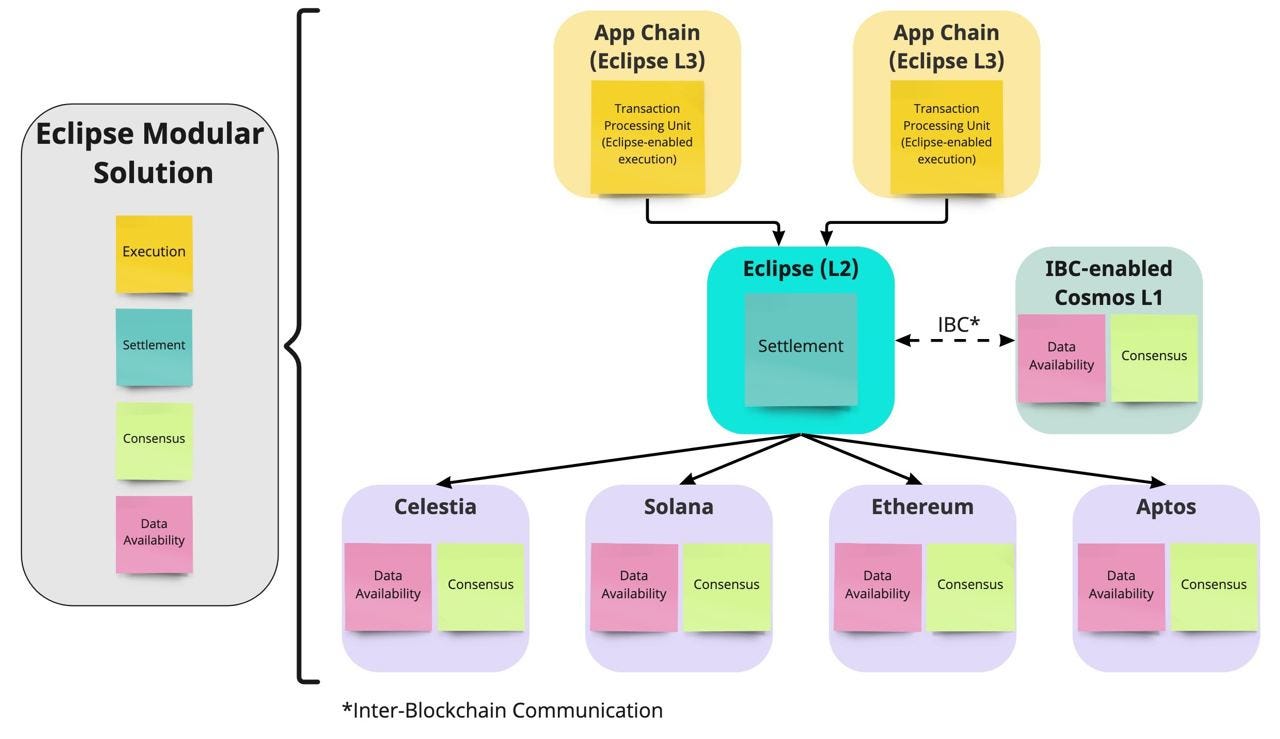

Twitter certainly reenergized the internal debate, but the uncertainty around the future of appchains, and scaling at large, was solidified once more by announcements this week that included Ribbon Finance (RBN) building its derivative exchange arm on a standalone EVM rollup chain and the diagram I encountered from Eclipse’s fundraising announcement this week.

Highlighting this specific diagram isn’t to endorse Eclipse as the winner of the scaling/appchain war, but rather to reiterate the complexity of the interoperable, cross-appchain future we’re moving towards. Eclipse’s vision, like a growing number of scaling solutions, separates the core blockchain functions of execution, data availability, consensus, and settlement *across different chains* that further exemplifies the uncertainty around the end state of (app)chain-agnostic scaling.

funding:

Pantera Capital looking to raise $1.25B for second crypto fund

Fasanara Capital launches $350M venture fund for “Web3 and fintech”

Deribit, derivatives exchange, raises funds @ $400M valuation

DeFiance Capital raising $100M for liquid token investments

Uniswap Labs raising between $100-$200M @ $1B valuation

Strike, BTC Lightning Network focused payments firm, raises $80M series B

Sei, new L1 launching soon, announces $50M ecosystem fund for DeFi protocols

MPCH Labs, private multi-party computation (MPC) solution building for self-custody, raises $40M series A and emerges from stealth

Coral, creators of SOL developer framework Anchor, raises $20M in preparation for new wallet product Backpack that introduces xNFTs

OneKey, crypto hardware wallet manufacturer, raises $20M series A

Space and Time, decentralized blockchain data provider, raises $20M

Juno, crypto-friendly checking account provider, raises $18M & launches token

Re, blockchain based reinsurance company, raises $14M seed

Blowfish, crypto firewall protector, raises $11.8M & emerges from stealth with SOL based wallet Phantom

Aqua, chain-agnostic NFT marketplace for in-game items, raises $10M

Eclipse, builders of “customizable, modular rollups using the Solana VM on any chain” raises $9M seed; aims to be a global L2 with Celestial data availability to start and Cosmos IBC compatibility

Krypton, DEX utilizing batch auctions to reduce MEV & IL, raises $7M

TokenScript, multi-chain token aware & marketing software, raises $6M & quadruples valuation to $200M

news:

Voyager, recently bankrupt crypto lender, to sell assets to FTX for bid of $1.4B

Meta announces all users of Facebook & Instagram in US are able to connect their wallets to display NFTs

Helius Labs launches webhooks on SOL enabling listens/triggers for on-chain transactions, events, & account changes

Robinhood launching self-custody wallet for 10k waitlisted with initial Polygon (MATIC) only support, multiple networks supported in the future

OpenSea announces support for ETH L2 Optimism (OP) NFTs & partners with Warner Music Group for NFT drops

Lightning Labs releases initial code base for Taro protocol that hopes to eventually allow users to issue & transfer assets on BTC

BlackRock launches iShares Blockchain Tech ETF in Europe

Circle, USDC issuer, announces cross-chain transfer protocol for USDC along with coming support for USDC on Cosmos, Polkadot, Optimism, NEAR, & Arbitrum

CryptoPunk #2924 sells for 3.3k ETH ($4.4M)

CoinStats launches native DeFi tracking in-app in addition to NFT & CeFi features

tokens & protocols:

LINK — staking confirmed to go live in December along with SCALE & BUILD programs that will result in LINK acquiring native tokens of other protocols in exchange for data feeds and other Chainlink services

RBN — announces Aevo, a next-generation options exchange built on EVM rollup

DOT — updated roadmap and developments moving forward

COMP — officially launches borrowing for institutions

INJ — announces “Project X” @ Cosmoverse that includes AMMS, strategy vaults for market making/yield, & native launchpad

SAFE — Gnosis Safe launches claims for SAFE airdrop & establishes SafeDAO

LayerZero partners with Circle to enable native omnichain USDC transfers

ParagonsDAO (PDT) launches staking for PRIME rewards in Parallel ecosystem

NostraSwap — stablecoin DEX announced on StarkNet

PUSH — ETH Push Notification Service rebrands to PUSH for multi-chain future

Stackr Network — announced as SDK for building app-specific rollups on ETH

Hashflow announced, gamified DAO with staking, quests, & rewards

reading:

“The Appchain Universe: The Risks and Opportunities” — Mohamed Fouda

As touched on throughout the opening of this post, appchain theses are a hot commodity nowadays. If readers are unaware of what is necessary for successful appchains or in what situations they are practical for, Mohamed has you covered with every possible specification.

“Appchains are designed to primarily perform a single functionality or application (game, DeFi protocol, etc)..that means that the application can use the full resources of the chain, e.g., throughput, state, etc, without competition from any other applications..this design choice allows optimizing the chain technical architecture, security parameters, throughput, etc to match application needs.”

While I’d recommend reading the article in its entirety, Mohamed highlights eight categories where appchains appear to be the most practical and we’ll likely see future impacts: (1) high performance DeFi protocols (2) appchain gaming engines (3) developer tooling to customize, deploy & maintain sidechains & L2s (4) AI-enabled appchains (5) abstracting cross-chain communication (6) crosschain DeFi (7) messaging between EVM & non-EVM chains (8) enabling cross-chain security sharing.

around the ecosystem:

Jack Chong with comprehensive report on DeFi & Real World Assets (RWAs)

Lars with his usual thread of data summarizing the previous month in crypto

Adam Cochran breaks down the bid/open interest dynamics for ETH on FTX

Meltem’s brain dump of current thoughts around crypto and markets broadly

tweets: