as always, thanks for reading and follow me here

tl;dr: Merge/L2 meta, OP’s strength/ongoing rotations, BTRFLY v2, lagging performance to macro markets, ATOM upgrades, & legacy announcements galore

BTC dominance 39% | ETH dominance 18% | DeFi TVL $69.5B |

Total Crypto Market Cap $1.14T | Stablecoin Supply $154B |

funding:

Famed macro fund Brevan Howard raises $1B+ for new flagship crypto fund

Yi He to lead Binance’s $7.5B venture capital and incubation arm

GSR Capital launches two new funds for investors seeking crypto exposure

Tomorrow Crypto, BTC/ETH mining infrastructure company, to go public through SPAC merger valuing the company at around $310M

LVMH backed Aglae Ventures to launch $102M crypto fund

Chiliz invests $100M into Barca Studios expanding FC Barcelona’s partnership with Socios as FC Barcelona expands its web3 strategies

Kurtosis, crypto dev tooling ecosystem, raises $20M series A

MarqVision, AI enabled counterfeit detection for NFTs, raises $20M

OneOf, NFT platform, raises $8.4M led by venture arm of American Express

Stride, Cosmos liquid staking protocol, raises $6.7M seed

news:

BlackRock taps Coinbase to offer institutional investors crypto exposure

Meta (Facebook) announced the expansion of Instagram NFT integration to over 100 countries; to support ETH, FLOW, MATIC blockchains and third-party wallets MetaMask, Rainbow, Trust Wallet, Coinbase Wallet, and Dapper Wallet

Binance partners with Mastercard for crypto-to-fiat card launch in Argentina

Crypto venture firm Hashed confirms losses of $3B+ following LUNA’s collapse

Alchemy expanding SuperNode infrastructure support to Polkadot ecosystem

Magic Eden (SOL NFT platform) to launch support for ETH NFT ecosystem

Gucci partners with BitPay to enable acceptance of ApeCoin for payment

BTC miner Marathon secures $100M loan from Silvergate; Marathon has 10k BTC in reserve and hasn’t sold since October of 2022

Bipartisan bill introduced by four Senators would establish CFTC as the primary regulator for crypto exchanges

Ticketmaster plans expansion of NFT offerings; Tiffany & Co releases NFT backed CryptoPunk pendants

Overviews of the frenzied Nomad $190M hack and Solana wallet Slope’s negligence of storing seed phrases in plain text leading to $6M+ user loss

Voyager cleared to return $270M to customers, anticipates resuming withdrawals beginning August 11th

Starbucks to unveil their web3 initiative at next month’s Investor Day event

thoughts & notes:

Merge Meta

As previously mentioned in the July Recap, the upcoming merge and L2 narrative is driving current market rotations. While ETH has led the broad market rally, tokens and protocols that give exposure to, or benefit from, the merge such as LDO, RPL, SNX, GMX, and OP have continually outperformed ETH over recent weeks. We can clearly see this as those tokens are plotted against ETH in DexGuru’s token terminal below.

The DeFi sector has continued to recover over the last month and is likely a result of a few converging narratives such as ETH fees collapsing returning capital from alt L1s, their robust performance during the recent crypto credit crisis, the increasing cash flow narrative rotation, and their PmF for users before and after the merge. Downstream of DeFi are the aforementioned tokens that have outperformed recently aided by Optimism passing Arbitrum in TVL through subsidized usage.

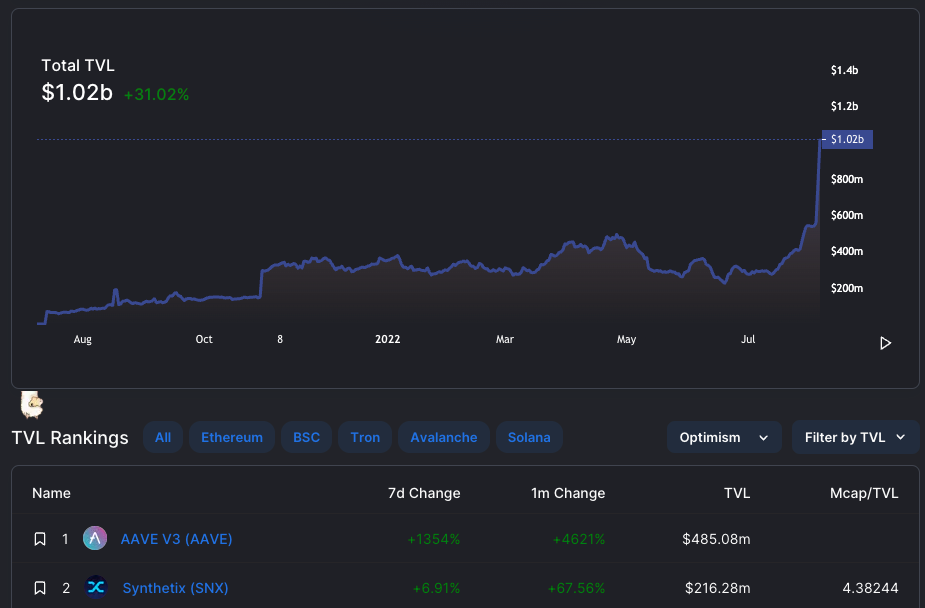

Visualized through DeFiLlama, we can see Optimism’s TVL has exploded this week through liquidity incentive partnerships with AAVE and SNX. Optimism’s surge and successful token launch, along with proximate OP DeFi protocols, should be referenced and studied by market participants as surely Arbitrum, zkSync, StarkWare and other L2 protocols will employ similar strategies when releasing their tokens.

Lagging Legacy

In recent weeks, there’s been a ton of thoughtful discussion surrounding crypto’s current correlation and relative underperformance to the upside/outperformance to the downside of legacy markets. Announcements such as BlackRock’s partnering with Coinbase and Meta’s (Facebook) Instagram expanding their NFT integration and third party wallet support would’ve corresponded to crypto markets rallying in past cycles.

Instead, reactions to those announcements, and several other like them over the past few months, has been tamed in crypto markets as Coinbase stock was the primary beneficiary. The reality seems that for the time being, enforced by the recent collapse of LUNA/3AC, exposure to the broad crypto ecosystem from legacy markets is enacted through public crypto adjacent companies. MSTR is essentially a sudo BTC ETF vehicle and COIN captures long tail of crypto assets so why deploy capital to tokens if you don’t have the capacity or time to understand what is real or fake within the space?

Fortunately, this temporary structure will change over time as the speculative wave collapsed revealing those swimming naked. Protocols have begun the healthy pivot to the cash flow narrative and displaying their PmF, NFTs continue adoption and increasing the usefulness of the underlying asset through financialization and liquidity improvements, and ETH’s catalysts of the merge and L2 adoption reducing transaction fees look stronger by the day.

tokens & protocols:

ATOM upgrades coming in whitepaper 2.0 — monetary changes to ATOM include “hub as fund, sound money”; Interchain Service updates include “multi-hop routing, interchain security, and protocol controlled value”

Redacted Cartel (BTRFLY) outlines v2 which will launch on August 8th, confirms plans for launch of stablecoin “eventually”

AAVE officially passes vote for creation of over collateralized stablecoin GHO

Integration of LINK Proof-of-Reserve feeds into AAVE’s cross-chain, bridged assets begins

Arbitrum (token soon) migrating to Nitro upgrade on August 31st

OP thread on the future of Optimism, their Bedrock upgrade, rollup decentralization, and potential for OP’s Bedrock to implement ZK-tech

UNI controversial proposal to establish Uniswap Foundation with a $74M budget and potential 2.5M UNI tokens for governance

overview of MEV protection and ‘middleware’ protocol Manifold (FOLD)

Aleo, ZK application toolkit and scaling, releases testnet 3

Pyth, oracle on SOL, launches Pythnet — a network built on Solana enabling price feeds to other chains through Wormhole’s cross-chain messaging

Alchemix (ALCX) integrates AAVE vault strategies, now live

around the ecosystem:

Huobi’s Web3 Middleware and Infrastructure research

Arthur’s post “Max Bidding” on the bullish case for $10k+ ETH

Vitalik on the differences and tradeoffs between various ZK-EVM solutions

Ansem details his usual monthly plan and releases some alpha

Kain with an overview of the crypto market and updates on SNX

tweets: