as always, thanks for reading and follow me here

tl;dr: SBF to prison, macro induced vol this week, Neon’s upcoming EVM on SOL launch, L2s led by Arbitrum continue growth, ETH’s reflexivity, & Binance FUD grows

BTC dominance 37% | ETH dominance 17% | DeFi TVL $42B |

Total Crypto Market Cap $877B | Stablecoin Supply $141B |

In the best late addition to a newsletter I’m about to press send on: it’s an amazing day for everyone across CT as SBF has been arrested and is going to prison (cheers to all waiting for this news & now back to the regularly scheduled programming).

Crypto was once again uncharacteristically quiet this week as the NFT market consumed most of the energy this week (which you can read about from terv in Page One #47). BTC and ETH continued in their tight range and are virtually unchanged from last week remaining at 17k and 1.25k respectively.

We may finally see some volatility in crypto this week, albeit coming from our macro overlords, as US inflation data is released tomorrow morning, Jerome Powell will speak along with the FED hiking rates on Wednesday (consensus 50 bps), and current FTX CEO John Ray will testify in front of U.S. House Committee on Financial services tomorrow morning at 10AM EST (although the expected fireworks are surely subdued as SBF won’t be testifying anymore as a result of his long-awaited arrest).

As for the micro, crypto-specific things I’m continuing to watch throughout this week and moving forward include:

ETH’s flatlined supply and the ease with which ETH will become reflexive next cycle as on-chain activity returns — can be seen this week through Binance shuffling addresses & reducing ETH suppply by 1.5k and worthless tokens such as XEN routinely elevating gwei and decreasing ETH supply

Neon Labs — launching this week that enables a fully Ethereum-compatible environment on Solana — dApps from any EVM chain can now deploy on SOL and I’ll be closer monitoring their rollout along with hopefully corresponding growth in SOL TVL, users, & transactions (should be more impactful with Phantom, top SOL wallet, integrating support for ETH/MATIC a couple weeks ago) — last minute update, Neon’s deployment has been “postponed until a later date”

Binance — the growing (deserved) FUD and backlash regarding their “audit” along with the continued exodus of capital from the ecosystem (Jump withdrawing $135M this week & net outflows totaling $300M in past 24 hours)

Stablecoins — their market share and the allegiance each has with the dominant exchanges — BUSD/Binance, USDC/Coinbase, Bitfinex/USDT — after Coinbase announced zero fee trading to incentivize users to swap USDT to USDC

Still monitoring updates on DCG as GBTC hits another new record discount low

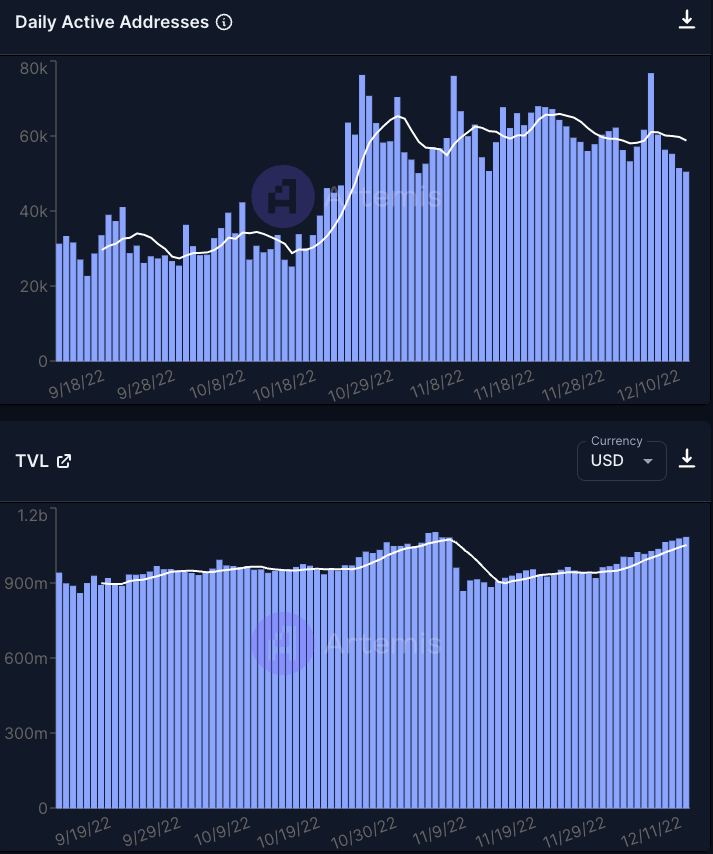

Continued L2 adoption and its corresponding growth in gas usage

Arbitrum’s continued growth — led recently by The Beacon (action roguelite RPG game), flipped Polygon in TVL, $MAGIC’s growth (used throughout Arbitrum gaming/NFT eco), & its DeFi strength evidenced by GMX & Rage Trade demand

Finally, we’ve partnered with Parsec to provide P1 and our readers with top notch data and analytics. We’ve been using Parsec for months and are happy to support their team of chads - use code PAGE1 for 20% Parsec’s NFT membership.

funding:

Bitwave, crypto accounting & tax platform, raises $15M series A

Perennial, derivatives protocol, raises $12M seed & launches live on mainnet

Forum3, NFT branding/strategy for royalty programs, raises $10M seed

Shibuya, NFT-based decentralized video platform, raises $6.9M seed

Metagood, for-profit social impact NFT startup, raises $5M pre-seed

Earn Alliance, community & tool builder for crypto gamers, raises $4.75M seed

Panoptic, UNI-based protocol for perpetual options, raises $4.5M seed

Outdefine, decentralized hiring network based on SOL, raises $2.5M seed

The Mirror, 3D virtual world developer, raises $2.3M in pre-seed funding

NF3, DEX for swaps & options on NFTs, raises $1.65M seed

news:

ETH devs targeting March 2023 for Shanghai upgrade that will enable users to withdraw staked ETH from network validators

Goldman Sachs planning to deploy tens of millions to crypto firms with distressed valuations from FTX’s collapse

Amber Group’s struggles continue as the crypto firm raises half of its planned $100M round, ends sponsorship with Chelsea FC, cuts more jobs, & reportedly owes ~$130M to Vauld’s CEO

Alameda’s $5.4B venture portfolio revealed by the Financial Times

Presidio Trading, quant hedge fund, to separate its crypto tail risk strategy into a standalone fund after its strong performance this year

Nexo, one of the last CeFi protocols left offering high-yield on crypto by operating a defacto hedge fund with user funds, is ceasing operations in the U.S.

Coinbase chooses USDC, offers free swaps of USDT to USDC

Winamp, Windows media player, integrates support for ETH & MATIC music NFTs

Genesis owes creditors at least $1.8B including $900M to Gemini Earn customers

Strike, BTC Lightning developer, enables payments to Nigeria, Kenya, & Ghana

Ledger, hardware wallet maker, releases Ledger Stax & details plans to go public

tokens:

SUSHI — proposes to direct 100% of xSUSHI revenue to treasury wallet as the protocol is running out of funding, token tanks as a result

AAVE — purchased crypto social gaming app Sonar to integrate into Lens

LINK — v0.1 staking is officially live with a 25M LINK token limit until early 2023

MPL — Orthogonal Trading defaults on eight loans totaling $36M

qETH — Tranchess, liquid staking provider for BNB ecosystem is expanding to offer LSD qETH for ETH that provides 4% yield

OSMO — ATOM-based dominant DEX launches a stableswap for stabelcoins

APE — APE staking is live with 64M APE currently staked worth $273M

GNO — Gnosis Chain completes upgrade transitioning consensus to PoS

Espresso — launches CAPE (Configurable Asset Privacy for Ethereum) on Arbitrum testnet

OP — announces airdrop #2 will occur in February with 10M OP distributed

BLUR — airdrop 2 is live, users have 14 days to claim by placing a bid

Rage Trade — launching delta neutral GLP vaults on Arbitrum December 12th

Nomad — bridging protocol hacked for $190M earlier this year details its relaunch plans including offering partial rewards to affected users

Hashflow & Wormhole partner to improve cross-chain swaps starting in 2023

RWA.xyz — analytics platform launched this week to monitor DeFi x RWAs

reading:

Arthur can of course be sensational in his essays, but his thought process, data-driven analysis and unique writing ability are admirable. This week he delivers us an exploration of whether the bottom is in through examining the forced selling that has occurred (and has hopefully exhausted).

“Therefore, at the margin, we likely already hit the lows of this cycle during the recent FTX/Alameda catastrophe…the CELs and all large trading firms already sold most of their Bitcoin…all that is left now are illiquid shitcoins, private stakes in crypto companies, and locked pre-sale tokens…I don’t know if $15,900 was this cycle’s bottom but, I do have confidence that it was due to the cessation of forced selling brought on by a credit contraction.“

around the ecosystem:

NoSleepJon on Hyperlane & how it processes messages between chains

0xsmac with the his usual topical “good stuff i read this week” list

Qaio Wang & Alliance examining Proof of Physical Work (PoPW) networks

realrubberjesus provides an overview a NFT project per month from 2020-2022

tweets:

Lastly, thank you all for the continued support! We’re actively looking to expand our platform and relationships in the form of protocol partnerships, potential guest posts, sponsorships, branding, etc. so reach out to me or terv to discuss any ideas.

Nice read!