as always, thanks for reading and follow me here

tl;dr: following macro down, SWEAT & consumer facing adoption, funding accelerates, gamefi and the next crypto catalysts, and Nasdaq enters crypto services

BTC dominance 37% | ETH dominance 16% | DeFi TVL $55B |

Total Crypto Market Cap $978B | Stablecoin Supply $152B |

musings:

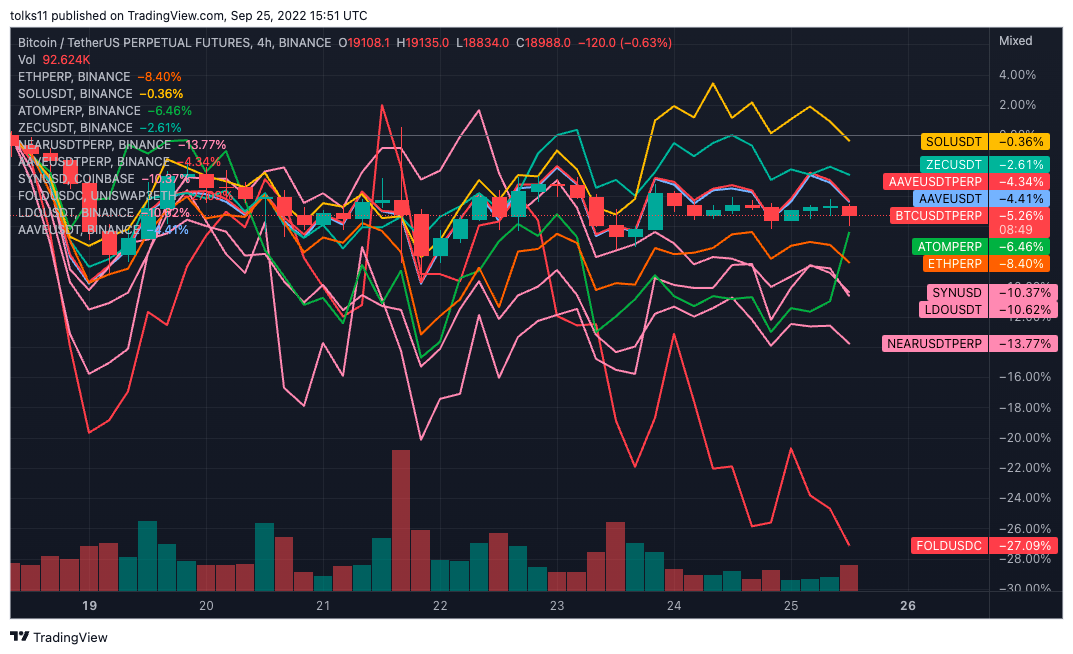

We’re now over a full week removed from ETH’s merge which resulted in an amazingly seamless transition of the consensus mechanism where PoS transactions and the functionality of DeFi and NFT protocols remain unaffected, a testament to the ETH core devs tireless work. Unfortunately, the devs can’t fix the price as ETH and the broad crypto market continue their drift downward following legacy markets.

Macro indicators including inflation, interest rates, and DXY strength continue to be the most important factors across all markets. This week, FOMC resulted in a 75 bps increase to the federal funds rate as our macro overlords attempt to reign in inflation through the systemic destruction of asset prices across the world.

To me, the core question for crypto markets is what narrative or catalyst can ignite idiosyncratic flows? ETH’s structural changes as a result of the merge, namely issuance reduction and ESG compliance, are often referenced as the answer to that question but the short to mid-term reality remains crypto as high beta to legacy markets and capital flows.

Sure, there are numerous crypto protocol upgrades, scaling solutions, tokenomics revamps, and more crypto native catalysts on the horizon, but that won’t necessarily introduce new flows of capital and entice retail. Retail doesn’t care about YFI’s v3 upgrade, FXS’s Fraxlend rollout, or the upcoming stablecoin releases from AAVE and CRV, while institutional capital waits for increasing numbers of DAUs returning to crypto applications that impact their daily life.

This is not to disparage the teams that consistently ship important protocol upgrades and improvements that are necessary to better serve users *when* the addressable on-chain user market reaches escape velocity. While sobering, this does provide us an edge and potential multiples of return before the market expands again as identifying the projects that have the fundamentals to absorb those flows when they return is key.

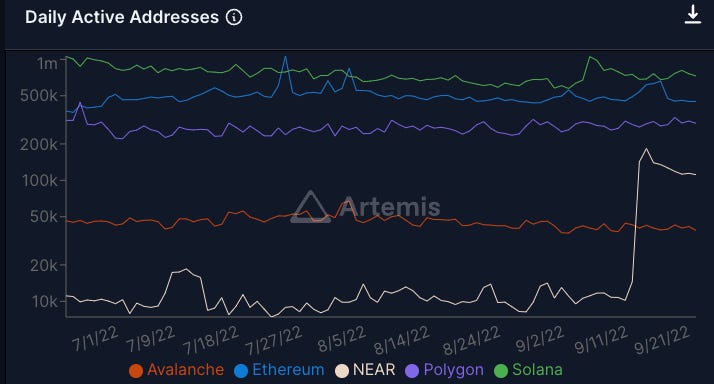

What fuels the idiosyncratic crypto flows that spill over to the protocol upgrades we all watch so closely are new consumer applications that incentivize behavior and routine use that impact day-to-day life. Below is a screenshot from the excellent data provider gokustats that shows one of those recent applications.

As you can see, NEAR daily transactions have sky-rocketed this week from 10.2k to peaking north of 183k. This sudden, massive increase is the result of the launch of Sweatcoin (SWEAT). SWEAT is similar in nature and design to the once popular STEPN, as users are rewarded in SWEAT tokens for their movement. Admittedly, I haven’t personally analyzed the tokenomics, token sinks, and sustainability of the SWEAT ecosystem, but the ability to onboard users to crypto rails is unquestioned.

Of course, SWEAT may follow it’s predecessors such as AXIE and STEPN to the heavily populated token emission graveyard, but the near-term adoption is notable. SWEAT may falter and fail, but the takeaway, as it was with AXIE and STEPN, remains clear. In my current view, crypto adoption accelerates not through niche protocol upgrades, but through consumer facing, mobile-friendly applications that impact consumers everyday routine and behavior. Downstream of onboarding the next millions of users are the important protocol upgrades that lead to more efficient DeFi protocols working in the background of consumer facing applications.

Generally speaking, I think this line of thinking is what has so many excited for the next wave of gamefi applications. It remains unclear which game or application ignites the next bull market (or if that occurs at all), but it’s becoming an increasingly consensus view that some form of gamefi, consumer focused application or protocol combining NFTs and DeFi leads to the next wave of adoption. While markets may continue downward, experimentation and improvements never stop and Page One will be here covering it all as we progress to the other side of the bear market.

funding:

FTX in talks to raise up to $1B around previous valuation of $32B

European venture firm DTCP raises $300M for third fund, to deploy partial capital raised to crypto ventures

Spice VC to close second crypto venture fund with $250M target in Q4

Hong Kong VC firm C Ventures raising $200M for new crypto fund

Sardine, real-time fraud prevention company, raises $51.5M series B

Yellow Card Financial, African crypto exchange, raises $40M in series B

3Commas, automated crypto trading platform, raises $37M series B

Messari, crypto data & analytics company, raises $35M series B

Immunefi, crypto bud bounty platform, raises $24M series A

Hyperlane, cross-chain app connection platform, raises $18.5M

Lit Protocol raises $13M and announces new cloud wallet app platform

Integral, real-time asset management platform for crypto teams, raises $8.5M

NFT-gaming firm Vulcan Forged raises $8M series A

Tres, crypto financial tooling software, raises $7.6M

Random Games, blockchain gaming studio, raises $7.6M

news:

Nasdaq to launch institutional crypto custody service

PGA Tour partners with NFT platform Autograph to launch golf-focused NFT platform in 2023 selling PGA Tour highlights as “digital collectibles”

OpenSea integrates support for L2 scaling ecosystem Arbitrum and launches rarity features natively inside OpenSea

Crypto political action committee GMI PAC says it spent $10M+ on congressional and senate races, eyes general elections in November and 2024

House proposes stablecoin bill that would create two-year ban on creation of algo-stablecoins that are “endogenously collateralized” or insolvent

Nomura Holdings, Japan investment banking giant, to launch crypto VC arm

Singapore banking giant DBS launches crypto trading product

Italian soccer club AC Milan launching new NFT collection in partnership with SOL-based esports franchise MonkeyLeague

tokens & protocols:

Maple Finance (MPL) launches $300M lending pool for BTC miners via the Icebreaker Finance platform with 15-20% interest rates over 12-18 months

Helium (HNT) partners with T-Mobile for missing 5G coverage ahead of its Helium Mobile (MOBILE) launch in early 2023; HNT officially migrates to SOL

MakerDAO (MKR) passes proposal to accept GnosisDAO (GNO) tokens as a new collateral type for DAI

LsETH — institutional liquid staking token launched by Liquid Collective with foundation including Coinbase, Kraken, Figment, Staked, and others

HXRO, SOL based DeFi platform, launches weekly, monthly, & quarterly derivatives for BTC with support for ETH and SOL coming soon

Metaplex, SOL based NFT metadata standard & infrastructure provider, to decentralize protocol through MPLX token airdrop

BOBA Network, L2 scaling solution, integrates support for AVAX

Urbit (U) announces EVM blockchain with good info on it here

reading:

“The Next Big Crypto Narrative” — @mattigags

While global liquidity tightens and macro uncertainty leads to our token prices to continue falling, thoughts around catalysts that can reignite upward momentum are explored. Matti thoughtfully explores cyclicality, market psychology, and what can become the new shiny thing narrative.

“It is ironic that we laugh at fundamentals when times are good but beg for the market to recognize them when times are bad…the new thing narrative matters and is an essential part of the industry’s vision reset…we should not be relying on macro narratives but rather explore the potential micro-narratives of the future.”

As far as what those micro-narratives actualize as, Matti outlines the sectors that he believes could be the next promising technological triggers including:

Actual DeFi 2.0 - more sophisticated on-chain tooling, sustainable yields, structured products, stablecoin experimentation

Web3 Commerce - gamefi, IP, NFTs and a focus on people spending money on blockchains outside of gas fees and speculation

Web3 Social - new forms of monetization, user sovereignty in digital domains

Decentralized Science (DeSci) - confluence of value shifting from intermediaries with the desire to change research funding & knowledge sharing

World of Atoms - connection between crypto & the production economy

around the ecosystem:

0xShual releases investing criteria “Gigachad Due Diligence Questionnarie”

0xYakitori launches Stealth Money Dune dashboard tracking new whale wallets

“Web3 in Data” slides depicting the current market from DuneCon 2022

Arthur pens “Snippets”, a tour around recent crypto events

tweets: