as always, thanks for reading and follow me here

tl;dr: private markets slowly aligning with public sentiment, cross-rollup liquidity and composability are key to scaling, flared gas BTC mining shifting narratives, and OP/VELO airdrops are live.

BTC dominance 46% | ETH dominance 17.5% | DeFi TVL $106B |

Total Crypto Market Cap $1.22T | Stablecoin Supply $155B |

funding:

Binance VC arm raises $500M for incubation, early-stage, and late-stage

SoftBank leads $66M series B in blockchain infrastructure provider InfStones

Canonical Crypto raises $20M for its first fund

Akatsuki, Japanese gaming firm, raises $20M for NFT & GameFi investments

Merge, crypto payments infrastructure, raises $9.5M seed round

WAX blockchain raises $10M to further develop NFT ecosystem

Utopia Labs, DAO payrolls, raises $23M series A

Hydra Ventures, DAO investing in investment DAOs, announced and launched

Six different crypto startups raised between 3M-6.5M this week:

Dework (DAO management), Liminal (wallet startup), Big Whale Labs (wallet privacy), Cloudwall Capital (risk management), Alloy (institutional DeFi), and Size (sealed OTC bid auctions for vested tokens)

Animoca acquires mobile gaming firm Notre Game adding to previous acquisitions Grease Monkey Games and Eden Games

news:

Fidelity to continue expanding digital asset offerings & hiring spree

Japan passes stablecoin bill ensuring redemption/backing at face value

Zerion releases 10 chain compatible mobile wallet for web3 apps

Chainlink price feeds are now live on Solana, first non-EVM chain integration

Alchemy, dev infrastructure provider, announces support for Solana

FTX readies war chest for acquisitions to expand its suite of products

Chipotle partners with Flexa to accept crypto at its U.S. based locations

Binance sponsors upcoming The Weeknd tour and commemorative NFTs

FTX passes Coinbase in CEX spot marketshare

Kucoin launches non-custodial web3 wallet

Crusoe Energy, flared gas BTC mining, previously raised $350M in April and this week announced expansion to Middle East countries Abu Dhabi & Oman

I’ve previously written multiple times about BTC flared gas mining, highlighting it’s ability to form positive, deserved narratives and deeper growth throughout the industry while creating additional revenue streams

thoughts & notes:

Cross Rollup Composability

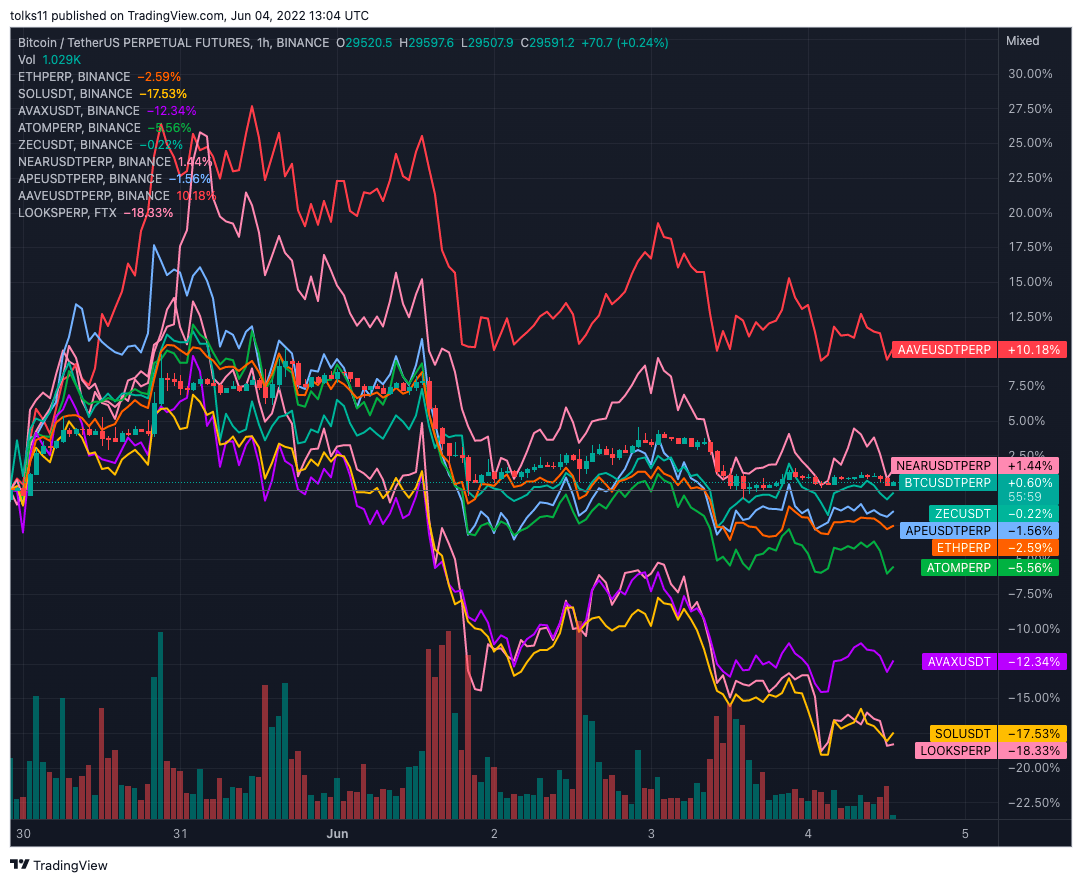

With the Optimism token airdrop complete (along with VELO its main AMM), the race to scale L2s, reduce transaction fees, and acquire users is upon us. One of the previous negative externalities regarding L2 scaling was the fragmentation of users, liquidity, and assets across the various competitors. This problem was also applicable over the past year to the various L1s that were attracting TVL and growth, but has been largely solved through the Bridge Wars covered in previous Round Trippings.

L2s are currently integrating similar bridging solutions to ensure cross-rollup liquidity and asset transfer, but benefit from a shared settlement layer. All L2s built on the same underlying L1 have the ability to build easier, trust-minimized bridges between them compared to cross L1 and L2 solutions such as SYN and Layer Zero, a point Alex Beckett explains in his excellent post, Composability in a Rollup Ecosystem.

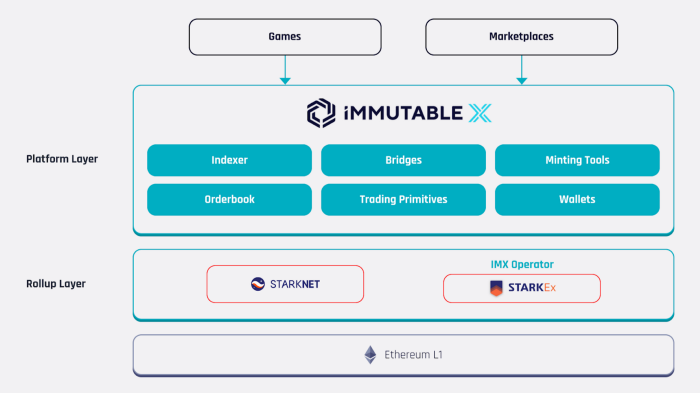

Further solidifying the above is Immutable X and StarkWare’s StarkNet recent announcement of their L2 partnership. In that post, they outline the ability to establish cross-rollup NFT liquidity highlighting the need to, “ensure that there is robust interoperability between rollups…through the construction of seamless and trustless asset bridges…as these rollups share a settlement layer (L1 ETH), bridging is possible without compromising asset security.” As an increasing number of L2s begin deploying to mainnet and distributing tokens over the coming months to acquire users, composability and liquidity between them will be a core focus for L2s and market participants.

Token News:

OP (Optimism) token launches — currently $1.37 with a ~$5.85B FDV

VELO token is live — Velodrome Finance the AMM of Optimism

ZCash NU5 upgrade is live — transactions now private by default on network

ETH testnet Ropsten moving to PoS on June 8th

StarkNet partners with Braavos wallet for direct StarkNet L2 integration

BTRFLY releases Pirex, a futures marketplaces for yield generating tokens

LDO announces liquid staking for DOT is now available

Maple Finance (MPL) introduces staking

JPEG’d (JPEG), NFTxDeFi collateral, launches the Citadel for CVX/CRV rewards

futureverse.xyz announced — PoS, EVM compatible blockchain with a dual-token economy integrating Fluf World and Altered State Machine

Celer Network (CELR) launches xAsset V2 for omnichain asset compatibility

Astroport’s ASTRO token airdrop for terra 2.0 outlined

$90M exploit of Mirror Protocol on Terra goes unnoticed for seven months

around the ecosystem:

ultimate web3 blockchain development stack through freecodecamp released

North Rock Digital’s research on ETH’s “generational” value post-merge

model and analysis on CRV/CVX subsidized stable pools of various sizes

bunchu.eth outlines guiding principles for proper wallet management

0xHamZ with a discussion on L1s as Money

Andrew with a good analysis on VC token dumping & what to watch for

tweets: