as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: Celestia & dYdX launch, SBF’s guilty, SOL continues upwards, inflows continue to increase, wealth effects are coming, funding grows & the eventual ETF bid remains

BTC dominance 51% | ETH dominance 17% | DeFi TVL $45.4B |

Total Crypto Market Cap $1.44T | Stablecoin Supply $126.7B |

We’re just over a year removed from Caroline’s famed $22 FTT tweet at CZ and the ensuing collapse of FTX. It’s been an incredibly long year, but the light at the end of the tunnel has continually brightened as the one year anniversary sees the coin prices marching higher and SBF officially heading to prison. Good riddance to the goblin and cheers to the well deserved future we have ahead.

Poetically, SOL continues to be one of the top performing assets in 2023 as it successfully overcomes any remaining claims that the chain is/was dependent on FTX. Undoubtedly, FTX played a large role in SOL’s original ascent but thinking SOL couldn’t succeed without FTX was always a foolish take. ~4 hours of due diligence in early 2023 would have resulted in the simple conclusion that the price of SOL was severely disconnected from its potential both in USD terms and to its peers.

As a result, SOL is up another 51% since the start of November and ~6x higher than the FTX-induced lows. I’ve been writing about the Solana ecosystem’s resurgence and mispricing since weeks after FTX’s collapse, and will continue to do so until SOLETH is 0.1+ & SOL reclaims its previous ATHs+. Regarding the rest of the market, it’s been an interesting few days as BTC, ETH, & SOL are slightly off their recent highs thanks to a Tuesday wipe of building OI and ~$300M worth of longs.

Regardless, ETF enthusiasm remains heightened and 10-20% corrections are to be expected even in upward trending markets given the amount of leverage natively in crypto. While ETH currently sits at ~$1950, it briefly rallied to $2100+ in response to BlackRock filing an application for the “iShares Ethereum Trust”, a spot ETH ETF. Fidelity followed BR’s lead and filed for their own ETH spot ETF after hours Friday, bringing the total spot ETH ETF filers to 7. BlackRock’s weight is of course massive and ETF analysts have highlighted specific language in their filing that boils down to Grayscale’s court win + the SEC’s recent approval of ETH futures ETFs = eventual spot ETH ETF approval, something I clearly outlined in the October 1st edition of Round Tripping.

Speaking of ETF analysts, plenty of offside longs were liquidated in the anticipation of the long awaited spot BTC ETF approval that could’ve theoretically come this week. Last Wednesday, James Seyffart noted, “we still believe there’s a 90% chance of approval by Jan. 10…if it comes earlier we are entering a window where a wave of approval orders for all the current applicants *COULD* occur…if the agency wants to allow all 12 filers to launch — as we believe — this is the first available window since Grayscale’s court victory was affirmed.”

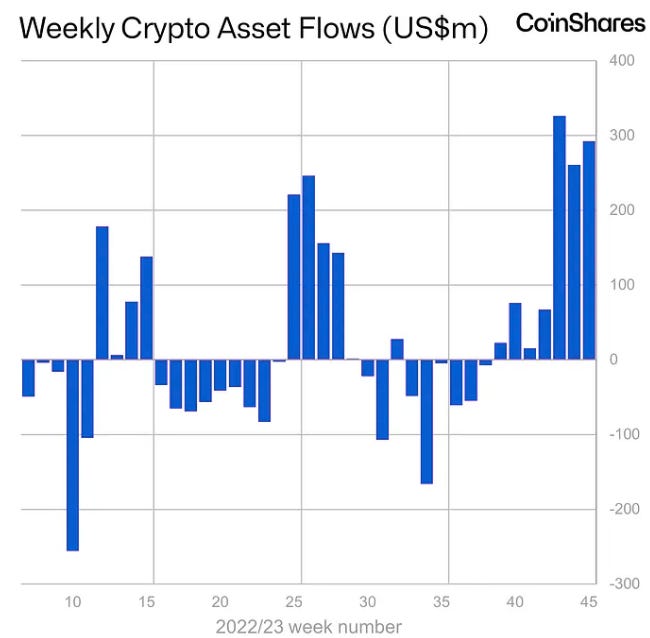

While there were a significant amount of the aforementioned longs & OI wiped, the market remains structurally bullish until proven otherwise for the reasons I outlined two weeks ago. In addition, while leverage gets wiped as leverage normally does, the spot bid volume increase and structural demand on BTC, ETH, & SOL is evident in essentially every metric available. Currently, The Block’s data has total spot volume across exchanges in November at $479.5B. That total in all of October was $516.4B which is significantly up from the ~$334B total throughout September. In addition, one of the most notable metrics of capital positioning for the eventual spot ETF approval is CoinShares’ tracking of weekly crypto ETP flows.

James Butterfill writes, “digital asset investment products saw inflows totaling $293M last week, bringing this 7-week run of inflows past the $1B mark…ETH saw its largest inflows since August 2022.” Per CoinShares tracking, the $767M of inflows that occurred *prior to the additional ~$300M this week* represent a total that is larger than *all of 2022’s inflows combined*.

As we stand, we currently have BTC sitting at 36.6k and waiting for its next direction. While there’s certainly a case to be made for a general retrace as essentially everything is up 2-4x+ in the past month+, the spot + institutional demand through ETPs and the CME is evidently clear. Even in bullish trending crypto markets, pullbacks of 10-20%+ are to be expected but for me those will remain an easy buy. Those buys will come on incredibly strong alts (TIA, SOL, INJ, LINK, DYDX, PRIME, AVAX, TAO, RUNE, etc.) as well as leaning into BTC’s strength.

There’s been endless discussion about ETH’s recent underperformance & people wanting knife catch ETHBTC. To me, this is a fool’s errand. ETH will have it’s time but the weak reaction to BlackRock & Fidelity filing spot ETFs + its lack of strength *throughout 2023* are clear signs to wait. The most obvious time to bid ETH is right before/on the eventual approval of BTC ETFs, and I’ll be waiting for that clear signal from the market before prematurely rotating any increased exposure to ETH.

As for the rest of the ecosystem and developments, the most important to me are:

Wealth Effect — TIA’s airdrop is complete, PYTH & JUP are coming, projects such as zkSync, LayerZero, HyperLiquid, Berachain, Friend Tech, Scroll, StarkNet, Blur & more are coming + the entire SOL DeFi ecosystem (marginfi, jito, drift, zeta, pyth, jup, etc.) is soon to have “free” capital released; determining which tokens, protocols, & assets will benefit the most from this + the potential of alt season accelerating across both ETH & SOL is key over the next few months

ETH Burn — the burn & positive catalysts of BlackRock & Fidelity filing for spot ETH ETFs have yet to impact price, ETH’s reflexive monetary policy + staking yield will compound soon as ~$17.5M worth of ETH was burned this week alone

Arbitrum (ARB) — Arbitrum’s DAO approves initial vote on proposal to activate token staking. Upon final vote passing, ARB stakers will earn “yield” funded by the Arbitrum treasury distributing 100M tokens as rewards over the course of 12 months; Arbitrum Foundation says Orbit, a program for developers to spin up L3s on top of Arbitrum’s L2, is now live & ready to settle to Arbitrum’s mainnet

Current Barbell of Outperformance — there’s been a few recent ETH onchain winners, namely TAO, MUBI, TURT, & OLAS, but the current onchain capital seems to be dispersed between SOL tokens & BTC ordinals + brc-20s; will continue to monitor this trend in the coming week(s)

Celestia (TIA) — highly anticipated modular blockchain officially launches mainnet & token, TIA has been one of the best performing tokens over the past two weeks with the token appreciating ~200%

dYdX — dYdX’s Cosmos-based, standalone appchain is officially live; dYdX foundation officially confirms that the chain’s accumulated trading fees will be allocated to network validators & token stakers, distributed in USDC

Mad Lads — the SOL-based NFT is up ~5x since it’s October lows as the Backpack team has announced and launched their in-wallet exchange beta, holders have access PYTH’s airdrop, & speculation builds on future airdrop benefits from the broad SOL ecosystem + the *likely* future exchange token

Polygon — there’s a slowly building consensus that Polygon is at the forefront of ZK tech; MATIC has been underperforming for years, but we could see that change over the course of the next 3-6+ months. Also, Polygon has begun the migration of their MATIC token to POL as they align their future vision of ZK + other chains tapping into the underlying POL chain tech

FTX claims continue increasing in value in OTC markets, reach as high as 65 cents; theoretically, the higher FTX claims go, the more “found” capital is returned to creditors which they can then potentially inject back into the market

USDY — Mantle (MNT) partners with Ondo Finance to launch RWA-backed yield generating token. USDY is backed by short-term treasuries & bank demand deposits, yield is generated via underlying assets increasing token value

Stablecoin Inflows — while it’s mostly FDUSD & USDT benefitting, stablecoin inflows are very slowly increasing; the total stablecoin market cap looks like it bottomed in late October at ~$124B, since then it’s climbed to ~$126.5B

BTC Ordinals — per usual, once almost the entire space writes off a new fundamental development after it’s initial peak, said thing has returned with a vengeance. In this case, it’s the burgeoning ecosystem of ordinals (BTC NFTs) & brc-20s. The growing fees, ordinal transactions, brc-20s & security budget for BTC are things I’m betting will only continue up & to the right.

As a reminder, the P1 team is always reachable at contact@pageone.gg. If you want to sponsor the newsletter & reach an audience of 12k active market participants, pitch a guest post, tell us about your protocol or to collaborate on anything in general, you can always reach us there or @PageOneGG.

funding:

Lightspeed Faction launches $285M fund for seed & Series A rounds

Blockchain.com raises $110M Series E

Standard Chartered & SBI Holdings partner to launch $100M fund

Fnality, fintech building tokenized versions of currencies, raises $95M Series B

Saudi Arabia’s NEOM megaproject proposes $50M investment in Animoca Brands

Ritaul, decentralized platform for AI, raises $25M

Neon Machine, creator of highly anticipated game Shrapnel, raises $20M Series A

Superstate, tokenized asset management fund, raises $14M Series A

Forge, rewards platform for gamer achievements, raises $11M

VersiFi, crypto trading & lending platform, raises $10M Series A

Triple-A, crypto payments company, raises $10M Series A

Rymedi, healthcare data exchange platform, raises $9M Series A

Modhaus, South Korean blockchain-based K-pop startup, raises $8M Series A

Taproot Wizards, BTC Ordinals NFT project, raises $7.5M seed

Modulus Labs, zkML verification for AI content, raises $6.3M seed

Nocturne Labs, developer of private accounts on ETH, raises $6M seed

Llama, a smart contract governance platform, raises $6M seed

Moonveil, crypto gaming studio, raises $5.4M seed

Pimlico, ETH smart accounts & ERC-4337 focused firm, raises $4.2M seed

Union Labs, cross-chain bridge based on ZK proofs, raises $4M seed

StablR, euro-backed stablecoin issuer, raises $3.5M seed

Due, decentralized non-custodial payment platform, raises $3.3M seed

Anboto Labs, non-custodial institution focused trading platform, raises $3M

STIX, OTC secondary trading platform, raises $2.7M

news:

Circle, USDC stablecoin issuer, considering 2024 IPO

Digital Prime Technologies embraces deserted crypto lending space, launches crypto lending service for institutions called Tokenet

EIP-4844, ETH’s highly anticipated next upgrade that aims to drastically lower L2 gas fees, delayed until at least Q1 of 2024

Dune Analytics launches DuneAI, supports questions in any language to return blockchain data insights

Firedancer, Jump’s highly anticipated independent validator client for SOL, launches on testnet, Solana Labs launches startup incubator

OpenSea cuts 50% of staff, Coatue marks down OS equity 90% to $1.4B or below

Rainbow Wallet intros new features including scam warnings for dapps & websites

Animoca Brands pitching in house market making services for startups, adds to hedging and node operation services for their 400+ projects backed

SOL-based crypto wallet company Backpack announced plans to launch a crypto exchange after securing a VASP license from Dubai Virtual Assets Regulator

Eliptic, blockchain forensics company, says recent figures of crypto use by terrorist organizations are being misrepresented; “the unique traceability of these assets have meant that the amounts raised remain tiny compared to other funding sources”

Swiss bank St. Galler Kantonalbank partners with SEBA Bank to launch custody & trading services for BTC & ETH

JPMorgan’s permissioned blockchain intra-bank value transfer system JPM Coin is handling $1B in daily transactions

Taiwan officially proposes bill that would regulate crypto assets; UK Treasury releases final proposals for crypto asset regulation

KBank, Thailand’s second-largest bank, acquires local crypto exchange Satang

Mastercard partners with MoonPay to deepen crypto push

Exchange operator Kraken reportedly in talks with Polygon, Mantle & Nil Foundation on the development & launch of their own L2

tokens & protocols:

POL — Polygon's 1:1 transition of MATIC to POL is now live

DYDX — launches alpha mainnet of standalone dYdX chain

FTM — launches testnet for Sonic upgrade

FLOKI — launches tokenization platform dedicated to RWAs

RNDR — completes successful transition of protocol and token to SOL

GRT — releases AI-assisted queriers, verifiable data, improved tooling + more

NEO — to launch testnet for EVM compatabile sidechain by EoY

STRK — Starknet allocates 50M tokens for early ecosystem contributors

JUP — SOL’s Jupiter exchange confirms future airdrop & launches perps product

Celestia — highly anticipated modular blockchain officially launches mainnet

Hyperliquid — perp DEX announces points program beginning on Nov 1st

Prisma Finance — LST backed stablecoin says PRISMA token to launch Nov. 2nd

Fuse Wallet — “first smart wallet for SOL; one wallet, three keys, no seed phrase”

Zeta Markets — perps protocol on SOL intros Z-Score, “curtain-raiser to token”

Lifi Protocol — launches allbridge Solana MVP to integrate SVM to EVM swaps

around the ecosystem:

Chainalysis releases 2023 Geography of Cryptocurrency Report

Will Robinson’s “Removing Web3 Friction: Pt.1 Progressive Onboarding & Games”

w4vitale’s thread on all the developments out of Solana’s Breakpoint conference

tweets:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.