as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: (friend, friend), SOL’s recovery continues, ETH mainnet activity dwindles, funding heats up, ETH futures ETFs ahead, & a potential end to the endless range

BTC dominance 47% | ETH dominance 18% | DeFi TVL $39B |

Total Crypto Market Cap $1.15T | Stablecoin Supply $124B |

gm gm & welcome to a loooong overdue Round Tripping! My friend tech induced apologies for the lack of content over the past month, but some travel + incredibly quiet markets + being lucky enough to be one of the first 50 users of FT and realizing its opportunity/potential has lead to minimal recent writing (if you can write for free or make 15-25e on FT in a month, the short-term choice is clear). Of course, I deeply miss expressing my thoughts on a weekly basis so if you work for, have funded, or know a protocol/team looking to advertise to 12k active readers you can guarantee at minimum a weekly post by having them reach out to me (@_tolks) or @PageOneGG on Twitter).

Sponsors or not, Page One has never been more back then in this moment and I’m back ready to grind harder than ever. So, at an absolute minimum, you can expect Round Tripping (weekly recap) in your inboxes by Sunday morning, a monthly recap, and a biweekly (until the market calls for more often) Trend Chasing article.

In addition to that, by subscribing to Page One, you can expect periodic deep dives on various sectors & protocols. Also, we’ve been toying with some daily formats (only applicable when the market/news actually enables it) that you may soon see in your inbox as well. If P1 has been anything, it’s respectful of your inbox/time while always writing with a purpose, something we’ll continue no matter our frequency moving forward. With that housekeeping out of the way, I can’t thank you all enough for the incredible support over the past ~year & a half. Let’s mfin get to it.

Since Friend Tech initiated my writing delay, let’s start there before moving on to the broader market. On August 15th, when FT was live for five days, I wrote about FT’s benefits despite the (at the time) broken app saying it included a, “fast, easy signup/install steps, a mobile dapp, & a seamless one-click, no gas fee transaction that should be copied by every hybrid crypto application moving forward.” Since writing that, FT’s TVL has increased 50x from $1.2M to $50M+ and the mindshare it occupies has skyrocketed.

While the long-term sustainability is still in question, FT has now successfully captured the scarcest resource in markets, attention, for almost two months. While a significant portion of that attention capture is aided by the carrot of a likely future airdrop, the data on FT is incredibly impressive and speaks for itself.

Throughout the history of my 4+ years in crypto, FT remains the only native crypto app I open multiple times a day. There are clearly sticky habits the app induces which should be celebrated as a relative first in crypto. Whether FT continues to capture attention months to years from now remains in question, the go to market strategies FT deployed should be repeated by crypto apps ad nauseam moving forward. Launching as a mobile first, progressive web app (PWA) to work around Apple’s approval, the app’s minimalistic, easy to onboard wallet experience and the reignition of what token incentives can accomplish should be table stakes for every future consumer facing crypto app. As far as I’m concerned, FT was a resounding success for those realizations alone and everything else it accomplishes will be an added bonus.

Outside of Friend Tech, it’s been another incredibly slow month+ of general crypto news. Until the strong rally over the past few days, the state of the market was clearly enduring time-based capitulation. As I’m writing, BTC and the broad market are rallying as BTC sits at 28k, squarely within the same ~15% range it’s been oscillating in since the middle of March (!!!).

While the endless range and time-based capitulation continue, there are several reasons to believe that BTC, along with the entire market, *should* finally push up and through 30k+. First, the importance of Grayscale’s court win against the SEC on August 29th can’t be overstated as until proven otherwise, it all but guarantees eventual spot BTC ETF approval.

Following the logic of Grayscale’s case (futures ETFs for BTC should allow spot ETF approval), ETH spot ETFs seem likely to gain approval by the end of 2024 as we’re now hours away from the first deadline where the SEC could delay a decision or grant approval for ETH futures ETFs (Valkyrie’s first, October 2nd). From what we know, it seems incredibly likely that for the first time, the SEC will approve essentially all applications for ETH futures ETFs throughout October. As Bloomberg’s Senior ETF analyst Eric Balchunas says, ETH futures ETFs are “highly likely (90% odds) to start rolling out in early October”.

So far, we have Grayscale’s court win all but guaranteeing spot BTC ETF approval and the almost guaranteed ETH futures ETFs (which the Grayscale case seemingly indicates eventual spot ETH ETFs) officially being approved tomorrow. In addition to those catalysts, we’re quickly approaching the BTC halving in April of 2024, something that historically starts bullish trends ~6 months before it occurs.

While the exact timing and official approval of the BTC and potentially ETH spot ETFs are unknown, markets routinely front-run upcoming narratives, events, and catalysts. Throw in the historical returns for BTC in October, historical equity markets returns during an election year and the forecast of the first rate cut in 2024 and suddenly you can easily see why sophisticated market participants would be buying crypto at current prices.

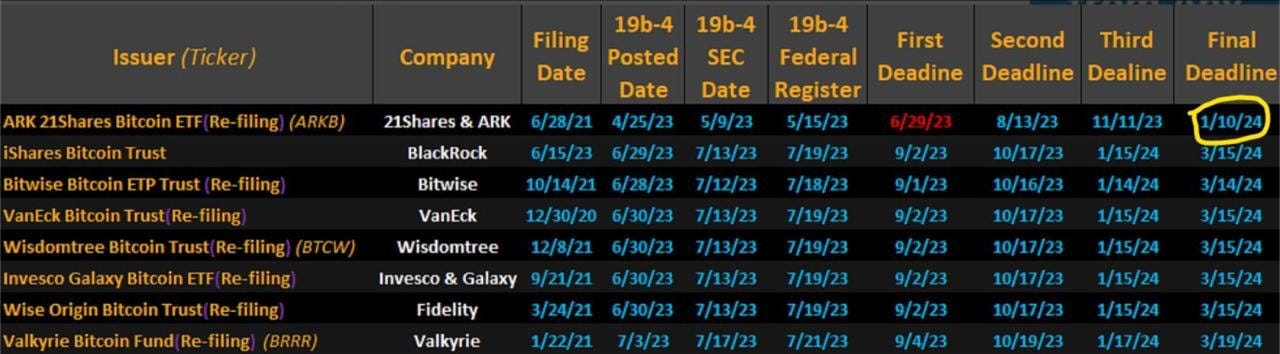

While there are of course still hurdles (FTX/Celsius sales, Binance x DOJ case, potential US government BTC sells) and unknown timelines for ETF approvals, the path for upwards expansion in the short, mid and long term clearly outweighs the one time hurdles listed above. In other spot BTC ETF news, the SEC delays Ark 21 Shares BTC spot ETF application was once again delayed, with the final deadline now set for January 10th, 2024.

As you can see from the below image, the ARK 21Shares BTC ETF is the first in line for a final ruling in January. From my understanding, the likeliest outcome of the years long saga that is a spot BTC ETF finally concludes with the approval of numerous ETFs on/around ARK’s final deadline date of January 10th, 2024. Combining all of the above, we’re now likely ~3 months away from the first ever spot BTC ETF approval, ~7 months away from the BTC halving and potentially ~12-14 months away from spot ETH ETF approval. Does anyone really want to be selling coins at these prices? The time to be structurally bearish has come and gone.

As mentioned, the coins are enjoying a strong weekend rally with BTC (+5.5%) and ETH (+9%) closing higher. Despite everything we outlined above clearly benefitting BTC and ETH, SOL was clearly the top performing large cap token this week gaining 24%. It’s of course just a one week sample, but the market’s clear upcoming narratives and events drastically favor BTC and ETH compared to anything else. There’s been plenty of discussion about a BTC-led rally occurring but we’ve yet to see it materialize despite the bullish catalysts. Over the course of the next few months, I’ll be monitoring coins that continually outperform their ratios to both BTC and ETH as a signal to their prospectus in the next bull run.

Speaking of those coins, SOL has continued to display impressive strength against both BTC and ETH. While almost everyone left Solana for dead, and many still confusingly choose to, SOL has continued it’s impressive rebuild throughout 2023. As regular readers of P1 know, SOL’s future was never in question to me and I’ve publicly supported them since the December of ‘22 lows. Over the past four weeks, the SOL to ETH and BTC ratios have increased and the fundamental developments teams and protocols have been working towards continued to be displayed. In addition the price appreciation, over the last month+ the Solana ecosystem has seen:

Visa is expanding their stablecoin settlement capabilities to Solana

Rune, the founder of MKR (one of ETH’s oldest/largest DeFi protocols), says Solana is the best tech stack to potentially fork and deploy MKR on if the Maker protocol was to build a new, stand-alone blockchain; Among other things, Rune highlights SOL as the choice because of “the technical quality of the Solana codebase…the Solana ecosystem has proven its resilience…there already exists examples of the Solana codebase being forked & adapated to act as appchains.”

Solana Pay has been integrated with Shopify allowing millions of merchants to directly accept USDC on SOL

Elusiv launches protocol enabling fully private token swaps on Solana

DeFi Liquidity Mining — jitoSOL announces points program for users that deposit SOL to their MEV-rewarding liquid staking protocol, marginfi points program continues bolstering TVL & marginfi partners with Jito to introduce LST, a 0% commission liquid staking token

Eclipse introduces “Ethereum’s fastest L2, powered by the SVM (Solana Virtual machine)”, highlights SOL’s “best in-class execution environment” & details the advantages SOL execution has through: Optimized Parallel Execution, Local Fee Markets, State Growth Management, EVM Compatibility, Firedancer (SOL client being built by Jump), Safety & Easier Proving

While essentially everything I’ve written this week presents clear bullishness, there are unquestionably going to be continued choppy weeks, hurdles, and setbacks ahead. To me though, it’s evidently clear that if anyone was on the fence about the future, we’re going up. That timeframe is ~3 months+ to years though and I’ll continue to employ the DCA strategy I’ve had since December (SOL twice weekly, ETH once) until ETH is 4k+ and SOL is 150+.

Outside of SOL, Friend Tech, and the ETF news for BTC & ETH, the top notable stories of the past few weeks include:

Toncoin (TON) — quietly rallies ~50% over the past 30 days (up 75% this year) & briefly enters top 10 tokens by market cap; Telegram & the TON Foundation jointly announced a new self-custodial wallet, TON Space, at Token 2049 conference; Telegram founder Pavel Durov “endorsed TON as its blockchain of choice for expanding web3 infrastructure on the platform”; Joel John of Decentralised provides a good bull case for Telegram/TON

EigenLayer — raises deposit caps for restaking protocol, sees $160M of inflows within a few hours; EigenLayer also announced EigenDA, their data availability solution for ETH L2s

Optimism — worth monitoring the OP token as the foundation sold $162M of tokens to 7 separate buyers (2 year lock), additionally $31M worth of OP (~3% of supply) unlocks October 30th

Arbitrum Flows — along with the resumption of Arbitrum Odyssey this week, ARB holders approved a proposal to distribute up to 50M ARB for incentivized release to actively building Arbitrum protocols, Odyssey + pseudo $40M ecosystem fund + any EIP-4844 narratives/momentum likely shift some attention back to ARB eco — for a good breakdown on the protocols applying for grants, see this thread.

Chainlink — Swift interoperability experiment with LINK’s CCIP was successful & the LINK token continues to outperform as it’s (likely) bid up before selling off during/after the annual Chainlink SmartCon conference starting October 2nd; Chainlink also teases “Pay with anything, received in LINK. Universal gas token”

Metamask — introduces “Snaps” which allows users to install third-party developed applications directly to their wallets; wallet becomes customizable in a similar way to Chrome extensions for the Chrome browser, opens up interoperability to other blockchains (SOL & ATOM)

Moving forward, we have the historical trend of positive returns for crypto in October, conferences from ATOM & LINK kicking off next week, SBF’s trial starting on Tuesday, and the aforementioned likely approval of the first ever Ethereum Futures ETFs on Monday. As a programming note, my final travel of the year takes place next week as I’m going to Sedona & Phoenix for some reason to spend money watching my awful Bengals. As a result, you can expect the next Round Tripping to be next Tuesday evening with a new Trend Chasing article coming on Thursday. Cheers, frens.

As a reminder, the P1 team is always reachable at contact@pageone.gg. If you want to sponsor the newsletter & reach an audience of 12k active market participants, pitch a guest post, tell us about your protocol or to collaborate on anything in general, you can always reach us there or @PageOneGG.

funding:

Blockchain Capital raises $580M for two new funds

Electric Capital looking to raise $300M for its third crypto fund

BitGo, crypto custodian, raises $100M in Series C @ $1.75B valuation

Kraken Ventures, investment arm of Kraken, seeking $100M for second fund

Bitget, crypto exchange, establishes $100M fund for ecosystem growth

Oak Grove Ventures launches with $60M for early-stage crypto, AI, biotech

Vessel Capital emerges from stealth with $55M fund for infra & apps

Proof of Play, crypto gaming company, raises $33M seed

ZetaChain, new interoperability focused L1, raises $27M

Bastion, crypto onboarding company, raises $25M seed

Reverie, crypto advisory firm, launching $20M fund for pre-seed/seed companies

IYK, creators of digi-physical experiences/collectibles, raises $16.8M seed

Rated Labs, staking infrastructure provider, raises $12.8M

Jiritsu, verifiable computing & asset tokenization platform, raises $10.2M

GRVT, builders of hybrid crypto exchange, raised $7.1M @ $39M valuation

CoinScan, crypto analytics platform, raises $6.3M

Essential, intent-based infrastructure protocol, raises $5.15M seed

Freatic, decentralized information markets protocol, raises $3.6M seed

Bubblemaps, onchain data visualization company, raises $3.2M seed

Drip Haus, pioneers of the NFT ecosystem on SOL, raises $3M seed

news:

Circle outlines “the next chapter for USDC”, to launch native USDC on 6 new blockchains (Base, ATOM, NEAR, OP, DOT, & MATIC); Coinbase invests in Circle, will share USDC reserve interest revenue with Circle; Circle will take full control over USDC issuance and governance

BTC mining difficulty reaches all-time high

Coinbase secures approval from CFTC for registered futures exchange operations

Tornado Cash founders charged with money laundering and sanctions violations

USDT issuer Tether releases latest transparency report, cites $3.3B equity buffer

Phantom launches Sign In With Solana (SIWS) allowing apps to easily authenticate users with a single click

Beam wallet introduces instant payouts, enables the transfer of crypto from Metamask directly to a debit card in “under a minute, for no additional fees”

Unstoppable Domains launches decentralized, e2e encrypted messaging via web3 domains, powered by XMTP

Franklin Templeton applies for spot BTC ETF

Citigroup expands digital asset services, launches new custodian partnership & pilot program for tokenized deposits

Nomura’s crypto arm, Laser Digital, launches Bitcoin Adoption Fund; provides long-only BTC exposure for institutional investors

Venmo to launch support for PayPal’s recently launched PYUSD stablecoin

Microstrategy & Saylor acquire another $150M worth of BTC

tokens & protocols:

Base/OP — Base set to receive 118M OP tokens over the course of six years, in return Base will contribute 2.5% of its sequencer revenue or 15% of net profits to the Optimism Collective

HNT — DEPIN protocol on SOL launches Helium Mobile plan for $5/month

MNT/LDO — Mantle stakes 40k ETH from their treasury with Lido

CANTO — announces plans to migrate to ZK-powered ETH L2

DYDX — integrates Squid & Axelar for seamless bridging ahead of v4 launch

MKR — approves proposal to double t-bill allocation

SYN — launches Synapse Interchain Network & Synapse Chain testnets

YFI/YETH — Yearn Finance launches yETH, basket of ETH LSTs

Celstia — highly anticipated modular blockchain announces genesis airdrop

MC — migrating MC token to BEAM token, Merit Circle to be overarching brand

INJ — Cosmos-based L1 releases testnet of inEVM L2 rollup solution, will support dapps deployed on ETH, SOL, & ATOM

Eclipse — introduces Eclipse Mainnet: The Ethereum SVM L2

Elusiv — launches protocol enabling private token swaps on Solana

Dymension — incentivized testnet is officially live

around the ecosystem:

Matti of ZeePrimeCapital on all things crypto social in “The Future of OwnyFans”

CoinGurruu’s massive thread outlining “The Ultimate Memecoin Trading Guide”

tweets:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.

we are so back