as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: bottomish signs were gift wrapped, the endless 30-31k range continues, COIN’s PA signaling *something*, healthy BTC dominance, everyone gets an L2 & UNI v4

BTC dominance 50% | ETH dominance 20% | DeFi TVL $46B |

Total Crypto Market Cap $1.25T | Stablecoin Supply $127B |

While the innagrual edition of Trend Chasing (covering: ETH staking, East vs. West, Stablecoins, Optimism’s Outlook, CCTP & Bridge Wars, Improving Fluidity, Onchain Activity, BTC Ordinals & Inscriptions, ETH Burn) was most recently, the last Round Tripping covered a drastically different crypto market sentiment.

At that time, even the most consensus following market participants should’ve noted that the “crypto is over” signs were beyond the point of satire and actually signaling the perfect opportunity to bid. I mean, come on, *Vox* stated, “now might be a good time to consider quitting crypto”. During that week, BTC and ETH were down ~20% from their mid-April highs as we were a week removed from the SEC filing suit against both Binance & Coinbase. Unquestionably, the outlook was bleak.

Two days after that post, and a ~week after statements of crypto’s death were once again becoming consensus, we convincingly found out who was “stepping in to be the marginal buyer and liquidity addition” as the world’s largest asset manager, BlackRock, announced that they filed for a spot BTC ETF. CT is known/built on the ability to display massive sentiment changes, but the shift over the course of the past ~month from “crypto in the US is on life support” to “we’re so fucking back” has rarely been this profound. Over the past ~three weeks we’ve received essentially nothing other than good news including:

Jerome Powell says Bitcoin & other cryptocurrencies have “staying power”, acknowledges that stablecoins are a form of money

King Charles signs Financial Services & Markets Bill recognizing crypto as a regulated activity, stablecoins as means of payment under existing laws in the UK

Deutsche Bank applies for digital asset license in Germany

Wisdom Tree, Valkyrie, ARK, Invesco, VanEck, Fidelity, and Bitwise follow BlackRock’s lead and apply for spot BTC ETFs

EDX Markets, backed by Charles Schwab, Citadel & Fidelity, launches; will operate as non-custodial exchange & won’t directly handle customer assets while initially only listing BTC, ETH, LTC & BCH

BlackRock files for spot BTC ETF, CEO Larry Fink says BTC is “digitizing gold”

SAP publishes “Cross-border payments made easy with Digital Money: Experience the Future today” — “rather than using traditional rails, business partners agree on settling a cross-border transaction with USDC or EUROC, tokenized versions of USD or Euro manifested in a blockchain as issued by Circle”

2x BTC ETF BITX was approved & launched, sees ~$5.5M traded on its first day, “among the best first days of an ETF launch this year”; BITO, ProShares’ BTC futures ETF had its highest weekly inflows in over a year the week of June 26th

Ripple’s Hinman documents were released to the public; the documents provided no clear advantage in favor of Ripple but increased scrutiny on the SEC for providing inconsistent guidance creating uncertainty in the industry

Crypto investment products saw their largest weekly inflows of 2023 the week of June 27th, inflows totaled ~$200M

As a result of that slew of bullish news, BTC has led the recent rally which has been flatlined between 30 and 31k since June 22nd. Still, since BlackRock’s announcement, BTC is up 25% with ETH lagging behind gaining 17% over the same time span. Of course, ETH trailing makes sense as BTC has an iron-clad grip over the current narrative as the market awaits the SEC’s ETF decision.

While it’s impossible to know the result of that decision, imo reading the tea leaves suggests that eventual approval is far likelier than not. There’s a combination of factors leading to that conclusion with the first being COIN’s recent price action. Since the SEC announced their suit against Coinbase on June 6th, COIN is up ~120%. In addition, COIN is up ~110% since BlackRock announced their ETF filing (that names Coinbase as their exchange partner for the SAA & the usage of Coinbase Custody) on June 15th. To me, it would appear as if COIN (while currently being sued by the SEC) is trading like it’s going to be the partner exchange and custody solution of the first ever approved spot BTC ETFs.

COIN also isn’t the only crypto specific and/or adjacent public company that has vastly outperformed the broad crypto market in recent months as Saylor’s MSTR, MARA, WGMI, HUT, BITQ, SATO, & BITS have all outperformed their crypto counterparts. Of course, the above public companies have market caps that are significantly less than BTC, ETH & other crypto majors but their rally in recent weeks is still notable as it likely shows a consistent bid coming from equity market participants as they tangentially allocate to crypto through publicly accessible vehicles as allocating directly to crypto would require significant time and due diligence cooperation.

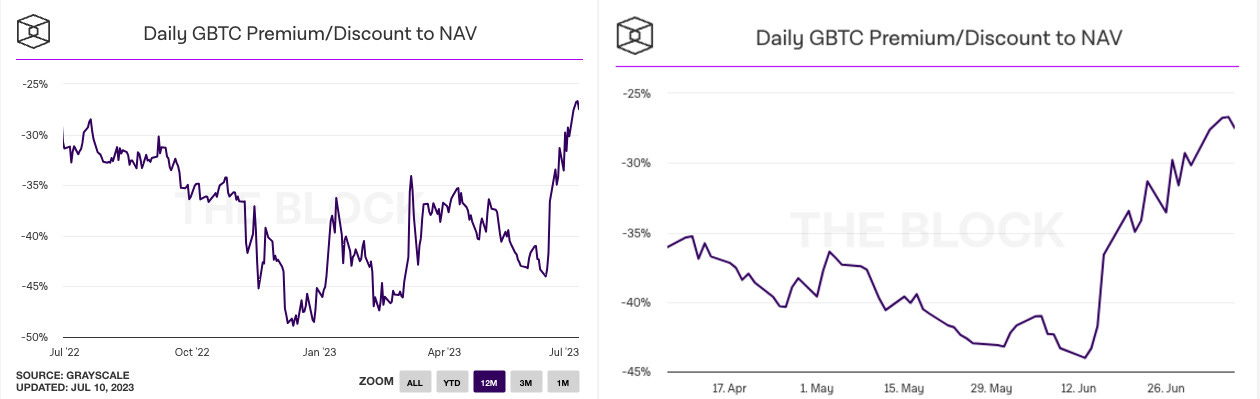

If COIN and the crypto specific public companies aren’t enough evidence for you, let’s take a look at an asset that was incredibly toxic as little as ~2 months ago. Grayscale’s GBTC product is approaching the lowest levels it has been in a ~year+, another added signal in addition to COIN’s outperformance that people are buying and positioning for an ETF approval. As a result, GBTC’s discount has gone from December lows of almost 50% (!!), to 44% on the day of BlackRock’s announcement, to ~28% today.

The GBTC discount to NAV has skyrocketed since BlackRock (& the flurry of others) have applied for spot BTC ETFs as market participants are consistently repricing Grayscale’s eventual ETF conversion allowing GBTC to redeemed for BTC 1:1. In addition to the ETF excitement, there’s continued positive developments surrounding Grayscale’s ongoing legal battle with the SEC as Eric Balchunas of Bloomberg notes, “another reason why we give spot BTC ETF approval 50% chance is our senior legal analyst gives Grayscale a 70% chance of winning case against SEC”

While the confluence of green candles, BlackRock’s ETF filing, COIN/publicly traded crypto companies, the GBTC discount & the slew of good news we’ve received in recent weeks has bolstered broad crypto sentiment, SOL specific sentiment is off the charts since it bottomed ~a month ago on June 10th. Since then, SOL is up over 100% and there’s (finally) a growing consensus that the token and ecosystem are only just beginning their recovery while cementing their place in the future of crypto. Solana will be one of the main topics for Wednesday’s second edition of Trend Chasing, so for now all I’ll say is that envisioning Solana’s eventual resurgence was clear if you were looking in the correct places and Page One has been writing about SOL’s eventual recovery since the week after FTX’s collapse.

Finally, since the initial run up after the flurry of ETF news, BTC has essentially remained in a tight range coiling between 31 and 30k for the past ~25 days. While we hopefully don’t trade within this tight ~1k BTC range for the next month, the next major crypto-specific date is the SEC’s deadline to respond to ARK’s BTC ETF filing suit on August 13th.

Outside of SOL’s recovery & ETF news, other noteworthy developments of the past few weeks include:

UNI outlines v4; expected to go live after ETH’s Cancun upgrade & security audit, timeline would place the official v4 launch around October; v4 introduces dynamic LP management, hooks for more creative protocols/pools & more

FXS announces plans for Fraxchain L2, a DeFi focused ETH-based optimistic rollup will be ready before year end

Circle launches programmable Wallets-as-a-Service — “embed secure wallets in your app in minutes, onboard users with familiar UX, & scale transactions effortlessly with our comprehensive wallet as a service solution”

zkSync introduced ZK Stack & Hyperchains, outlines their future vision

OG DeFi tokens continue their recent outperformance

zkSync introduces the ZK Stack, a modular framework for building sovereign, zk-powered L2s & L3s that will be known as Hyperchains

Lastly, I know I didn’t touch on the price movement of yesterday (that has since been retraced) and what the Ripple case news means for crypto moving forward, but everything above this paragraph was all already written and I wanted to let the dust settle a bit before making rash judgements. So, expect thoughts on that + everything from Tuesday on of this week to hit your inboxes Sunday evening.

As a reminder, the P1 team is always reachable at contact@pageone.gg. If you want to sponsor the newsletter, pitch a guest post, tell us about your protocol or to collaborate on anything in general, you can always reach us there or @PageOneGG.

funding:

Connext, bridging protocol, raises $7.5M in strategic funding @ $250M valuation

Kaito, AI search engine for crypto industry, raises $5.5M Series A @ $87.5M val

Mythical Games, crypto gaming studio, raises $37M Series C extension round

Hash3 announced, seed stage crypto fund with $29M for $250k-1m investments

Bit2Me, leading Spanish crypto exchange, raises $15M

Neutron, Cosmos-based blockchain, raises $10M seed

CryptoQuant, onchain data & analytics provider, raises $6.5M Series A

TapiocaDAO, borrow/leverage/lend omnichain protocol, raises $6M seed

Mnemonic, AI-backed NFT data platform, raises $6M seed extension

Pixion Games, gamefi company focused on AVAX, raises $5.5M

Shardeum, L1 chain launching late 2023, raises $5.4M in strategic funding

ResearchHub, Brain Armstrong co-founded decentralized platform rewarding scientists in ResearchCoin for publishing content, raises $5M

Poko, Singapore-based crypto payments startup, raises $4.5M seed

Superstate, RWAs & regulated financial products onchain, raises $4M

Concordia, credit protocol launching on Aptos, raises $4M seed

Intuition, decentralized identity startup, raises $4M seed

Waterfall, live onchain NFT pricing/protocol for “rare” NFTs, raises $4M seed

BoomFi, crypto payments company, raises $3.8M seed

Northstake, staking platform aimed at institutional investors, raises $3M seed

Ola, privacy focused crypto startup, raises $3M seed

news:

MicroStrategy acquires additional 12,333 BTC for $347M; average price of ~28k

Shopify announces step-by-step details for building a token-gated storefront

Polygon Labs introduces The Value Prop, an open database “showcasing 300+ blockchain-based apps making a positive impact in the world”

4KProtocol stores two Rolexes, tokenizes them as NFTs and Arcade.xyz facilitates the loan of $14.5k @ 12% APR enabling the owner to tap into global liquidity through DeFi

Fortnite adding special in-game items specific to holders of Nike’s .Swoosh NFTs

Binance reaches deal with SEC allowing Binance.US to keep operating

Strike expands BTC Lightning Network powered crossborder payments to Mexico

Alchemy, crypto dev platform/tooling, releases suite of tools leveraging AI to help developers launch crypto products

Singapore-based Finblox bringing tokenized US Treasurys to Southeast Asia

UK Parliament approves new bill (Financial Services & Markets Bill) that would recognize crypto as a regulated activity & stablecoins as means of payment

Hong Kong pressuring major banks to approve crypto exchanges/customers

EDX Markets, new crypto exchange backed by Citadel, Fidelity, & Charles Schwab officially launched; tokens available are BTC, ETH, BCH & LTC

ETH staked now exceeds ETH held on centralized exchanges

Mastercard piloting tokenized bank deposits on Multi-Token Network (MTN)

Circle, issuer of USDC, launches programmable Wallets-as-a-Service

tokens & protocols:

UNI — announces their vision for & the future launch of UNI v4

MKR/DAI — DAI Savings Rate (DSR) increased to 3.49%

MATIC — publishes proposal to upgrade Polygon PoS to a zkEVm validium L2

zkSync — introduced their vision for the ZK Stack & Hyperchains

FXS — announces plans to launch ETH L2 “Fraxchain”

OSMO — launch “supercharged liquidity” & plans to decrease emissions by 67%

BLUR — launches fully compatible mobile support for NFT marketplace

BNB — releases L2 testnet based on Optimism’s OP tech stack

BTRFLY — releases Hidden Hand v2

DYDX — ATOM-based appchain launches v4 testnet

CRV — voting to add WETH collateral for crvUSD with $200M debt ceiling

USDC — Circle’s CCTP now officially operational on ARB

OP — rebrands Optimism chain to OP Mainnet to align w/ Superchain vision

SYN — proposal to reduce emissions, stableswap emissions by 50%

RLB — CT’s favorite casino coin has migrated from SOL to ETH

XRP — granted In-Principle Payments License in Singapore

Ambient Finance — DEX formerly known as CrocSwap rebrands to Ambient & outlines the DEXs benefits compared to its competitors

EigenLayer — highly anticipated ETH restaking protocol launches Stage-1

MetaMask/Connext — Connext bridge routes now natively available in Metamask

Orbiter Finance — details their plans for the orbiter cross rollup protocol/bridge

Xai — L3 designed for gaming set to launch this year leveraging Arbitrum Orbit

around the ecosystem:

Joel John & Siddharth on Web3 Primitives & Social Networks, “A New Internet”

Consensys releases their “Global Survey on Crypto and Web3”

Kel’s comprehensive thread on SOL & it’s potential valuation

tweets:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.