Trend Chasing

coverage on the most important metrics, trends, & developments of the past ~month

as always, thanks for reading, follow me here and reach out at contact@pageone.gg

gm and welcome to the first edition of a new biweekly (until things pick up again) Friday afternoon post, Trend Chasing. The aim of this is to cover interesting metrics, data, trends, developments, onchain activity and fundamental improvements that are often overlooked in the frenzy that is the day-to-day in crypto markets. This post will be longer than what I have in mind for the biweekly posts moving forward as it’s a comprehensive overview with important takeaways covering the last ~month & a half.

Before we dive in, I didn’t realize that last week’s Round Tripping was Page One’s 150th (!!) published article to date. If you’ve ever received anything of value from Page One, we’d greatly appreciate sharing this post, a tweet, pageone.gg, or our Twitter account with a friend, co-worker, acquitance, etc. It’s been an incredible ride over the past 18 months as I’ve gone from tweeting word doc screenshots in 2020 to sub 100 followers to the reach Page One has now. It’s hard to express my gratitude for the support we’ve received but it’s deeply appreciated. Cheers to the next 150 posts.

While memecoins and US regulatory action have dominated the crypto headlines since the start of May, as always, there’s been continued development and growing trends that slowly work in the background to push the global asset class forward. This week, we’ll cover those that occurred over the past ~month+ which include sections on: ETH staking, East vs. West, Stablecoins, Optimism’s Outlook, CCTP & Bridge Wars, Onchain Activity, BTC Ordinals & Inscriptions, ETH burn and Improving Fluidity.

ETH Burn

As an obvious result of memecoins skyrocketing onchain activity throughout May, gas fees and the corresponding amount of ETH burnt reached continuous levels we haven’t seen since ETH’s transition to proof of stake. To highlight the pace at which ETH was burning, there was a 24 hour period spanning across May 4th/5th (the height of PEPE and endless meme derivative activity) where the average base fee was above 200 gwei and 12,00 ETH was burnt.

Over the past few weeks, gas has returned to normal levels but the impact on ETH’s fundamentals (total supply, deflationary status, ETH staking yield) were drastic throughout meme szn as ETH supply is now convincingly deflationary since the merge at a pace of -0.31% per year. Throughout May, the base gwei transaction fee remained convincingly above the 17.4 threshold necessary to make ETH the asset deflationary for a month+ straight.

I’ve talked about this numerous times previously, but for better or worse, ETH the asset massively benefits from heightened onchain transactions and outrageous fee prices to transact on the chain. In addition to memecoin trading pushing gas fees upwards, the total share of publishing fees L2s pay to mainnet to settle transactions reached a new ATH in May. The fees paid to batch and settle transactions to mainnet reached ~$17M this month as the memecoin and onchain trading volume spiked gas fees and market participants continue to explore and farm for future airdrops of L2s and their developing protocols.

At some point in the next 6-12 months, the thesis of ETH’s increasing onchain activity creating a flywheel that benefits the token stakers through decreased supply and increased yields will become mainstream. I continue to think that accumulating and staking ETH will be one of the safest 3-5x’s heading into the next eventual cycle. Simply deploying this strategy until there are daily CNBC segments (2025?) discussing ETH’s current deflation rate & staking yield seems optimal and “safe”.

With that being said, as with many things in life, the effect of these eventual flows are drastically over stated in the short term but are under-appreciated and make for incredible tailwinds in the mid to long term. Since before ETH’s transition to PoS speculation about this flywheel creating structural flows changes has persisted, but we’ll likely have to wait until 2024 for it to start playing out on a meaningful level.

One of the downstream effects of ETH’s burn rate increasing through amplified onchain transactions is the boosted MEV extraction and priority fees (hello, jaredfromsubway.eth) that are eventually passed down to higher staking APRs. With that in mind, let’s take a look at the liquid staking market since Shapella went live.

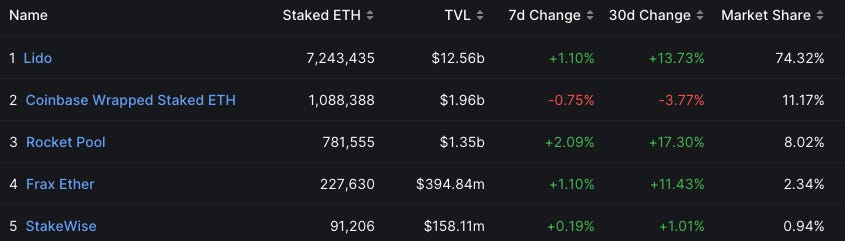

Liquid Staking

Despite the irrational fears of a “death spiral” and broad ETH selloff due to staked ETH withdrawals finally being enabled, the polar opposite has occurred. The entry queue for new staking validators sits at 40+ days long while the withdrawal queue, outside of Celsius, has been largely inactive allowing anyone wanting to remove their ETH free to do so at anytime. As you can see, the cumulative total of locked ETH has steadily and continuously moved up and to the right with the net flow since Shanghai resulting in 3.58M additional ETH staked.

The reason for this is multifaceted and includes the large majority of previous ETH stakers being committed to/believing in the protocol’s future, steady yield generation at a time when DeFi yields have been pillaged by US treasury bills, stakers witnessing others successfully remove their ETH eliminates the tail risk of their potential inability to withdraw, and a combination of enhanced yield through the aforementioned increased onchain activity along with the growing LSDfi sector. Since the Shanghai fork, the cumulative number of ETH staked has risen from ~19M to ~22.9M.

As for the LSD sector at large, Frax’s staked frxETH routinely generated upwards of 8% in it’s early days while Rocket Pool’s recent Atlas upgrade, reducing the number ETH necessary to pool, have contributed to the the liquid staking category surpassing DEXs in TVL for the first time, making it the leading category in DeFi by TVL.

Throughout much of May, the corresponding LSD APR’s for each of the above protocols were continuously between 5-8% as elevated onchain activity leads to increased APRs (through MEV & priority fees). While those APR’s have since come down to the 3.5-5% range, the ability of staking APRs to randomly spike for weeks or months due to heightened onchain activity which in turn burns ETH contributing to supply deflation creates an enticing flywheel. So while APRs between 3.75-5% may not seem incredible, those levels as a relative baseline with spikes to 6, 7, or 8%+ for days to weeks at a time reinforces the desire to stake.

As I previously wrote, I would expect the trend of ETH staked to continue up and to the right as the total percentage of ETH staked currently sits just above 19%. For other PoS chains, this number ranges between 35-60% & I’d expect the LSD sector to benefit from the total amount of ETH staked approaching ~30% by year end.

CCTP & Bridge Wars

As with most of the fundamental developments over the course of the last few weeks, Circle’s CCTP announcement flew relatively under the radar. What Circle announced was their release of their Cross-Chain Transfer Protocol (CCTP) for ETH and AVAX allowing users to seamlessly move their USDC between chains.

In their announcement tweet, Circle highlights the benefits of CCTP saying, “with the Cambrian explosion of third-generation blockchains and ETH scaling solutions, moving USDC across blockchains became a desirable primitive for many developers and applications…CCTP removes the need to bridge USDC via traditional lock-and-mint approaches, improves liquidity across the blockchain ecosystem, and enables developers to provide their users a seamless and secure experience moving USDC natively across chains.”

While this may seem like another run of the mill “we’re the best” announcement from a protocol highlighting their “unique advantages”, Circle’s announcement carries weight because of its effect on the broad, highly competitive and valuable bridging market. As the chart below shows, bridge TVL has been dominated by USDC, something that Circle can and will likely monopolize moving forward.

Circle’s USDC is transparently and natively backed with treasuries and other short-term cash assets, so Circle can easily move native USDC across chains by avoiding the trust heavy lock-and-mint mechanism. This enables Circle to instead institute native burn & mint of USDC on any chain USDC is supported on. CCTP will improve the security/trust of bridged USDC, improve capital efficiency (as liquidity for USDC on various chains is no longer needed), and expand the reach/scale of USDC.

As the graphic above shows, USDC is the most bridged asset out of Ethereum, accounting for nearly a third of the bridged asset distribution. In my view, this is bearish for other popular bridging protocols that include CT’s favorite SYN and VC’s favorite STG as their total bridged volume is likely to take a large hit.

In other bridging news, Axelar (AXL) announced the launch of their General Message Passing (GMP) that enables connections between Cosmos and all EVM chains, providing composability for dapps that span both ecosystems. In similar fashion to Layer Zero’s general messaging protocol, AXL now enables a developer building on any Cosmos to chain to call any function on an EVM chain and vise versa.

While Axelar’s development is another player entering the “bridge wars”, Circle’s CCTP is the infinity gauntlet for the most bridged asset, USDC. To defend against Circle, Synapse has continued forever teasing the launch of SYNchain and Layer Zero/Stargate have their own moat through what is seemingly infinite funding and the ultimate crypto carrot of incentivized usage in hope of a future airdrop. CCTP puts pressure on other bridging protocols, and the future benefits SYN and Layer Zero have teased are now under the most scrutiny and competition they’ve ever faced.

Speaking of Circle and USDC, let’s take a look at recent/current developments in the stablecoin space and how the launch of CCTP and native USDC finally entering the Cosmos/Arbitrum ecosystem may provide Circle tailwinds they could use.

Stablecoins

The unquestionable top takeaway of recent stablecoin developments, something I’ve routinely covered, is the continued growth and success of Tether’s USDT. The total market cap of USDT recently surpassed the previous all-time highs of ~$83B. That previous peak was elevated by the collapse and subsequent flee of capital from LUNA/UST to USDT and Tether is once again benefitting from another stablecoin’s struggles. As for total stablecoin dominance, USDT is currently 65%, a market share level that hasn’t been seen since the heights of the 2021 bull market before the eventual growth of Circle’s USDC.

Tether continuing to dominate headlines (announcing that they’ll be purchasing BTC with 15% of net profits & mining BTC in Uruguay) is not necessarily bad, but consolidation of any one of crypto’s largest sectors into the hands of one entity surely is. As the below image shows, Tether’s dominance was relatively flat before March 10th as USDC’s trust took a hit from the SVB induced depeg and BUSD has been trending downwards in the face of mounting regulatory pressure since ~February. Since that image on March 10th, the market cap of Tether has risen to $83.3B while USDC and BUSD have fallen to $28.2B and $4.81B. Of note, TUSD’s market cap has increased to $3.1B since the below image after ~$1B+ was minted on Thursday June 15th. Binance appears to be shifting capital from BUSD to TUSD, something I’ll dig deeper into in tomorrow night’s Round Tripping.

As for the overall stablecoin market, one of the best indicators of new capital entering the crypto ecosystem, the total market cap continues to slowly trend downwards from $137B at the start of 2023 to $128B now. This stagnation of stablecoin market cap comes as a relative surprise to me as my assumption would be that the recent flurry of onchain growth/activity combined with the “risk-free” yields available to ETH stakers would’ve corresponded to at least minor stablecoin growth.

What this then signals is that new capital is not entering the crypto ecosystem and the inflow of capital chasing memecoins was largely a result of previously siloed NFT capital fleeing BLUR and majors traders escaping the tight range, choppy markets in order to find somewhere volatility and volume are abundant.

Speaking specifically to USDC’s decreasing market cap since March 10th, it would appear that a combination of demographics (USDC dominant in US, USDT offshores), growing US regulatory pressure, and yield multiples greater than DeFi available in US Treasuries (mostly inaccessible to USDT holders) are responsible for the decline.

Despite USDC’s stagnant growth in the face of increased onchain activity *everywhere* throughout May, USDC has potential catalysts in the aforementioned CCTP launch along with finally deploying native USDC to the Cosmos and Arbitrum ecosystems. Native Cosmos USDC is a particularly strong catalyst as the ecosystem has been searching for a native stablecoin since UST’s collapse more than a year ago.

In other stablecoin news, Curve, one of the largest DeFi protocols, has officially launched their crvUSD stablecoin. While once again the short term implications are often overstated, Curve’s protocol native stablecoin will likely have drastic long term effects on the stablecoin market as well as liquidity, TVL, and flows throughout the DeFi sector. Curve is not alone in their pursuit of vertically expanding as AAVE is following closely behind with their own native stablecoin GHO. At a minimum, I’d expect Uniswap to follow AAVE and Curve’s expansion to the stablecoin market with others soon to join the never ending competition to capture users, capital, and TVL.

Ordinals & Inscriptions

Outside of the memecoin insanity that was taking place on ETH, the biggest story of the last several months is undoubtedly BTC Ordinals, Inscriptions, and BRC-20s. The ability to create, trade, and purchase what we colloquially know as fungible tokens and NFTs on BTC has rapidly escalated throughout Q2. There were multiple days in late April and May where an Ordinals collection was the highest volume collection across *all* blockchains according to cryptoslam.io.

The increased activity on BTC has lead to predictable infighting where braindead maxis demand a censoring (of the most robustly decentralized blockchain to ever exist!) of transactions and/or blocks that contain Inscriptions or Ordinals. Their pleas of “the chain is congested!!!” are reminiscent of the 2017 block wars but are thankfully falling on deaf ears (s/o to Nic Carter, Udi, Eric Wall & the Taproot Wizard gang for spearheading the charge & education). As with any blockchain, heightened activity leads to fee spikes and BTC transaction fees recently surpassed the peak they reached in the 2021 bull market.

In another first since 2021, BTC block 788,695 had more fees than the miner reward. Once taboo conversations around BTC’s long-term security and fee generation have slowly drifted to the surface over the past year+, but the development of Ordinals and Inscriptions have provided a likely solution to BTC’s future security. Fees captured by miners have been up only and public BTC miners along with the burgeoning BTC scaling solutions seem poised to benefit from BTC’s newfound features.

While activity has since slowed, there have now been upwards of 10M (!!) Inscriptions forever etched into the BTC blockchain since their launch in ~March. BTC daily transactions have doubled from their baseline levels of the past 3 years while DEX volume on BTC has increased by multiples as people continue experimenting.

While the peak insanity has certainly calmed down, the excitement and future of Ordinal Inscriptions and BRC-20s is clearly here to stay. Unquestionably, the heightened activity of BTC transactions is gaining attention and developer mindshare towards what’s possible on BTC. Looking back a year+ from now, the development and excitement about what BTC can enable will forever be linked to the explosion of Ordinals and Inscriptions in early 2023. The world’s biggest shoutout is in order for Domo, a fellow TheOne discord member and the original creator of BRC-20s. Salute.

Onchain Activity

As you can see from the chart below, unique Uniswap users hit 74k+ on May 7th, a level that hadn’t been reached since around the peak of the bull market in May of 2021 (also aligning with almost prefect local tops of ETH and BTC). DEX volumes have skyrocketed as capital has rotated from the stagnant NFT market and choppy majors price action to chase the volatility and volume spikes in memecoin land. Once again, while the peak insanity has calmed down in the same vein as BTC Ordinals, the ability to generate headlines and FOMO severely aids crypto’s growth.

On May 5th, total ERC20 daily token transfers hit one of their highest levels ever. Much has been made of the increased transaction fees, volume, and activity on ETH, but DeFiLlama shows that ETH is not the sole beneficiary. The future of ETH is scaling through various L2s and the general consensus since ~2020 has been that L2s will make alternative L1s obsolete. That theory, while likely true in the long term, was proven wrong over the past few weeks as general token swaps on Arbitrum reached upwards of $5 during peak memecoin frenzy. In a likely response to that, BSC DEX volume reached heights not seen since 2021 and Solana DAUs topped 400k.

We can argue back and forth ad infinitum about the importance of cheap fees and users’ demand for them, wether they flee ETH due to fees, how much that matters, and how it’ll play out heading into next cycle but what I think is the clear takeaway outside that debate is that crypto activity moves in unison. The parabolic rally of PEPE and other memecoins on ETH rejuvenated energy and attention to crypto which benefitted *all* chains when looking at metrics (volume, DAUs, etc.) throughout May.

Another metric that stands out looking back at May, is the DEX to CEX spot trade volume ratio. The ratio reached a new all-time high of 22% in May as onchain trading dominated the crypto landscape as majors continued to chop and volume left the NFT market to chase “the next PEPE”. While the memecoin carousel has since come to a stop, I’d expect this ratio to continue pushing upwards as the recent regulatory actions against Coinbase and Binance along with a general lack of demand for majors force users to embrace trading onchain. To further highlight the exodus of volume from CEXs, crypto exchange volumes recently plummeted to their lowest monthly levels since 2020.

The last thing I’ll say about onchain activity surrounds the prospects of the strongest memes created throughout the memecoin frenzy potentially providing signal moving forward. Of course, this is the furthest thing from financial advice, but PEPE and something like HarryPotterObamaSonic10Inu (ticker BITCOIN) could provide some of the first onchain signs that risk is back in the same way DOGE did for so long. As access to exchanges and regulatory pressure in the US mounts, onchain memes that crypto native participants appreciate and respect will likely be some of the first movers when the environment is conducive to risk-on.

West v. East

While putting the outline and pieces together for this article, “West vs. East” was unfortunately a section before the developments last week. In even more unfortunate news, the US regulatory actions have escalated as the SEC sued Binance & Coinbase.

The hostile regulatory climate has contributed to Coinbase and Gemini, originally US companies, both announcing their plans to launch offshore derivatives platforms in recent weeks. a16z announced that they’re opening a UK-based office and are relocating their crypto startup school there. In addition to that, Jane Street and Jump are pulling back their crypto trading and market making amid the US crackdown. Fwiw, both entities have offshore operations that will continue, but the regulatory crackdown that began in February is continuing to push US companies along with their innovation, economic benefits, and employees offshore.

In stark contrast to the US’s hostility, the East and Latin America continue to embrace crypto providing relatively clear regulation, accommodating banking relations, and an environment in which crypto companies can comfortably operate. While the US pushes activity, volume and tax revenue offshore, the rest of the world seems eager to capitalize on the promising industry as it licks its wounds from the chaos of 2022.

In addition, Hong Kong has enabled retail access to crypto trading as of June 1st, continues to court US-based companies to relocate, and is pressuring banks to take on crypto exchanges as clients. Europe’s comprehensive framework Markets in Crypto Assets (MiCA) regulation, while nowhere near perfect, seems poised to pass and provide companies with clearly established rules and guidelines to operate within.

It’s not all gloom and doom for the US regulatory climate though as BlackRock filed application for a spot BTC ETF and Patrick McHenry, Chairman of the House Financial Services Committee (SEC), & Glenn Thompson, Chairman of the House Committee on Agriculture (CFTC), introduced a comprehensive framework for crypto regulation that includes an impressive amount of nuance and understanding.

While the current US regulatory environment casts a bleak shadow, crypto remains a far-reaching, global asset class. In addition, there’s plenty of pro-crypto supporters throughout regulatory positions and elected officials while BlackRock’s ETF filing (using Coinbase Custody & price data) and the McHenry/Thompson proposed bill provides some pressure on the SEC. Hopefully this regulatory environment will soften after the 2024 election but regardless, it’s clear that other governments and regulatory bodies are ecstatic to pick up any scraps that the US mistakenly pushes their way.

Improving Fluidity

Despite the current US regulatory environment, the accessibility, usability, fluidity and uniquely crypto-native products have continued to slowly improve. Wallet management, UI/UX improvements, mobile apps, benchmark rates, onramping, and real world assets onchain are expanding through recent developments that include:

Apple’s Crypto Policy Slowly Softening — iOS mobile crypto applications have recently experienced good news as Apple has approved Uniswap’s mobile wallet, a limited version of Axie Infinity, and StepN’s mobile app launch that allows users to buy, sell and trade NFTs natively in-app (30% tax to Apple of course)

BlackRock’s (Potential) Spot BTC ETF — whether BlackRock ultimately receives approval or not is TBD over the next 6-12 months+, but the premier US asset manager signaling their desire to possess a BTC ETF, even if only for fee capture reasons, once again shows that the ability to gain crypto exposure will only become easier

ETH Benchmark Staking Rates — CoinDesk Indices & Coinfund partnered to launch an ETH benchmark staking rate and Chainlink launched ETH staking APR feeds. TradFi pillars such as the discount rate and forward rate curve can now be emulated onchain in ETH staking yield opening the potential for massive innovation in DeFi and the ability to gauge risk/reward of exogenous staking yield

RWAs Onchain — Incredibly nascent compared to the ultimate potential of the sector, RWAs onchain are consistently growing. This week, Arcade.xyz facilitated a loan of two tokenized NFTs representing Rolexes onchain allowing the owner to tap into global, onchain liquidity to borrow in an instant; expect this trend to drastically increase (Rolexes stored @4KProtocol, s/o Cashtro @ Arcade.xyz)

Sending Crypto w/ Ease: TipLink — TipLink, a protocol built on SOL, recently debuted their ability to “send crypto to anyone, even if they don’t have a wallet…TipLink is a lightweight wallet designed to make transferring digital assets as easy as sending a link…send that link to anyone over any platform”

Swapper— On June 8th, the team behind Swapper officially introduced it’s capabilities saying that Swapper “swaps all tokens (ETH or ERC20s) it receives to a predefined output token of your choice…someone can send ETH and you’ll receive USDC…by swapping a portion of income into stablecoins, Diversifier acts as a tax-withholding wallet for NFT creators, DAO contributors, and anyone else earning onchain income.”

Stripe Embeddable Onramps — Stripe introduced their Stripe-hosted-fiat-to-crypto onramp (includes built-in fraud tools and identity verification to support companies in meeting KYC and compliance requirements). Stripe, “today announced [their onramp]…making it easier for Web3 companies to help US-based customers purchase crypto…Stripe’s onramp allows customers to purchase crypto at the precise moment they need it.”

While none of these features are a panacea to instant adoption, what they highlight is the constant adoption, building and improvements teams continue to push towards. The above, combined with improving wallet experiences led by Rainbow’s mobile focus and Castle’s integration with Safe, paint a future where crypto’s ease of use is no longer a hinderance to adoption. Increased building and adoption of native account abstraction will further improve the current crypto UI/UX by orders of magnitude and the steady refinement of crypto rails continues to march onwards.

Optimism’s Outlook

While Arbitrum continues to dominate in daily active users, capital chasing new token launches, and DeFi protocols for L2s, Optimism has continued building and has an interesting strategy that should come into clearer resolution throughout the rest of the year. OP’s successful completion of their Bedrock upgrade last week was a massive step towards achieving the protocol’s eventual endgame. Bedrock opens the door to Optimism’s future as the upgrade drastically widens the design space available to applications and developers building on top of OP.

To me, the most interesting of the above improvements Bedrock enables is the “modular superchain future”. As the L2 competition wages on, Optimism has a potential influx of users vastly greater than any crypto app (outside of peak Axie incentives) has seen to date. These potential users of OP come from Coinbase’s Base L2 and Worldcoin committing to building on top of OP’s Superchain.

Users are undoubtedly an important metric, but value accrual to the underlying token along with fee revenue generated for the protocol remain paramount in achieving. As of now, that value accrual remains difficult to parse and it’s unclear how a potential influx of tens of millions of users on OP’s Superchain tech stack (through Worldcoin & Base) translate to sustainable protocol revenue and demand for OP. The next few quarters for the Optimism stack are an exciting time, but protocol revenue and value accrual to OP should be an increased focus so the token and Superchain thesis doesn’t result in a similar fate to that of ATOM and the IBC ecosystem despite the total number of users and applications building on it.

An interesting sidenote on OP’s upgrade surrounds the reduction of fees by up to 47%. As everyone is mostly aware, fee cost reduction has so far not been a significant driver of user adoption as applications users want to use control the flow of capital and daily active addresses. Despite OP’s reduction in fees, along with numerous other blockchains having cheaper fees than ETH, users of ETH have remained sticky. There’s been a ton of hype around the reduction in fee cost EIP-4844 will enable for ETH L2s, but I’m skeptical of its translation to L2 adoption in the short to mid term despite the growing narrative.

OP’s fee reduction has yet to translate to an increase of users or capital shifting from other L2s because, once again, fee cost (so far) doesn’t drive user intent. EIP-4844 has been lobbied as a massive driver of L2 adoption but the point remains that users want *apps* to use almost irregardless of fees. The design space for what can be built on L2s will certainly expand and the fees will be cheaper because of EIP-4844, but it’s ultimate effects appear much further out on the timeline than most are willing to admit.

Putting the Pieces Together

Well, this post ended up being far longer than I anticipated but it feels good to recap and conclude takeaways from what has been an absolutely batshit insane crypto sector since the end of April. If I had to summarize the entire post to seven bullet points, they would be as laid out below. Once again, thanks for reading and for the continued support of Page One!

The bridge landscape and omnichain developments are worth monitoring over the next few quarters with Circle’s CCTP rollout, SYN’s Synchain launch, and LayerZero’s (eventual?) airdrop

Asia, Latin America, Europe, Hong Kong, BlackRock & the McHenry/Thompson bill are putting increasing pressure on the SEC and US regulators as crypto remains a global asset class other countries are eager to embrace and support

Optimism’s Bedrock enables the Superchain thesis to take shape; a potential influx of tens of millions of users could be onboarded to OP’s stack within the next 12-24 months through Base & Worldcoin but OP value accrual is paramount

Percentage of ETH staked will continue to climb as onchain activity scales, creating a flywheel of benefits for staked ETH through ETH burning & yield generation; the LSDfi sector remains in its early days

The usability of crypto continues to improve through wallet management, UI/UX improvements, mobile apps, benchmark rates, onramping, and RWAs onchain

BTC Ordinals have caused a rejuvenation of life to the BTC ecosystem generating a path towards long-term BTC security & heightened developer interest

Users remain largely agnostic to fee costs, instead are driven by applications they can use, and increased onchain activity on ETH correlates to the entire space benefitting as overall crypto activity moves in unison across chains

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.