as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: the endless range & onchain summer continue, Grayscale outcome provides vol, BASE launches, PayPal’s PYUSD, Visa’s AA push, & Friend.Tech captures mindshare

BTC dominance 47% | ETH dominance 18% | DeFi TVL $42B |

Total Crypto Market Cap $1.2T | Stablecoin Supply $124B |

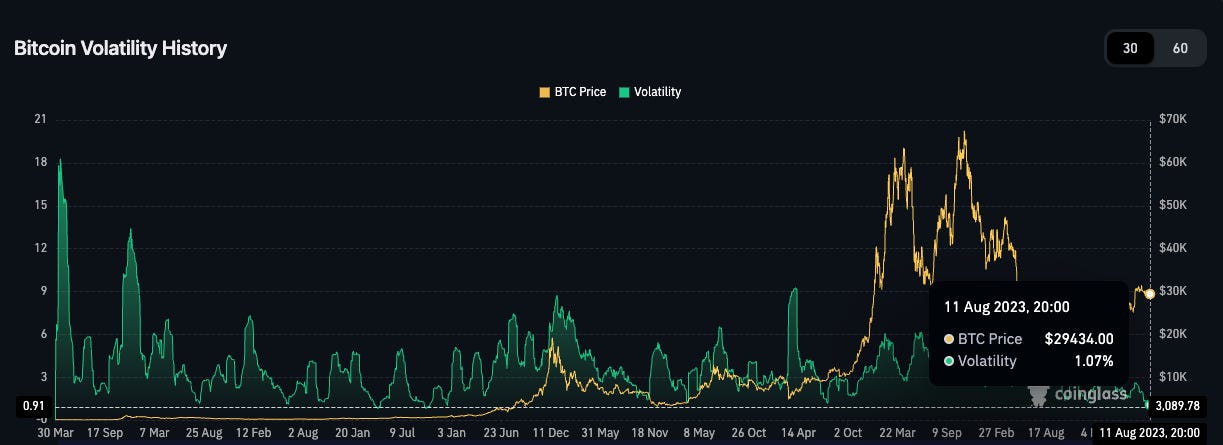

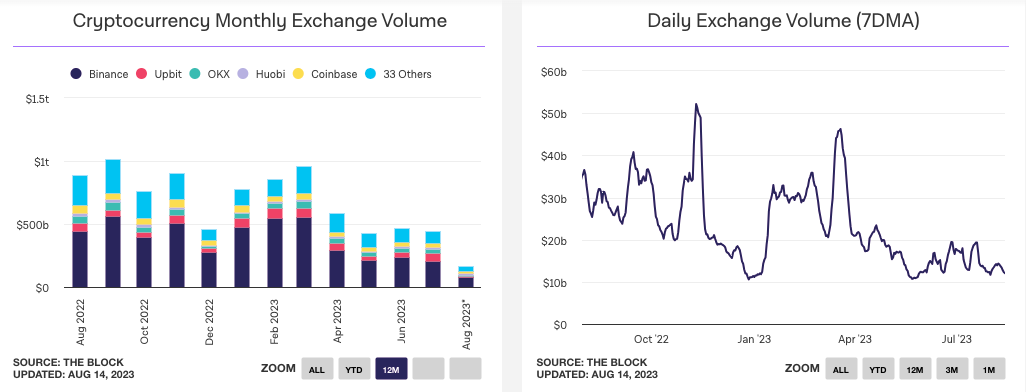

It’s been an incredibly eventful few weeks since I last wrote (apologies for that, I’ve touched copious amounts of grass this summer but am back grinding more than ever), but you’d never know that from looking at BTC and ETH. BTC has been between 29k and 31k since June 15th while ETH is essentially a $1850 stablecoin. The Ripple news has come and gone, every major US financial institution has applied for a spot BTC ETF, almost as many have applied for a ETH futures ETF, stocks have generally continued up and to the right, and yet crypto majors are pushing towards all-time lows in volatility.

The reason for this lack of vol has been discussed at length on CT and in my opinion it’s a combination of capital and energy being directed elsewhere (AI, stocks uponly), general boring seasonality effects, and mostly a massive stalemate of activity from the largest market participants. Of course, markets are always forward looking but it appears that the front running of an ETF approval or Grayscale win are limited compared to most market events.

This is just a streamline of my thoughts, but the severity of impact a Grayscale win or spot BTC ETF approval would have on the market may be allowing the largest participants and flows to take a wait and see approach. If the impact is as large as most think, the repricing and positive catalysts for BTC, ETH, and the entire crypto ecosystem will provide more than enough upward volatility allowing large fund and trading flows to capture the continuation move upwards. What makes this situation relatively unique is the uncertain timeline and date with which decisions are made.

So, where that leaves us is a standoff with incredibly stagnant crypto major prices as we’re potentially enduring the rare case where large capital and smart money are positioning to be reactive instead of proactive due to the likely severity of an outcome in either direction. As far as the Grayscale outcome goes, we can look to GBTC and public commentary on the case to get an idea of the outcome.

As the above chart shows, the discount of GBTC to BTC has steadily climbed higher since Blackrock applied for their spot BTC ETF and it currently sits at 25%, the lowest the discount has been in a ~year and a half. In addition to that optimism of a Grayscale win displayed through GBTC’s discount, Bloomberg’s senior legal analyst previously wrote, “Grayscale has a 70% chance of winning its lawsuit against the SEC over the company’s bid to convert the Grayscale Bitcoin Trust (GBTC) to a Bitcoin ETF.”

Regarding the timing of the decision, the first deadline for response was today (Tuesday August 15th) and Scott Johnsson notes that a decision by the end of August is almost guaranteed. It’s also been noted that rulings come on Tuesday or Friday, so I’m preparing for a decision to become public Friday at 11 AM (and then rolling that over to the following Tuesday and Friday if no decision is made).

Regarding the spot BTC ETF race, ARK’s deadline came and went last Friday with the SEC electing to delay their decision. That decision had been expected for weeks as the SEC wouldn’t approve any spot ETF until they know the result of the Grayscale case. If Grayscale wins, it would appear as if a slew of spot BTC ETFs would be essentially guaranteed for approval but the expectation is that even if a favorable outcome occurs for Grayscale the SEC will use all of their allotted time and wait to approve BTC ETFs until January of 2024.

In addition to the Grayscale case result and the eventual approval or denial of spot BTC ETFs, recent weeks have seen increased pressure applied to the SEC in the form of numerous ETH futures ETF applications. What all of this highlights to me is a perfectly rational time for BTC and ETH to be void of volatility as the soon to be regulatory decisions will provide ample continuation and volatility in either direction.

Now, to the fun stuff. While volatility has evaporated from the BTC, ETH and most CEX tokens as we await the court and SEC rulings, the onchain trenches have flourished. Hamster racing, telegram bots (UNIBOT), Rollbit and the gamblefi narrative, HarryPotterObamaSonicInu10 (ticker: BITCOIN) are some of the select onchain tokens that have captured mindshare and/or benefitted from the lack of CEX activity.

This shouldn’t come as a surprise as in the June 18th edition of Trend Chasing I wrote, “new capital is not entering the crypto ecosystem and the inflow of capital chasing memecoins is largely a result of previously siloed NFT capital fleeing BLUR and majors traders escaping the tight range, choppy markets in order to find somewhere volatility and volume are abundant.” NFT volume & prices continuing to decline + CEX traders losing their minds and capitulating to the onchain games = price expansion for the onchain leading tokens RLB, UNIBOT, BITCOIN, & OX.

Recently, this trend has been referred to as onchain summer, but the reality is that it’s an extension of what started back in April with the initial run of PEPE. While a majority of the newly indoctrinated onchain traders will never fully leave, I suspect that when CEX volatility returns (soon) and NFT volumes/activity recover (who knows when) most will migrate back to their comfort zones.

Still, the onchain revolution has occurred and there’s no going back as the tooling, analytics, security, AI help, etc. will only continue to improve overtime. Moving forward, I expect there to be four main buckets of crypto activity: onchain tokens, NFTs, CEX traders, and institutional flows to the overarching/L1/L2 tokens that represent the increased onchain activity. This topic is an entire article itself, so we’ll come back to that at a later date.

Switching gears, one of the most impactful developments last week came from PayPal as they officially introduced their stablecoin PYUSD describing it as, “PYUSD is fully backed by U.S. dollar deposits, short-term U.S. treasuries and similar cash equivalents, and can be redeemed 1:1 for U.S. dollars.” I’ve written numerous times about how stablecoin issuers are some of the best businesses ever created (at least while yield can’t be passed through to holders) and it seems like PayPal, along with what will be ever-growing competition, wants their shot at capturing marketshare.

PayPal’s entrance to the stablecoin market is a welcoming development as they already have a massive, mobile friendly, generally younger skewed user base through Venmo. As far as impact and adoption goes, it’s TBD and their initial fee structure could be a hinderance to adoption. More importantly, PayPal’s approval to launch their stablecoin along with what it signals to the politicians and the broader fintech/tech industry is most notable.

It’s easy for crypto opposed politicians and critics to point fingers and ridicule, justified or not, “shady” offshore stablecoin issuers (USDT) and onshore ones that depegged over fears of insufficient backing and “shady” banking partnerships (USDC) but PayPal, one of the most successful fintech companies of the 21st century and a publicly listed company, gives further validation of crypto to politicians and the tech industry.

In other traditional payment giant news, Visa released their latest experimentation with account abstraction in “Paying Blockchain Gas Fees with Card: bring the ease and convenience of traditional payments to the world of crypto”. The core idea leverages recent advancements in account abstraction and the ERC-4337 standard and showcases the ability/future of eliminating the necessity for ETH users to pay ETH for transactions and/or gas fees while potentially enabling gas fee payment with any token.

Simplifying and distilling the UI and UX of crypto to one-click transactions while simultaneously eliminating the friction of onramping fiat to ETH or worrying about gas fee fluctuations are step function improvements. While obviously still in the earliest days, the developments are rapidly progressing with Visa product manager highlighting the benefits saying, “…we are accepting fiat and covering onchain fees on behalf of users using our offchain solution. It will simply appear to users in the same way that regular card-based payments are made for their onchain fee cost.” Props to Visa and PayPal for their continued embrace of the future.

Simplified and distilled UI/UX (once downloaded and actually working) not only benefits the future but also captures the present attention as Friend.Tech burst onto the scene late last week through an application built on Coinbase’s BASE L2. Similar to PayPal’s PYUSD, whether Friend.Tech is a fad or demonstrates staying power is TBD, but there are clear takeaways regardless.

Friend.Tech perfectly outlined the playbook that future crypto hybrid dapps should employ. What Visa, and others, are attempting to do with account abstraction, Friend.Tech executed incredibly well enabling users to install their dapp on a mobile phone home screen while simultaneously abstracting away the friction of transactions through BASE’s L2 built on OP’s tech stack. Fast, easy signup/install steps, a mobile dapp, and a seamless one-click, no gas fee transactions should be copied by every hybrid crypto application moving forward.

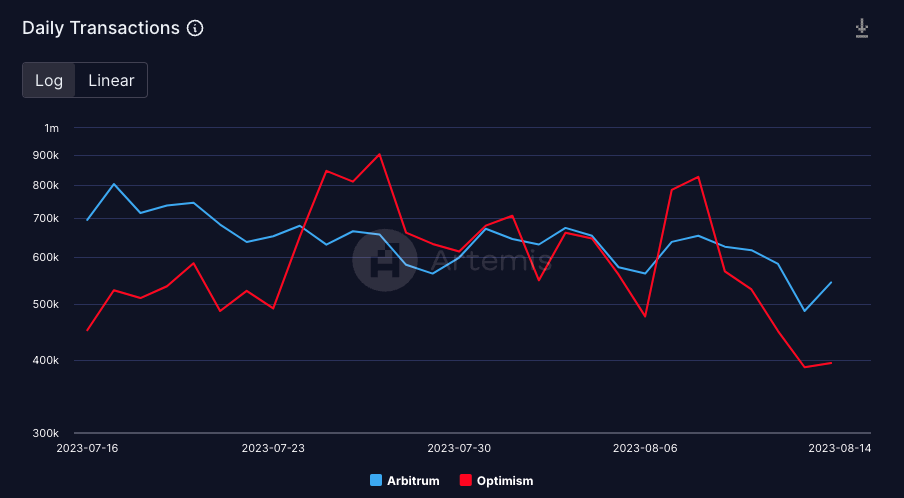

As the above image shows, the result of Friend.Tech’s seamless UI/UX along with numerous other applications and tokens launched on BASE contributed to a successful launch of Coinbase’s L2. Since BASE’s launch, a total of $235M worth of assets have been bridged to the new L2 and Coinbase has collected roughly $2M in revenue from fees.

BASE and Friend.Tech weren’t the only beneficiaries as Optimism, the tech stack they’re both built on, has enjoyed some impressive metrics. Since Worldcoin related activity began to accelerate in early July, OP's price is up ~20% while BASE and Worldcoin’s launch have resulted in Optimism flipping Arbitrum in daily transactions a few times in recent weeks. Arbitrum has since reclaimed the lead, and still dominates in TVL, DEX volumes, etc. but the launch of BASE and Worldcoin provide potential daily active users of OP’s stack multiples greater than any other crypto protocol, something to watch as we move forward.

In addition to all the above, some other noteworthy developments that occurred recently include:

Chainlink launches CCIP — long awaited cross-chain interoperability protocol is launched on ETH, AVAX, OP, & MATIC

Tokenized US Treasuries surpass $600M, currently sit at $642M

Mantle Network (formerly BIT, now MNT) launches $200M ecosystem fund along with new ETH L2 officially live on mainnet

Starknet completes mainnet quantum leap 0.12.0

Neon EVM Officially Launches — developers can now start building ETH-native applications on SOL, EVM code can now exist on top of Solana — failed launch, delete

Polygon — details roadmap of Polygon 2.0 and announces POL token, “the upgraded token of the Polygon protocol”

ETH staked rate tops 20%, currently sits at ~21.5%

House Committee on Agriculture introduces the Financial Innovation and Technology for the 21st Century Act — “the bill establishes a regulatory framework for digital assets, protects consumers, fosters innovation, and positions America as a leader in finance and technology”

Worldcoin (WLD) suspended Kenya services as Kenya’s Ministry of Interior can “assess risks posed by the project”; 250k of 1M onboarded from there

Ondo Finance launches USDY, tokenized note secured by US Treasuries & bank deposits, that can be used as a stablecoin while holders earn ~5% APY

This edition of Round Tripping is sponsored by Jito. JitoSOL is Solana’s first liquid staking token to include rewards from revenue associated with MEV extraction. Users can swap their SOL for JitoSOL to maintain liquidity and participate in DeFi, while earning MEV-boosted yield from staking.

With Jito’s validator set running MEV-enabled clients, the pool has seen massive growth since launch, becoming the third largest SOL LST with $36m in TVL. Get started staking SOL with Jito today!

funding:

Polychain Capital so far raises $200M of planned $400M for fourth fund

CoinFund raises $158M for Seed IV Fund

L1 Digital raises $152M for its second crypto venture fund

Flashbots, ETH MEV company, raises $60M Series B, valuation @ $1B

Futureverse, AI x blockchain metaverse builders, raises $54M Series A

CVP NoLimit Fund I raises $50M+ for early-stage crypto venture investing

RISC Zero, ZK tooling & developer support, raises $40M Series A

p0x Labs, developers of Manta Network (modular ecosystem for ZK applications) raises $25M Series A @ $500M valuation

Sound.xyz, music NFT platform, raises $20M Series A

Xterio, crypto gaming platform & publisher, raises $15M from Binance Labs

Alluvial Finance, enterprise-grade liquid staking company, raises $12M Series A

Argo Blockchain, crypto mining company, raises $7.5M in share sale

Ambient Finance, decentralized trading protocol, raises $6.5M seed

Ethena, ETH-backed decentralized stablecoin developers, raises $6M seed

Artela, blockchain infrastructure company, raises $6M seed

Gondi, NFT lending protocol, raises $5.35M seed

LunarCrush, social analytics & trading platform, raises $5M Series A @ $30M val

Get Protocol, NFT ticketing company, raises $4.5M

Olympix, AI-backed crypto security firm, raises $4.3M seed

Narval, wallet management for organizations, raises $4M seed

Giza, AI platform for smart contracts & crypto protocols, raises $3M Pre-Seed

news:

Google shifts policy, to allow the ability of apps to offer ability to buy/sell/trade NFTs and for users of Android app store to earn tokenized assets

PayPal announces the launch of their stablecoin PYUSD

Gnosis partners with Visa to launch Gnosis Card allowing users to easily spend self-custody crypto

Former Celsius CEO Alex Mashinsky arrested, Celsius to pay $4.7B settlement

BlackRock CEO Larry Fink says crypto will “transcend any one currency”

Solana Labs release Solang compiler enabling developers to write smart contracts on Solana in ETH’s programming language Solidity

Binance completes BTC Lightning Network integration, users can now deposit & withdraw BTC via Lightning’s L2 netowork

Nasdaq pauses crypto custody ambitions citing regulatory concerns

Solana Labs introduces Solang, a complier enabling developers to write smart contracts on Solana in Solidity

Jacobi Asset Management to launch Europe’s first spot BTC ETF “in July”

Tether, USDT issuer, now 11th largest holder of BTC, worth ~$1.6B; Tether also provides Q2 attestation report showing a net profit of $850M and excess reserves now sitting at $3.3B

Saylor buys more BTC, total holdings now 152,800 BTC worth ~$4.4B

HashKey becomes first HK exchange to obtain license for retail trading of crypto; Hong Kong-based OSL also approved to offer retail trading of BTC and ETH

DCG earned $40M of revenue from GBTC & ETHE products in July

Alchemy Pay, fiat-crypto payment gateway, partners with Checkout.com

tokens & protocols:

MATIC — announces POL, the upgraded token/vision of Polygon 2.0

LINK — launches cross-chain interoperability protocol on AVAX, OP, ETH & MATIC

AAVE — officially launches native stablecoin GHO on mainnet

UNI — announces UniswapX, aggregates liquidity across various DEXs, provides gas-fee execution & MEV protection

SNX — Kain outlines Synthetix part four and what comes next, SNX announces perp dex Infinex with front end focus to compete with CEXs

BNB — completes 24th quarterly burn, removes ~2M BNB worth ~$484M

MNT — ETH L2 announces mainnet alpha launch, $200M eco fund backing

OSMO — launches supercharged liquidity across Osmosis DEX

SD — Stader launchers liquid staking ETHx live on mainnet

RBN/AEVO — announces plans to merge RBN into AEVO

MNDE — LST protocol on SOL launches Marinade Native for institutional staking

CELO — proposes to leverage OP stack & transition Celo L1 to ETH L2

Base — Coinbase ETH L2 opens mainnet to builders

zkSync — releases Boojum, new proof system enhancing the L2s scalability

Lens Protocol — decentralized social media graph protocol launches v2

Starknet — completes “mainnet quantum leap 0.12.0”

Linea — ConsenSys’ house built zkEVM L2 releases mainnet alpha

Powdr Labs — zkVM language & complier modular stack for zkVMs announced

Babylon — releases 1st public version of BTC staking protocol litepaper

NeonEVM — officially launches making ETH-native dapps compatible with SOL

around the ecosystem:

Cat with always prescient thoughts on the internet in “Scam Shitcoin Super Cycle”

Squads Protocol’s “An Overview of the Solana DeFi Ecosystem (2023)”

Bobby Ong breaks down CoinGecko’s 2023 Q2 Crypto Industry Report

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.