Cyclicality & What's Next

an overview of the crypto ecosystem providing when and how we move forward

as always, thanks for reading and follow me here

The usual disclaimer, none of the below is financial advice and I have positions in some of the tokens covered. This post is an overview covering most of the crypto ecosystem, specifically the protocols and sectors I find most interesting moving forward. For anyone wanting a TLDR or to skip through various sections the outline is:

Intro & The Current State of Things

The Devs Are Doing Something — the growth, importance, & incentives of devs

Planting Seeds — outlining the good & extractive parts of VC capital

What We’ve Earned — overview & leaders of the exciting various sectors built

Scaling (L1s/L2s), NFTs, Infrastructure To Scale, Token Enabled Incentives, GameFi, and Interoperability & Bridging

What’s Next

exploring what I’m excited to watch develop, & how they sectors covered will combine and leverage one another to propel our next cycle

my outlook on the current market and view through the end of the year

The State of Things

As everyone knows, crypto has historically operated through reflexive cyclical price action. Breathtaking explosions upwards are followed by net-worth diminishing corrections with demoralizing chop until the next cycle begins. BTC topped just short of 68k on November 8th, the same day ETH reached its all-time high of 4.8k and we currently sit -60%+ of those highs while many alts are down 80%+.

Since then, we’ve had inflation prints not seen since the 80s, soaring commodity prices as a result of Russia invading Ukraine, continued rolling COVID lockdowns in China exacerbating supply chain problems, and the FED committing themselves to address some of these issues and inflated asset prices by raising rates. While I don’t have all the answers, I hope this post will alleviate worries about the long term market direction by admiring what has been built, highlight some positive forward looking indicators, and inspire people to explore the growing number of crypto verticals that, when combined, will fuel our next beloved cycle.

The price to innovation flywheel pictured above is one of the best descriptions outlining the cyclical nature of crypto markets. Chris Dixon and Eddy Lazzarin originally outlined the concept in their aptly named piece, “The Crypto Price-Innovation Cycle”. Their article has many astute data-driven observations and can be boiled down to one key takeaway quoted below.

“Notice how developer, social media, and startup activity is sustained even after prices decline. As we’ll see later, this is a consistent pattern that leads to long-term steady growth in fundamental innovation…A key feature of crypto cycles is that each one plants seeds which later grow and drive the next cycle.”

With this quote and that flywheel in mind, we’ll rehash what’s been built, ongoing developments, the trend of growth in developers across the ecosystem, examine the funding landscape, highlight sectors and protocols to watch, and envision the how and when we escape the current bear market.

The Devs Are Doing Something

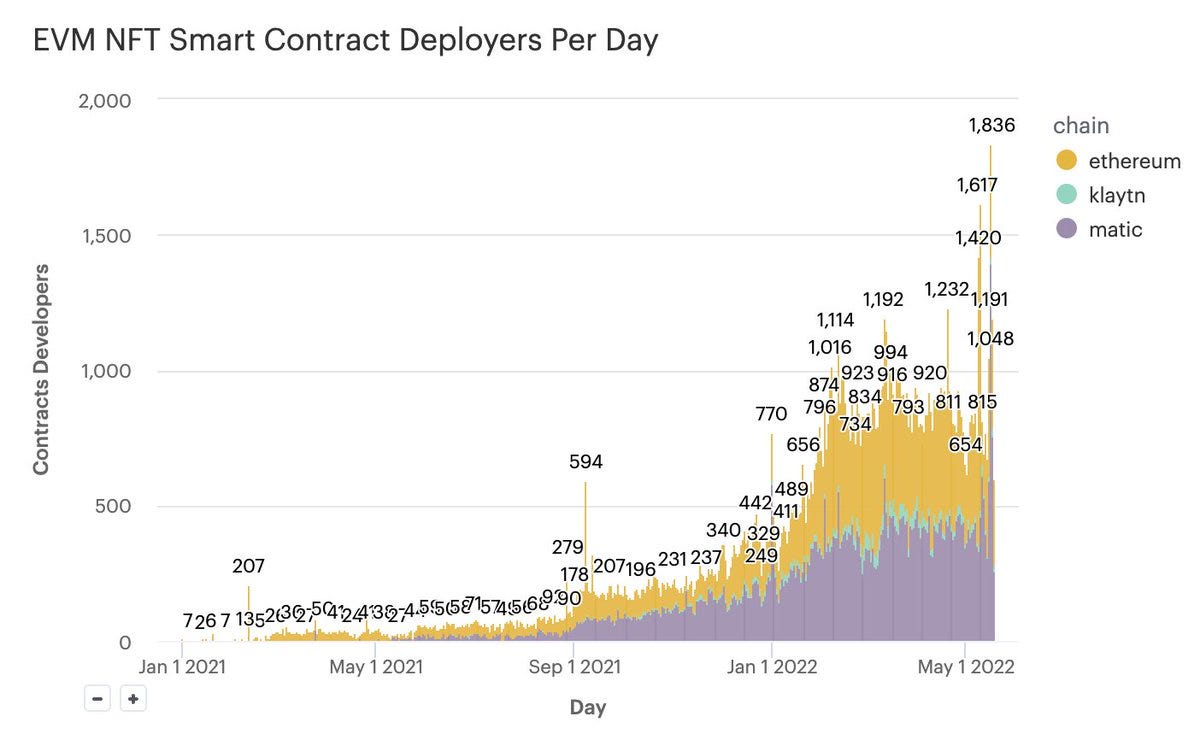

Developers are the most important crypto ecosystem participant and their growth correlates to innovative protocols being created, maintained, and updated pushing the flywheel of growth forward. One of the mildly surprising developments of the past six plus months has been the exodus of FAANG developers to the crypto ecosystem. While this pace of developer migration has likely slowed as prices decline, the trend is established, clear, and solidified moving forward.

Devs unfortunately take a lot of heat from left-curve market participants when token prices are down, but crypto affords them opportunities that FAANG and big tech can’t provide. The global, 24/7 rails crypto resides on and the ability to empower users combined with the explosive growth of a new protocol or primitive that finds product market fit will continue to attract and entice the world’s most driven and curious developers.

Following the open-source ethos of the early web, developers in web3 have the ability to create an insane scale of economic value and impact per line of code. We’ve seen numerous protocols (good and bad) launch throughout the years that are flooded with hundreds of million to billions of dollars, a unique incentive for the developers of tomorrow’s protocols. The ability for a singular person or small group of people to have an outsized impact on the future of global capital markets and human coordination in a burgeoning asset class is as strong of an incentive that has existed within the internet era.

Further solidifying the above arguments is Electric Capital’s web3 developer report. They routinely release the most comprehensive web3 developer report in the industry, with their most recent in January of this year. A few key data points from their report are as follows:

65% of active developers in Web3 joined in 2021

2,500+ developers are currently working on DeFi projects

Less than 1,000 full-time developers are responsible for over $100 billion in total value locked in smart contracts.

Devs are the past, present, and future of the crypto ecosystem and their growth, an incentive to build, support/funding available and curiosity towards the space are at all-time highs.

Planting Seeds

Devs, along with the protocols they build, need funding and there is ample money waiting to enter the crypto ecosystem. The current crypto venture market is accelerating at a dizzying pace. Obviously, this metric doesn’t correlate to price, but providing general and ecosystem specific funding that entices and empowers entrepreneurs and developers to enter and create the protocols of the future is a necessary evil.

There has been a growing backlash against the crypto funding environment in recent months, and rightfully so. The dichotomy between public and private market valuations continues expanding which may incentivize more public token investments. Sadly, it’s absolutely the case that some of the VC funds that have entered or are entering the space are inherently predatory in nature. Some funds and market makers in the space routinely dump private allocations upon launch and farm tokens to death while hedging and TWAPing the token (and potentially protocol) to the growing graveyard of former crypto experiments.

Crypto will always remain an open, global, 24/7 market that enables users to invest and perform due diligence themselves. It is also the case that previous cycle protocols would’ve loved the ability to tap into seemingly unlimited funding as many foundational pillars of the crypto ecosystem today were on the brink of runway expiration.

Ideally, the ICO era would’ve taught investors the appropriate lessons and every innovative idea that entered the crypto ecosystem could tap into the wealth of public funding. Unfortunately, the SEC is here to protect us and we work within the structure we’re provided.

Massive PmF and global demand were a core reason for the tech boom we witnessed over the past decade plus, but the ability, formation, and mainstream acceptance of VC funding played an integral role. The same dynamics are playing out in crypto as capital continues searching for returns. VC giants of the old guard, global market makers, banks, pension funds, endowments, legacy corporations, credit card agencies, established brands, public companies, athletes, and more are all chasing returns and funding/buying crypto has provided the best risk-adjusted returns over the past decade. Again, VC has some rent-extracting qualities antithetical to crypto’s core values, but the ability of the innovators of tomorrow to have on-demand access to capital pools is crucial for the adoption we’ll see over the coming years.

What We’ve Earned

So, we have the health, albeit frothy and semi-extractive, of funding along with developer interest, growth, and incentives at all-time highs, but what has that provided us? What have the devs, entrepreneurs, and buildooors collectively created? Have we *earned* it?

Crypto’s total market cap, after peaking above $3 trillion, currently stands at $1.23T and a few multiples higher than the $500B it was when Vitalik tweeted the above. Let’s examine the core sectors built, leaders within them, and explore the protocols that justify crypto’s market cap and will inevitably lead to its expansion upwards.

Scaling — L1s and L2s

The L1 trade was one of the most profitable throughout the most recent cycle for good reason. While many ETH users and market participants were priced out of ETH transactions during the previous cycle, some alternative L1 smart contract platforms have established themselves and will continue expanding their ecosystems.

SOL — Highest throughput transaction chain (when fully operational) that has innovative DeFi solutions developing backed by CLOB hub Serum. SOL appears to me as the likeliest winner of non-ETH smart contract platforms as they continue scaling uptime/throughput and implement a functional fee market. The result of that appears like it will establish SOL as the home of several large GameFi and DeFi projects in the coming years along with the continued expansion a burgeoning NFT ecosystem.

AVAX — AVAX has solidified it’s place as a cheap EVM compatible experiment playground for DeFi and the home of future app-specific DeFi and gaming protocols through their subnet architecture (see JEWEL Crystalvale subnet). While AVAX’s staying power relative to L2s in the long term is somewhat questionable, the short to mid-term traction and growth is solidified to develop for the long run.

ATOM — Cosmos and the IBC network has innovated throughout multiple cycles in crypto but has failed to garner mainstream hype and appeal. JUNO and OSMO are good protocol developments and the Tendermint Consensus supports a growing number of crypto protocols. LUNA’s collapse could also spark the ATOM ecosystem growth as several previous LUNA protocols are compatible and begin porting over. Inter Protocol, ATOM backed over collateralized stablecoin for the ecosystem, was also recently announced and should be a positive growth development.

NEAR — Near is the L1 I’m most interested in watching and experimenting within over the coming months as they have rolled out the USN stablecoin and boast Aurora’s EVM compatibility for easy bridging. Aurora based Bastion Protocol which describes itself as an “algorithmic DeFi protocol“ has been NEAR’s largest growth accelerator after $410M was committed in Bastion’s initial lockdrop. NEAR has also partnered with Infura for a smoother developer experience and scalable platform while their NFT ecosystem and nightshade sharding developments are expanding.

DOT — Polkadot has been long admired by VCs and institutional investors which has yet to translate into actual impact. Still, the DOT ecosystem has one of the strongest developer counts and they recently announced support for parachain messaging and Statemint upgrades for NFTs.

Other L1s To Watch: Secret (programmable privacy), Espresso Systems (ZK base layer and CAPE protocol), Celestial (modular consensus and application layers)

L2 scaling solutions remain paramount to onboarding hundreds of millions to billions of future users to the crypto ecosystem. Optimistic and ZK (zero-knowledge) Rollups remain the main players here with optimistic rollups having the short term edge with live, application-ready deployments while ZKRs are the best bet long term. ZKRs are quickly advancing and are becoming production ready for the second half of the year. For a deeper dive into the various ZKRs, read the ZK Landscape I previously wrote.

Optimism — OP token announced, growth occurring, currently $492M TVL

Arbitrum — will soon follow Optimism in releasing a token as the race to incentivize users is underway; currently the L2 leader with $2.65B TVL

StarkWare — builders of Starknet and StarkEx

StarkWare received new funding of $100M valuing them @ $8B on May 25th along with StarkNet enabled StarkGate Alpha announced May 9th

zkSync — released zkSync 2.0 and EVM compatible ZKR currently on testnet

Polygon — Nightfall zk L2 announced adding to their suite of scaling solutions

Aztec — confirmed that Aztec Connect will be live on ETH mainnet June 6th

IMX — the current leader in ZKR adoption with a specialized NFT/gaming focus, while announcing cross-rollup NFT liquidity in partnership with StarkWare

Other Scaling Solutions to Watch: Mina, Espresso, Aleo,

NFTs

While everyone is aware of the NFT PFP craze, we’re still at the earliest stage of exploring the immense impact NFTs will have. Often forgotten in the everyday chaos is the simple, yet all-encompassing revolution NFTs present as a verifiable, digital wrapper around any unique asset. The programmable nature of the technology along with the royalties they can eschew to their creator are step-function advancements.

There are currently two traditional asset verticals that are beginning to make their impact on NFTs; liquidity and financialization. The improvements in liquidity for NFTs are done through two main concepts. First, there is expanding the potential market participants by fractionalizing NFTs (fractional protocol) and second, widening the potential buyers by increasing the available ways to sell. SudoSwap, NFTX, and OpenSea’s announcement of Seaport are the leading candidates in this category. Seaport is an entirely different marketplace than OpenSea and allows buyers and sellers to supply or accept a combination of various tokens.

SudoSwap is soon launching its novel deployment of an AMM based DEX for NFTs. 0xmons, SudoSwap developer, described the protocol as, a “capital-efficient, gas-optimized base-layer protocol for NFT liquidity.” Seaport and SudoSwap should improve NFT liquidity in the coming months/years and are exciting developments.

NFTX is the final notable protocol working to enhance liquidity which they achieved by building NFT exchange liquidity pools. Users of the protocol have the ability to deposit their NFTs into pools which are exchanged for fungible tokens and create yield generating opportunities while allowing anyone to buy fungible tokens representing a specific NFT collection on open DEXs.

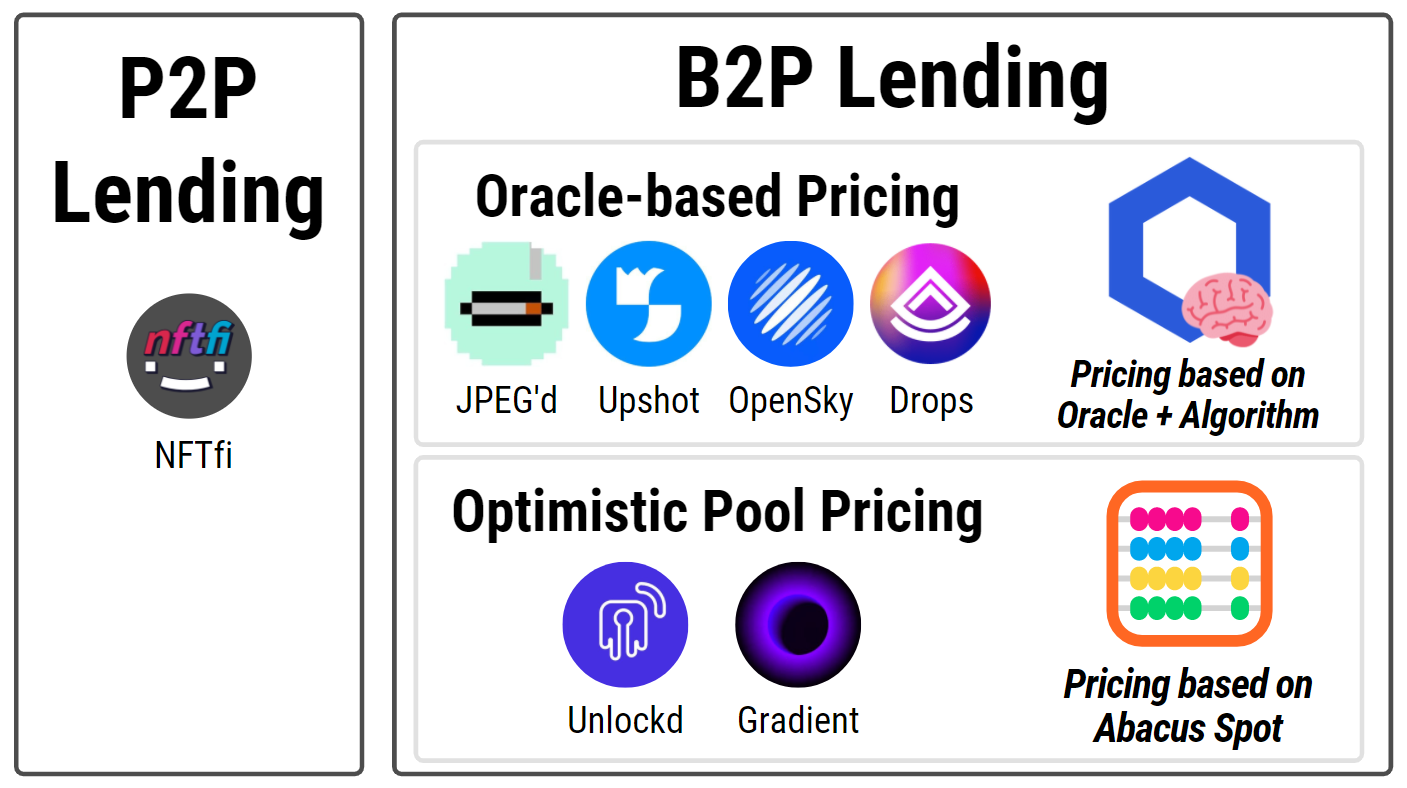

The financialization of NFTs currently has a small addressable market but will consistently increase as NFTs slowly expand into their trillions of dollars potential market. There are a few main protocols built to enhance the productive nature of NFTs as an asset. Peer to peer and protocol lending are the differentiated approaches which 0xRusowsky elegantly details and explores in his post, “The financialization of Non-Fungible Tokens”.

Eventually, the market cap of NFTs will be the most valuable asset class in the world as they continue their evolution to impact every industry. Art, collectables, social clubs, music, real estate, titles, user data, utility passes, intellectual property, and NFTs integration into games are a few of the sectors NFTs will drastically change.

Token Enabled Incentives

Incentivizing a user base of various different global market participants to perform some real-world action through uniquely crypto enabled tokens is one of the most exciting verticals in crypto. Empowering people to contribute and build a network through idle resources or time in exchange for tokens and ownership is extremely powerful.

The most known and trail-blazer in this sector is Helium (HNT). Helium rewards users with their token for purchasing a hotspot that is then installed and syncs to their blockchain. Helium has experienced explosive growth while scaling the necessary infrastructure orders of magnitude faster than traditional competitors. Subsidizing their growth while offloading, in sum, extreme capital costs to individual hotspot operators changes capital costs/formation while blitzscaling a network’s reach.

StepN (GMT) had its moment as the talk of CT while appearing in media outlets across the world deploying a similar token backed incentive structure. While what HNT and GMT are trying to accomplish are entirely different ends of the spectrum, the parallels are evident. Multicoin calls this sector “Proof of Physical Work” and we’ll continue to see these experiments providing real-world actions through token rewards.

Protocols to Watch: HNT, Pollen Mobile, Livepeer, Braintrust, Sweatcoin

GameFi

While GameFi has been more of a meme than an idea actually garnering and displaying a sustainable market impact, the future for the space is bright. There has been an infinite amount of pieces and discussions surrounding the sector and its potential future ramifications.

The eventual successful implementation of gaming combined with NFTs, DeFi, and the economies they’ll bolster will have flywheel effects on the entire crypto ecosystem. Axie displayed the unparalleled growth these ecosystems can foster in a few short weeks or months while eventually also displaying the results of poor tokenomics, sustainability, and incentive alignment. High quality, engaging games take several years to build and layering on a blockchain along with what virtually amounts to managing a substantial, sustainable economy is difficult.

Fortunately, there’s a plethora of funding, developers, and game enthusiasts inspired and driven by the opportunity and total addressable market. We should begin to see the GameFi sector take shape towards the end of this year led by two of the most exciting players in the space: Aurory on SOL and Illuvium on ETH (powered by IMX).

Interoperability and Bridging

Outside of the drastic need for more block space through alt-L1s and L2s, the other dominant narrative that emerged this cycle was the interoperable, multi-chain future through secure bridging and asset transfer. Unfortunately, this narrative came to the mainstream through a series of hacks including Wormhole, Axie’s Ronin, and to a lesser extent Poly Network. As the ecosystem continues developing and some chains and L2s become specialized in their service the need for secure, decentralized bridges will only increase. There’s a few protocols worth highlighting here competing with the current market leaders, STG & SYN.

Layer Zero & STG — STG is built on top of the underlying Layer Zero network and aims to solve the “Bridging Trilemma” through their innovative one-click chain-native asset swaps. Layer Zero is a complex messaging protocol that pioneered the omnichain token and NFT implementation which several protocols are now incorporating and building on top of.

SYN — Synapse is a CT favorite (heavy bags) and their bridging protocol is currently the most used cross-chain liquidity network. xAssets are their most recent innovation transforming native single-chain tokens into multi-chain assets. Synapse also recently announced that their cross-chain communications protocol supports NFTs.

Connext — facilitates transfers between blockchains and rollups allowing developers to build expressive cross-domain apps that they call xApps. Connext also confirmed the upcoming launch and vision of their $NEXT token.

HOP — initially launched in July of 2021 with USDC swaps, Hop has expanded to ETH, DAI, USDT, and MATIC swaps. Hop also recently confirmed and airdropped their $HOP token and outlined their vision for the HOP DAO.

Wormhole — Jump backed bridging solution that now supports the Cosmos IBC network marking their 11th base-layer chain support. Wormhole has ~$670M of TVL across various chains and utilizes the token lock, wrap, and mint functionality.

Others To Watch: REN, RUNE, Axelar, and Nomad.

Infrastructure To Scale

One of the positive developments of the surplus of capital deploying to crypto is that a large portion of the investments made have been to the infrastructure sector. Blockchain analysis and data analytics companies, non-custodial wallet providers, L2s scaling infrastructure, mining companies, service providers, staking solutions, fiat on/off ramp providers, and necessary infrastructure have been heavily funded this year as the infrastructure layer to support hundreds of millions of users takes shape.

There are plenty of protocols to highlight in this sector, but I recently read Zee Prime Capital’s excellent “Web 3 Middleware” breakdown and will highly, highly advise you to do the same. Zee Prime consistently has the best middleware and infrastructure stack analysis and my thoughts are aligned with them. Their research and depth on the subject would be stupid to try and emulate, so head over there for a detailed breakdown of the current state of the infrastructure landscape. For the many of you that fail to read things, I’ll provide some protocols operating within the infrastructure space that they highlight.

Protocols Zee Prime Covers: AR, POKT, Spheron Protocol, KYVE, Ceramic, Subsquid, SolanaFM, Glitter, Lit, Polywrap, Sepana, Kwil, and Guild.xyz

What’s Next

The foundational sectors of the crypto ecosystem are broadly established and the necessary infrastructure is rapidly advancing. These primitives and protocols are ripe for combination and future building through leveraging and integrating what they enable to extend crypto demand through more impactful applications, enhanced user experience, lower transaction fees, interoperable cross-chain experiences, and empowering people across the world with access and ownership they rightfully deserve.

A few of the verticals I’m closely monitoring that are starting to develop:

GameFi economies leveraging and incorporating established DeFi

Wallets expanding their services — see Think Bigger: Wallets as Profiles

Expanded NFT use cases & liquidity and the downstream effects of that

Omnichain protocols/NFTs leveraging various chains for new use cases

Developments around cross-rollup liquidity and compatibility on ETH

ZK Rollups: their tokens and dynamics of valuation/marketshare controlled

SOL/ETH ratio and SOL’s ability to scale and continue increasing traction throughout their NFT ecosystem & creating demand for DeFi tokens DownOnly

NFT marketplace metrics — LooksRare’s growth and SudoSwap’s rollout

Continued FXS, Curve, Convex, and BTRFLY growth and symbiotic relationship

Current Outlook

My current view is slow chop & pain until the sustained rally begins around the end of Q3/start of Q4 and accelerates through Q1. Many of the sectors developing I outlined receive catalysts starting in Q3 with the obvious caveat to a successful ETH merge.

L2 scaling solutions continue advancing and deploying production ready support to alleviate ETH transaction costs and provide a flurry of economic activity as they release tokens (Optimism, Arbitrum, zkSync, StarkEx & StarkNet) to incentivize users.

NFTs expand their use cases & impact through increased liquidity and financialization enhancements. The intersection of NFTs, gaming, and DeFi continues accelerating and takes shape late Q3 along with the developing meta narrative (gamefi supplies massive demand) that ignites the sector leading into the release of several gamefi ecosystems Q4 and onwards that have been committed to building long-term.

Solana largely solves their issues by Q4 resulting in continued excitement around their NFT ecosystem, gamefi releases occur, the innovative DeFi protocols recover, and SOL solidifies itself by emulating ETH’s previous run from two to four digits.

Layer Zero, Stargate, and Synapse provide developers the ability to leverage cross chain native assets/NFTs and build protocols leveraging chain and application specific benefits that takes shape in Q4 onwards.

Macro wise, YoY inflation numbers improve in Q3 onwards as the comparison rate increases, the FED eases rate hikes, and risk assets slowly start to catch a bid. Crypto adoption fueled by many increasing trends centering around time and percentage of networth spent online, leads to future generations DCAing into broad crypto exposure in their 401ks and IRAs.

Thanks for reading, supporting Page One! Reach out with comments and feedback on Twitter @_tolks and I look forward to continue conversing & building within this space.

Great analysis & nice reading!

good news!