as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: unusually quiet week, ETH’s always burning, “passive income” & its future powers, BTC & ETH’s growing tailwinds, L2 gas consumption & crypto’s inevitability

BTC dominance 45% | ETH dominance 18% | DeFi TVL $49B |

Total Crypto Market Cap $1.2T | Stablecoin Supply $132B |

The Monday Binance FTC not withstanding, which was covered in last week’s Monday edition of RT, crypto was uniquely calm this week minus some bear-market-induced-greater-than-usual attention on gainzy and Arbi’s governance debacle. Generally speaking, and supported by the number of chats I’m in, people are bored with the current market and protecting capital all costs.

As for the updated market conditions, BTC dominance is still approaching multi-year highs providing a semblance of hopium for a small altcoin rally. But, if everyone is aware it would be “small” then does it even manifest at all? Similar to the ARB airdrop where everyone was playing the $1 close to $2 in a hours/days rotation, this hopeful alt rotation feels DOA as market participants continue to look to sell alts into any semblance of strength. I wrote on this idea last week saying,

“The market (mainly alts, rotations, and onchain) is suffering from a form of survivorship bias as the only market participants left have survived apocalyptic level events and are protecting capital at all costs by exiting rotating with small, if any, gains that bleeds the risk end of the spectrum dry.“

Whether a small altcoin rally occurs or not is inconsequential to the overall health of crypto at large, as the often memed “fundamentals” continue to improve. Since the market has been void of major storylines, and thankfully remains relatively unchanged for the week, we’ll check in on some broad data that specifically applies to ETH.

First, ETH’s often out of mind burn has continued to work in the background despite the macro induced noise. For the extreme risk averse, simply staking ETH (specifically after a successful Shapella upgrade April 12th) and collecting yield into the eventual next cycle seems like one of the safest bets since DCAing BTC at the advent of crypto.

Supporting that thought process is the projected and currently active yield LSDs generate combined with the slowly, but gradually, diminishing ETH supply. As the below picture shows, ETH’s projected issuance has quietly usurped BTC’s as the effects of the merge and EIP-1559 continue to build in the background of current events that momentarily steal the long-term focus.

While it may be hard to parse from that image, ETH’s supply peaked around 120.6M ETH shortly after the merge, a total that has since reduced to 120.46M. Since the merge, ETH’s supply has reduced by ~75k+ ETH, compared to an increase of 2.2k ETH issued if it remained PoW, resulting in a selling pressure reduction of $135M over the course of the past 200 days.

$135M divided by the 200 days since the merge results in a relatively insignificant reduction of ~$675k in sell pressure per day but, combined with other growing trends, points to an extremely healthy picture for ETH’s future.

A large part of that healthy future is the ongoing demand of ETH block space from L2s. As we’re aware, the L2 ecosystem is currently booming as a result of recent launches including the ARB token and zkEVMs from Polygon, zkSync, and Immutable. In addition, OP continues to have protocols/teams building on their stack and future token/L2 launches from Scroll, Starkware, and Aztec (along with many others including modular solutions that settle to ETH) will only increase the demand for ETH L1 blockspace that further increases the aforementioned burn.

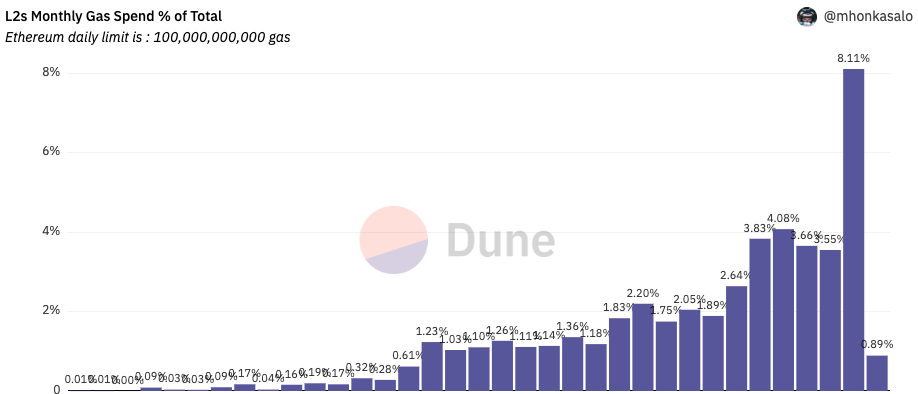

We see this clear as day from @mhonkasalo’s L2 monthly gas spent dune dashboard as the growing number of L2s consumed 2x the level of ETH L1 gas in March compared to any previous month. As previously stated, the below percentage will only increase as there remains a slew of L2s that have yet to launch (don't miss their potential airdrops anon). As with the ARB airdrop, market participants will gladly speculate on the various L2 valuations, but the ultimate underlying benefit, as long as they continue to consume L1 gas, remains with ETH and it’s slowly but constantly diminishing supply.

While this has edition of RT has mainly focused on ETH, the king, BTC, is also set up for strong tailwinds in the form of the greatest mainstream ideological presence since it’s inception in ‘08, Ordinals (BTC NFTs providing fees to the network) reaching a new ATH in inscriptions, BTC miners having their most profitable month since May of ‘22, BTC hash rate continuing to make new ATHs, and the cyclical-starting halving approaching closer by the day.

So, whether a small alt season occurs or not seems inconsequential in the face of sticky tailwinds that are ready to propel the asset class forward despite what macro podcast doomers say. Of course, there will likely be correlation (although the severity of which has decreased in recent months) driven moves downward that are macro induced, but the eventual future of crypto and tokenized assets has rarely looked brighter (which I expanded on in the March Recap). Onwards and upwards we go.

As a reminder, the P1 team consisting of myself, MoonOverlord, terv & boffin are always reachable at contact@pageone.gg. If you want to contact us in regards to sponsoring the newsletter, pitch a guest post, tell us about your protocol or to collaborate on anything in general, you can always reach us there or @PageOneGG.

funding:

Ledger, hardware wallet provider, raises “bulk” of $109M round @ $1.4B valuation

Pro Digital Future Fund secures $30M of ongoing target $100M raise for new Hong Kong based. crypto venture fund

EigenLayer, ETH restaking protocol, raises $50M series A with $500M token val

Fetch.ai (FET) raises $40M in new funding @ valuation around $250M

Orderly Network, NEAR-based DEX, raises undisclosed amount @ flat $200M val

Li.Fi, cross-chain bridging with DEX connectivity, raises $17.5M Series A

Hydra Ventures DAO raises $10M for fund of funds to back other DAOs

Conduit, crypto native infrastructure platform, raises $7M seed

Econia Labs, order book protocol on Aptos, raises $6.5M seed

So-Col, Irene Zhao’s web3 social platform, raises $4.5M

Polytrade, global trade DeFi protocol on MATIC, raises $3.8M seed

news:

ETH core devs officially confirm April 12th for Shapella/Shanghai upgrade

US Government sells 9.8k BTC (likely between March 4th through March 14th) and confirms plans to sell a further 41.5k BTC throughout rest of the year

SBF offered $40M bribe to Chinese government officials to unfreeze ~$1B worth Alameda assets

Volume & OI of CME BTC options reach new ATH amid banking crisis/crypto rally

Ticketmaster launches token-gated feature allowing artists to provide NFT holders with exclusive fan rewards

Crypto friendly casino Stake generated $2.6B in gross gaming revenue last year

Gucci announces new, unknown partnership with Yuga Labs

FDIC sets April 5th deadline for crypto depositors at Signature Bank to withdraw their funds, regulator still plans to sell off Signet platform

Consensys announces zkEVM Linea is now live on testnet for all users

BTC mining revenue for March hits highest levels since May ‘22

Kraken partnering with Williams Racing to become first F1 racing crypto sponsor

Gemini joining Coinbase in prepping overseas derivative exchange for perps

Digital payments processor Zebedee announces borderless transaction feature using BTC’s Lightning Network

Fidelity expanding crypto operations, building out a crypto & token research team

Homebase, NFT fractionalization on SOL, sells out 1st tokenized home on SOL

tokens & protocols:

INJ — partners with Eclipse to launch Cascade, first Solana SVM rollup for IBC allowing SOL-based assets to be able to be ported to the Cosmos ecosystem

MKR — governance vote ratifies Maker’s “Endgame”, “The Maker Constitution”; will result in the creation of six subDAOs underneath MakerDAO

RON — staking is now live & Ronin outlines next chapter/future developments

DYDX — v4 of private testnet is live; closer to eventual Cosmos appchain launch

USDC — market cap continues fall since depeg, down ~$10B in recent weeks

OP — announces results of latest Retroactive Public Goods Funding airdrop

EUL — exploiter says sorry, returns stolen $177M to the DeFi protocol

LRC — Loopring launches LRC staking

SWISE — introduces Vaults, non-custodial mini-staking pools for ETH staking

Starknet — alpha v0.11.0 successfully propagated to mainnet

Quasar — non-custodial Cosmos asset management platform live on mainnet

Iron Fish — privacy encrypted PoW L1 details April 20th launch & tokenomics

Ordinals — BTC inscriptions reach new ATH in daily inscriptions of 58k

Linea — ConsenSys’ zkEVM Linea now live on testnet for all users

Conduit — built on OP stack, enables infrastructure to launch a rollup effortlessly

around the ecosystem:

Emre with insights into analyzing 100M+ CT tweets over the past few years

Law firm Cooper & Kirk (successfully sued government over Operation Chokepoint 1.0) with a detailed summary & wrongdoings of OPC2.0

0xsmac on crypto technical design space in “Saying The Quiet Thing Out Loud”

tweets:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.