as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: Shapella bears capitulate, FTX 2.0 floated, Arbitrum’s L2 stranglehold, BTC dominance retreats, ETH & alts given life, Solana’s big week & PEPE’s uncertain signal

BTC dominance 47% | ETH dominance 19% | DeFi TVL $53B |

Total Crypto Market Cap $1.33T | Stablecoin Supply $131.5B |

Another week has passed and I’ve successfully survived NFT NYC and meeting terv irl for the first time, while ETH survived the daunting Shapella upgrade. While some forecasted fear of mass dumping, the effects of Shapella were incredibly overstated ahead of the event. In last week’s edition of RT, I wrote,

“in my view, the fear of a selloff is drastically overplayed and there are numerous reasons that Shapella results in more of a nonevent than anything…I’m currently positioned for Shapella being a successful nonevent that provides tailwinds to the LSD sector along with the medium and long term outlook on the ETH/BTC ratio…hopefully I’ll be back next week to talk about the continuously improving CPI numbers and the lack of immediate sell pressure from Shapella.”

While Shapella has since come and gone, with ETH gaining an impressive 14% on the weekly as a result, the effects and concerns of ETH withdrawals being enabled have also largely dissipated. Aided by continually improving CPI data that came in at its lowest level since May of 2021 and cumulative BTC short liquidations reaching ~$250M on April 13th, a number not seen since the rally off the lows to start the year, the crypto market once again climbed higher.

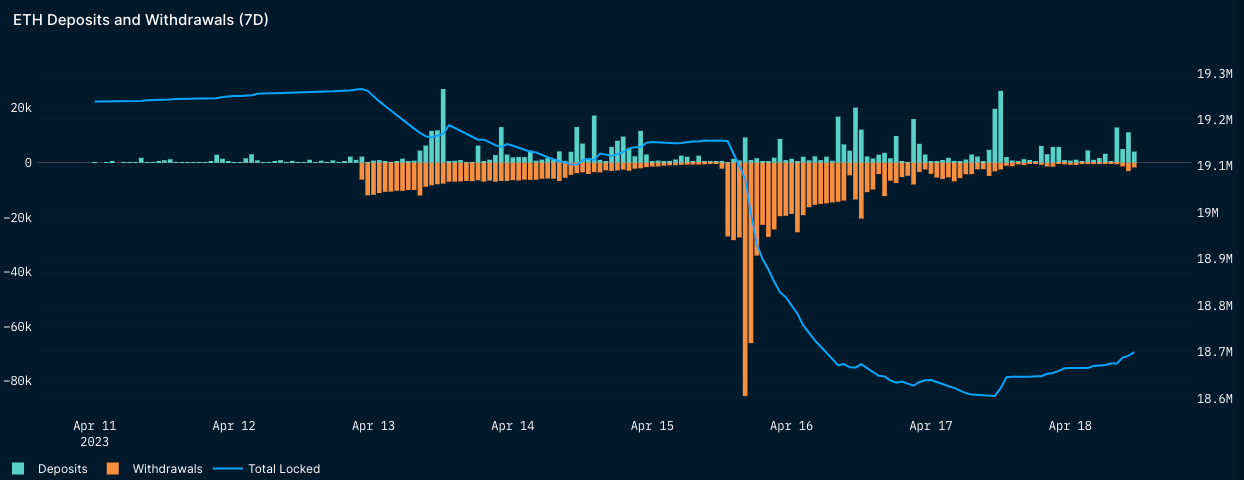

As you can see from the free public Nansen dashboard, the peak of withdrawal pressure, which was mainly a result of centralized exchanges withdrawing on their customers behalf, (specifically Kraken who was ordered by the SEC to do so for U.S. customers) has come and gone. Outside of that centralized exchange blip on April 15th, ETH deposited to staking services has continually exceeded ETH withdrawals.

Nansen’s dashboard clearly shows that ETH withdrawals within the first ~48 hours of Shapella being live were “shockingly” outpaced by new deposits and the majority of ETH withdrawn from staking occurred in an isolated ~48 hour window. That window was opened by regulatory pressure and centralized exchanges processing redemptions and has since been shut by the demand for global ETH deposits into decentralized staking protocols.

Shapella not only enabled withdrawals but also completed ETH’s years long transition from PoW to PoS. While ETH’s price and the withdrawal queue have taken center stage this week, the fundamental changes enabled through the transition to PoS (EIP-1559 implementing the burn, decreased issuance in PoS, staking yields) continue to provide background tailwinds.

As you can see on ultrasound.money, since EIP-1559’s integration 620 days ago Ethereum is burning ETH at a rate of $5.4B annually. As a result of the burn and the PoS transition, ETH’s supply growth since EIP-1559 is pacing at -1%+ a year. Those numbers if ETH remained PoW would stand at supply growth of 2.6% and $11.3B worth of ETH issued as mining rewards per year.

ETH is quickly approaching a reduction in supply of 100k ETH since the merge 215 days ago. At current prices, that’s $210M worth of potential sell pressure eliminated from circulation as a result of the PoS transition and onchain activity burning ETH. All of this is occurring in the face of crypto climbing out of the depths it was sent to from fraudulent collapses. Despite the “bear” market, NFT activity drastically reducing, and market participants fleeing, onchain activity and crypto’s broad fundamentals remain healthy. It’s easy to imagine the above images becoming increasingly wonky as market participants return and ETH L2s continue to increase their gas consumption.

Aiding ETH’s rally over the past week+ is BTC dominance respecting the 700+ days range high at around 49%. Two weeks ago I wrote, “as for the updated market conditions, BTC dominance is still approaching multi-year highs providing a semblance of hopium for an altcoin rally”. Thankfully, that has come to fruition over the past week and a half as BTC dominance has fallen 2%+ since the range highs providing room for ETH/BTC and alts to expand upwards.

Alts that stand out over the past week+ timeframe include ARB, SOL, RPL, BLUR, SYN, INJ, AVAX, DYDX, JOE, & SYN to name a few. As you can see, BTC dominance doesn’t spend much time deciding it’s direction in the middle of the range and those positioned for alt continuation are hoping to see BTC dominance continue to trickle downwards. In addition to a broad altcoin rally, risk is advancing further out the curve as PEPE, a memecoin launched on Friday, has exploded to a market cap of $40M+. While the signal is unclear to me, and as Ansem eloquently states, memecoins going parabolic usually marks the top or the beginning of unbridled degeneracy. Hopefully it’s the later of those possibilities.

Speaking of alts, Solana has been one of the top performing tokens recently on the back of their big week. Page One has been adamant of SOL’s potential for a strong recovery since the collapse of FTX and that belief was bolstered last week as Solana displayed their Saga mobile phone while Helium (HNT) completed its move to SOL and Render’s (RNDR) community voted to transition the protocol to SOL from MATIC citing the need for increased throughput that Solana can provide.

Two final notes to wrap up. First, the slow, but steady progression in the development of crypto’s coming mobile wave (where most users are) were advanced last week by the aforementioned launch of Solana’s Saga phone and Uniswap finally being approved by Apple to deploy their mobile wallet to the app store.

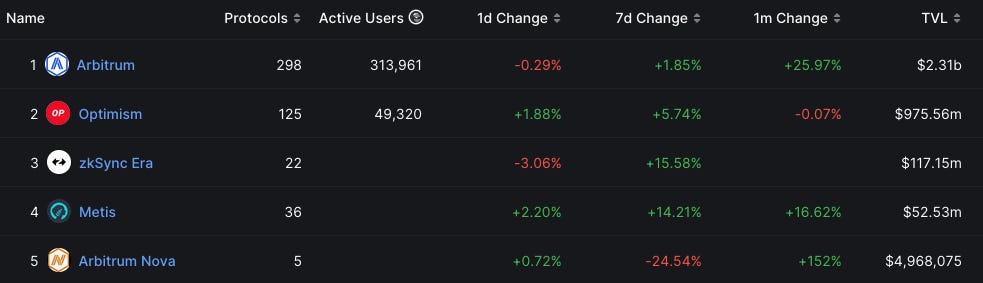

Secondly, the L2 wars continue as the growth in ETH gas consumed to settle transactions on L2s steadily increases. Arbitrum has remained dominant, but Optimism’s Bedrock upgrade is coming, zkSync’s TVL is up only (although heavily concentrated in a singular DEX as the airdrop is farmed), and Polygon’s zkEVM searches for scalability and product-market fit. Eventual launches from Scroll, Base, StarkNet, Aztec, Fuel, appchains and many other modular solutions complicate the picture but monitoring their developments and if Arbitrum can continue its stranglehold on users and TVL is important to understand how crypto develops in the coming quarters.

As a reminder, the P1 team consisting of myself, MoonOverlord, terv & boffin are always reachable at contact@pageone.gg. If you want to contact us in regards to sponsoring the newsletter, pitch a guest post, tell us about your protocol or to collaborate on anything in general, you can always reach us there or @PageOneGG.

funding:

Hong Kong’s Metalpha raising $100M to launch licensed fund in HK allowing investors access to Grayscale Trusts with redemption available after 1.5 years

Mysten Labs, developers of L1 Sui, pays $96M to repurchase FTX’s equity stake

Sei Labs, team behind upcoming L1 Sei, raises $30M in two strategic rounds

Fractal, transparent clearing/settlement across counter-parties, raises $6M

INTMAX, stateless zkRollup w/ mainnet planned in Q4, raises $5M seed

CAT Labs, cybersecurity tools to fight crypto crime, raises $4.3M pre-seed

Fire, crypto fraud prevention browser extension, raises $3.5M seed

Helio, instant crypto payments startup, raises $3.3M seed

news:

FTX bankruptcies lawyers float the possibility of reopening the exchange as part of a broader reorganization plan, FTT rallies but value in a new exchange launch is unclear; FTX lawyers also say they’ve recovered $7.3B+ in cash & liquid assets

eToro & Twitter partner to offer real-time crypto prices for cashtags users search, enabling users to trade stocks and crypto through the Twitter app

London Stock Exchange unit plans to start clearing BTC futures & options

NovaWulf set to acquire assets of bankrupt lender Celsius, plans to create a new company with tokenized equity following payouts to creditors

Good coverage on DWF Labs recent “rise” & extremely questionable “funding”

Solana Foundation introduces convertible grants & investments

Razer, global gaming organization, announces zVentures “Web3 Incubator”

DefiLlama launches their NFT dashboard

SEC moving towards pushing disastrous DeFi oversight that was originally proposed last year, would widen securities exchanges to include DeFi; SEC also sues Bittrex for operating “unregistered national securities exchange”

tokens & protocols:

BNB — completes 23rd quarterly burn, burns 2 million tokens worth ~$674M; BNB’s upcoming decentralized storage chain Greenfield launches official testnet

UNI — mobile wallet finally approved by Apple; UNI proposal to deploy UNI v3 on Polygon’s zkEVM also approved

YFI/yETH — proposal to launch YFI’s basket of ETH LSD tokens (yETH) is live

Ondo Finance — unveils stablecoin alternative backed by tokenized money-market funds (OMMF)

CFX — proposal to deploy UNI v3 & enter CRV wars with CFX bridged to ETH

MPL — preparing new lending pool for global access to on-chain U.S. Treasuries

around the ecosystem:

a16z releases their State of Crypto 2023 report & introduce State of Crypto Index

Joel John’s “From JPEGs to AI Models” examining all things BTC Ordinals

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.