as always, thanks for reading, follow me here and reach out at contact@pageone.gg

tl;dr: ETH keeps burning, U.S. pushing crypto offshore, stablecoins & Tether’s dominance, NFTs are very alive, SOL’s recent NFT success & sell in May questioned

BTC dominance 47% | ETH dominance 19% | DeFi TVL $48.5B |

Total Crypto Market Cap $1.2T | Stablecoin Supply $131B |

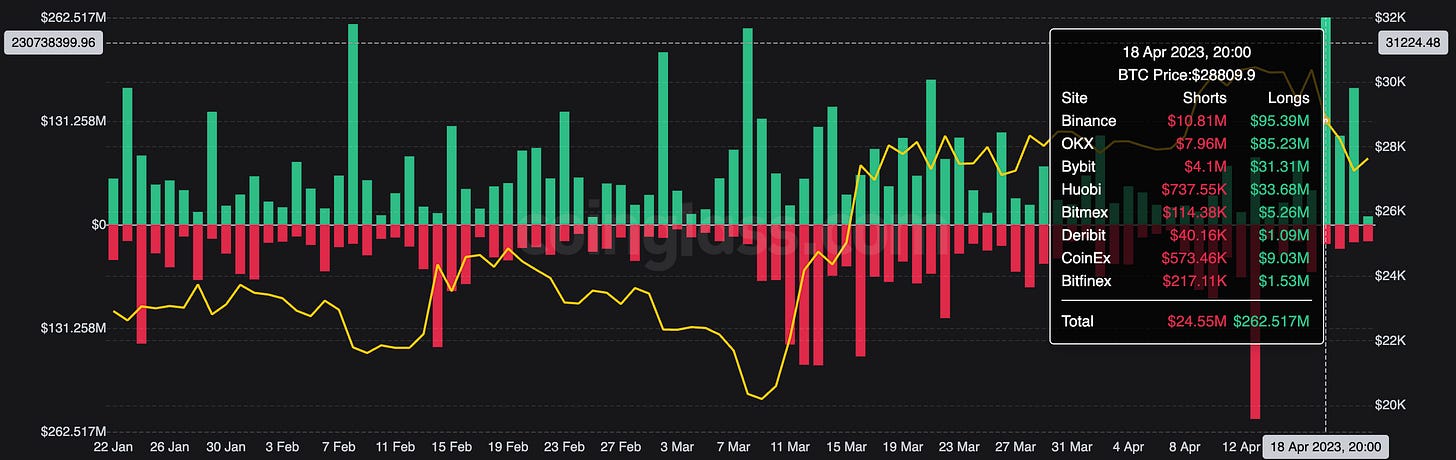

Leverage giveth and leverage taketh away. Two weeks ago, short liquidations (~$250M worth) propelled the crypto market higher as BTC and ETH broke 30k and 2k. This week, the markets gave back those key psychological levels as $262M worth of long liquidations helped fuel markets lower.

Last week, I wrote that, “while the signal is unclear to me, meme coins going parabolic usually marks the top or the beginning of unbridled degeneracy.” While we of course only have a one week sample, the early results on PEPE going parabolic appear to be signaling a broad market retrace as BTC (-10%) and ETH (-14%) gave back significant gains last week.

While PEPE remains ~30%+ off its highs, the market cap of the 10 day old coin still sits above $100M. Personally, I don’t have the slightest of interest in the token at these levels but I’m incredibly interested in the future price action and potential staying power it displays. As mentioned, the start and stop of previous cycles have been signaled in advance by meme coin rallies and I’ll be monitoring the flows into PEPE over the coming weeks to months to determine if PEPE has any semblance of becoming the new DOGE.

Regardless if that comes to fruition or not, the amount of ETH burned since PEPE’s launch and the ensuing meme coin frenzy is incredible. Preceding PEPE’s launch was a two day string of elevated ETH gas prices which has continued over the past ~two weeks. Over the past seven days, ETH’s burn rate has paced at a level that would see the protocol become deflationary as the supply reduction in total ETH reaches -1%+.

Throughout essentially the entire “bear market”, onchain activity has remained convincingly elevated signaling that users of ETH, and crypto at large, are making onchain transactions. As I’ve written numerous times, extrapolating ETH’s bear market activity and supply reduction levels to past bull market activity creates a picture where demand for ETH approaches a parabolic phase while the protocol quietly burns tens of thousands of its native currency per week due to said demand.

Outside of ETH burning due to elevated transactions as a result of PEPE’s launch, there were two other main focuses of the crypto ecosystem this week. First, as everyone has seen by now, Gary Gensler testified in front of Congress and the House Committee on Financial Services last week. While it was unquestionably an unmitigated disaster for the head of the SEC, it’s unfortunately important to remember that the usual bipartisan politics and camera performances were likely at play as public hearings don’t result in regulatory changes.

Still, Gary’s answers failed to provide further clarity to a regulatory environment that is confusing at best and malicious at worst towards the crypto industry. Having him publicly, on the Congressional record, fumble his responses to direct questions regarding the SEC’s treatment of crypto will benefit the industry over the long term.

The above SEC treatment of crypto in the US continues to have ripple effects throughout the industry as crypto is continually, and methodically, pushed offshore. In the same week that Gary stumbled around answers to basic questions, the European Union passed a comprehensive framework for crypto while Gemini and Coinbase announced their intentions to launch offshore derivatives products.

Established crypto companies and startups alike are not the only thing being pushed offshore, as the market cap and dominance of stable coins continues to shift in Tether’s favor. USDT’s dominance has now reached 62%+, levels not seen since April of 2021 when USDC was just beginning to bootstrap its network and growth.

Secondly, there’s been a flood of recent talk throughout the crypto ecosystem about NFTs, their future, and the current market dynamics. As everyone is likely aware, BLUR’s incentive driven airdrop “seasons”, combined with OpenSeaPro’s (Gem’s) likely future airdrop, have “wrecked havoc” on the NFT market. Twitter threads and influencers blaming BLUR for the current state of the NFT market is not new, but it appears to have reached a boiling point over the last week+.

To be clear, from my view, Blur didn’t “wreak havoc” on NFTs as the team simply capitalized on a market inefficiency. If Blur didn’t do it, any number of other startups would have. NFTs are not valuable because of their semi-illiquidity, they’re valuable because the technology behind them, the ERC-721 standard, is a digitally native, global wrapper that can be applied to assets that are unique and previously hard to value.

A common fallacy in crypto is that bringing assets onchain instantly guarantees liquidity. This couldn’t be further from the truth (see most recent example of PEPE running to $100M+ market cap with sub $3M in liquidity) and NFTs operated in a market of weak liquidity for much of their existence. While the common knowledge of NFTs has been that they’re unique and semi-illiquid, the future of NFTs, and crypto at large, is betting on NFTs becoming liquid. Just because something is non-fungible, there’s no reason that it can’t be liquid.

Sure, Blur is incentivizing the increased liquidity of assets that were once semi-illiquid, but if their prices have collapsed with increased, constant liquidity than the previous “value” was never real to begin with. Blur doesn’t inorganically force prices down, it’s just accelerating market dynamics that would’ve played out in the long run irregardless of what NFT holders want. On the bright side, Blur, increased liquidity, and the growing number of teams working on NFT financial products massively benefit from higher liquidity NFTs. In the long run, as every unique asset (cars, real estate, manufactured products, loans, etc.) are represented by an NFT onchain, the ability to price them properly will be appreciated as NFTs become “real” assets.

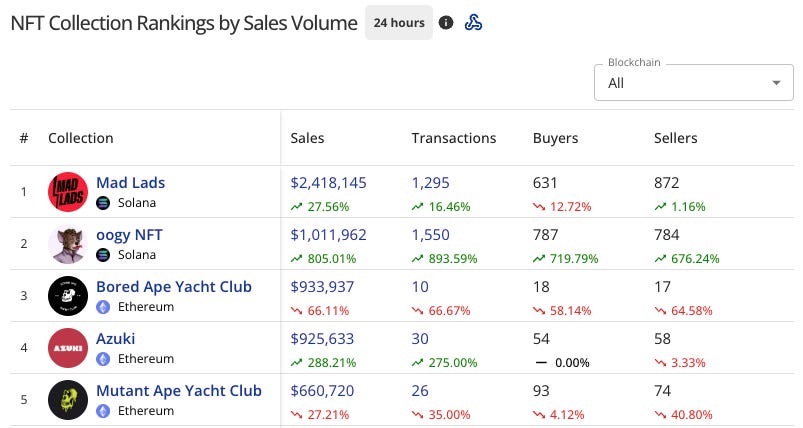

Finally, while we’re talking about the demise of ETH NFTs, it would be malfeasance not to mention their strong revival elsewhere. As you can see from the image below, the top two NFT collections across all chains in sales volume over the past 24 hours both reside on SOL. Another pocket of NFT strength comes from BTC Ordinals breaching a new all time high in daily inscriptions at 89,698. Mad Lads are leading the way in recent NFT success as the team behind the first backpack xNFT collection not only showed impressive demand, but successfully completed SOL’s first scaled localized fee market test.

Despite what many are painting as a bleak future for NFTs, Page One considers the enhanced liquidity selloff good for the long term future of the space. Almost one year ago, I wrote in Cyclicality and What’s Next, “often forgotten in the everyday chaos of the simple, yet all-encompassing revolution NFTs present as a verifiable, digital wrapper around any unique asset…eventually, the market cap of NFTs will be the most valuable asset class in the world as they continue their evolution to impact every industry.”

Whether that future is Blur induced or not, it’s eventually coming regardless of what market participants think about their once pristine, semi-illiquid non-fungible tokens. Liquidity enhances optionality and it was always destined to come for NFTs. Moving forward, the strong, broad consensus is “sell in May”. Of course, that consensus framing makes me question the validity of the statement and ponder whether the selling last week was once again front running the consensus. We’ll reconvene next week to decipher that equation. Cheers to constant onwards and upwards growth.

As a reminder, the P1 team consisting of myself, MoonOverlord, terv & boffin are always reachable at contact@pageone.gg. If you want to contact us in regards to sponsoring the newsletter, pitch a guest post, tell us about your protocol or to collaborate on anything in general, you can always reach us there or @PageOneGG.

funding:

Unchained Capital, BTC financial services firm, raises $60M series B

Berachain, DeFi-focused EVM compatible L1 built on Cosmos SDK, raises $42M

Karate Combat, martial arts league decentralizing through $KARATE, raises $18M

Tableland, permissionless database for crypto apps, raises $8M Series A

Yoz Labs, crypto onchain notification platform, raises $3.5M

Flow, rollup centric NFT ecosystem, raises $3M seed

news:

EU passes comprehensive crypto legislation and regulatory framework Markets in Crypto Assets (MiCA)

Once dormant BTC & ETH moves as mysterious wallet draining continues

Microsoft working with decentralized data provider Space and Time to add real-time blockchain data to Azure Cloud

Gemini introduces Gemini Foundation, a non-US crypto derivatives platform

Coinbase receives Bermuda license, launching offshore exchange in a few weeks

Square Enix partners with Elixir to further crypto game adoption

Krafton, game developer behind PUBG, to launch NFT metaverse platform Migaloo sometime this year

tokens & protocols:

Iron Fish — new ZKP PoW privacy L1 successfully launches their mainnet

INJ — partners with Tencent Cloud for support of Injective Global Hackathon

HNT — Helium completes its migration to Solana

RPL — completes Atlas upgrade, minipool minimum staked ETH lowered to 8

AZERO — Aleph Zero announces $50M ecosystem funding program

MC/AVAX — announce Beam, a sovereign gaming network powered by AVAX

SUI — DeFi-focused L1 details tokenomics ahead of May 3rd mainnet launch

SWISE — liquid staking protocol introduces StakeWise v3 & the road to mainnet

MPL — introduces onchain cash management solution and pool

MEV-Share — Flashbots beta product returning MEV to users is now live

Magi — a16z announces Magi, a rust-based rollup built on Optimism’s (OP) stack

Cashmere Labs — MEV protected cross chain swaps launches testnet

Ondo Finance — short-term US gov bond fund OUSG surpasses $100M AUM

around the ecosystem:

Gabriel Shapiro, Delphi Labs GC, details a new legal framework for DAOs

Paradigm with “The Current SEC Disclosure Framework Is Unfit For Crypto”

Hal Press’ ETH thesis and comparing “Decentralized SoV — PoS vs PoW”

tweets:

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.